URD 2022

-

1. GROUP PRESENTATION, OUTLOOK, AND STRATEGY

-

1.1.History

Marcel Bich acquires a factory in Clichy, France, and starts a Writing Instruments business with his partner Édouard Buffard.

Launch of the “Pointe BIC®” in France, a revolutionary improved version of the Ball Pen invented by Hungarian Laslo Biro.

Acquisition of the Waterman Pen company in the United States. Expansion into Africa and the Middle East.

Diversification into the leisure industry through its subsidiary, BIC Sport, specializing in windsurf boards.

Acquisition of Tipp-Ex®, the leading European correction products brand, and Sheaffer®, a high-end brand in Writing Instruments.

Mario Guevara becomes Chief Executive Officer of BIC in May.

Acquisition of PIMACO, Brazil’s leading manufacturer and distributor of adhesive labels.

November: opening of a new shaver packaging facility in Mexico.

December: acquisition of Antalis Promotional Products (Sequana Group).

March: Acquisition of 40% of six (of the seven) Cello group entities, a leading stationery group in India.

June: acquisition of Norwood Promotional Products, a U.S. leader in calendars and promotional products.

First-half: disposals of the PIMACO B-to-B division in Brazil and the REVA Peg-Making business in Australia.

November: acquisition of Angstrom Power Incorporated, a company specialized in portable fuel cell technology.

September: launch of BIC® Education, an educational solution for elementary schools, combining handwriting and digital technology. Completion of the share purchase following the call option exercised on September 17 on Cello. Increase of BIC’s stake in Cello's seven entities from 40% to 55%.

October: acquisition of land in Nantong, China (130 km North of Shanghai) to build a Lighter production facility.

April: sale of BIC’s Portable Fuel Cell Technology business to Intelligent Energy.

December: Cello sells its remaining stake in Cello to BIC. This raises BIC’s stake in Cello to 100%.

May: Mario Guevara retires from his position as Chief Executive Officer. The Board of Directors decides to combine the roles of Chairman and Chief Executive Officer and appoints Bruno Bich as Chairman and Chief Executive Officer.

June: sale of BIC Graphic North America and Asian Sourcing operations to HIG Capital.

October: opening of the new Writing Instruments facility in Samer (France).

May: Bruno Bich retires from his position as CEO. The Board of Directors decides to split the roles of Chairman and Chief Executive Officer. Pierre Vareille is appointed Chairman of the Board and Gonzalve Bich becomes Chief Executive Officer.

October: filing by BIC of an infringement complaint with the European Commission for lack of surveillance of non-compliant Lighters that are either imported into or sold in France and Germany.

December: acquisition of manufacturing facilities of Haco Industries Ltd. in Kenya and its distribution activities of Stationery, Lighters, and Shavers. Disposal of BIC Sport, BIC’s water sports subsidiary, to Tahe Outdoors and discontinuation of its Writing Instruments manufacturing operations in Vanne.

January: inauguration of BIC’s Indian subsidiary BIC Cello, in Vapi (Gujarat state).

March: inauguration of BIC’s East Africa Facility in Kasarani, Nairobi.

July: Filing by BIC of a complaint with the European Ombudsman claiming maladministration by the European Commission of the infringement procedure brought against the Netherlands in 2010.

October: completion of the acquisition of Lucky Stationery in Nigeria (LSNL).

July: acquisition of Djeep, one of the leading manufacturers of quality Lighters, reflecting BIC’s strategy of greater premiumization and personalization.

December: acquisition of Rocketbook, the leading smart and reusable notebook brand in the United States, expanding BIC’s business into the Digital Expression segment.

December: signature of agreement to sell its Brazilian adhesive label business, PIMACO, to Grupo CCRR, reflecting BIC’s portfolio rotation strategy and focus on fast-growing consumer segments.

February: completion of the sale of BIC's headquarters in Clichy-La-Garenne-based (France) and BIC Technologies sites for 175 million euros.

February: completion of the divestiture of the Brazilian adhesive label business, PIMACO, to Grupo CCRR for 40 million Brazilian Real.

January: acquisition of Inkbox, the leading brand of semi-permanent tattoos.

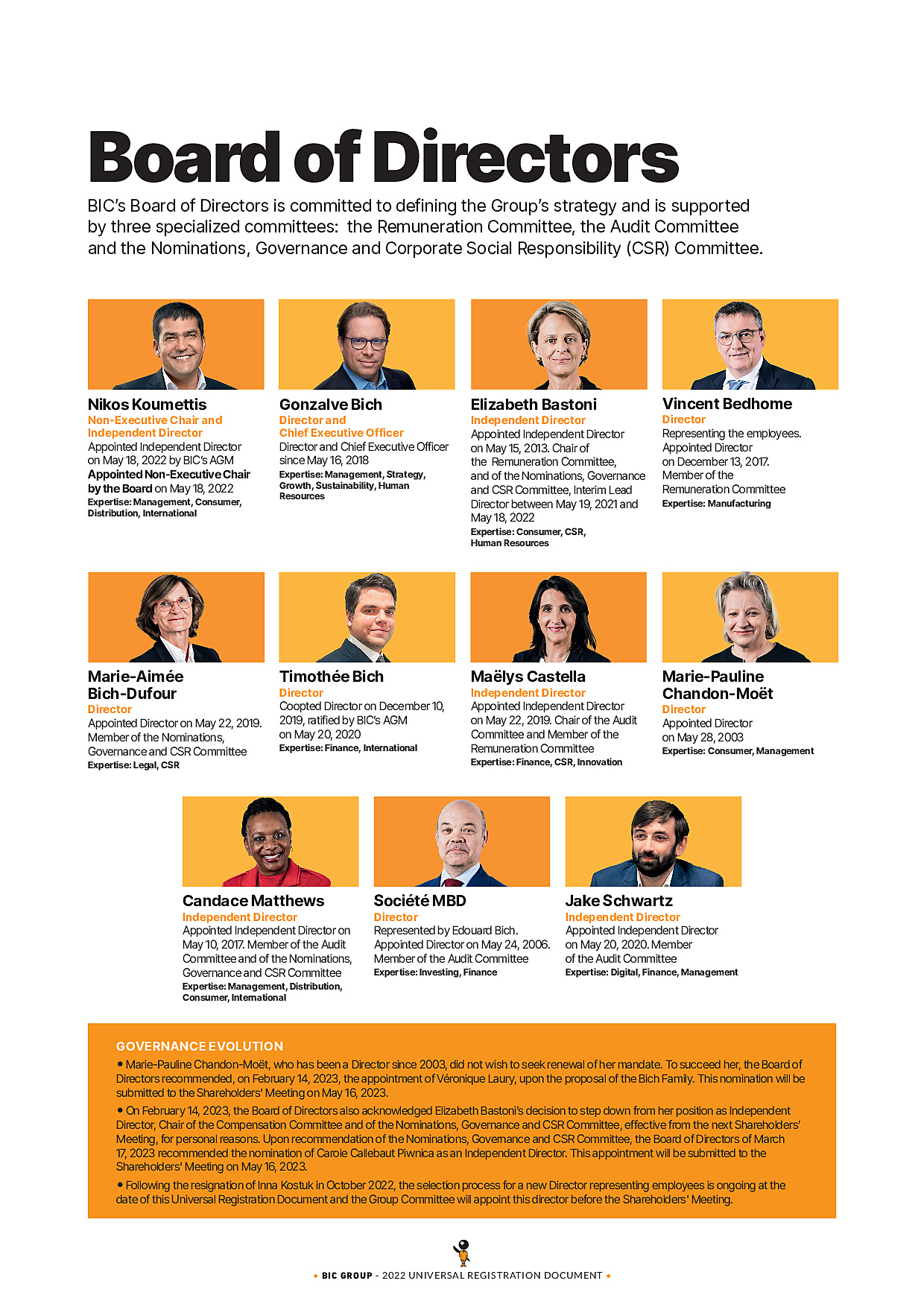

May: appointment of Nikos Koumettis as Chair of the Board;

August: acquisition of Tattly, a leading decal brand based in the US.

September: acquisition of AMI (Advanced Magnetic Interaction), a French start-up pioneer in augmented interaction technology.

-

1.2.Key figures

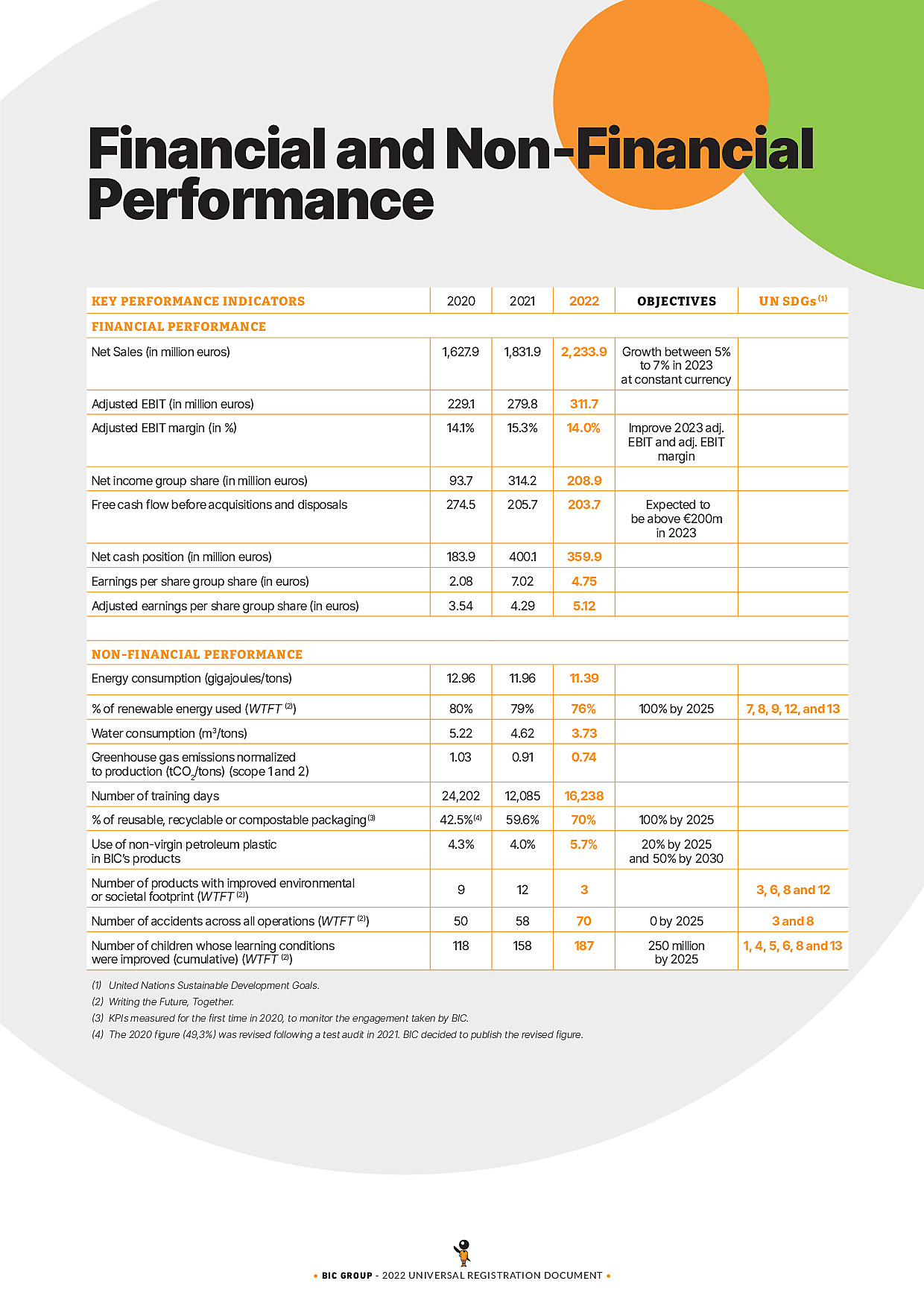

1.2.1Key financial figures

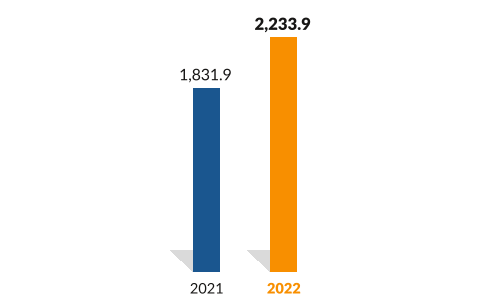

Net sales

2022 net sales

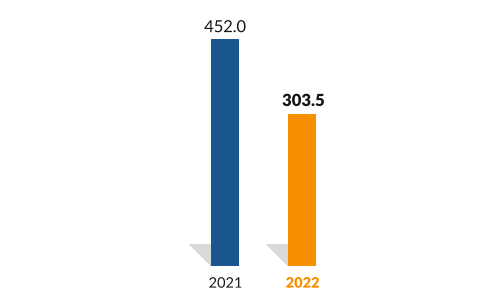

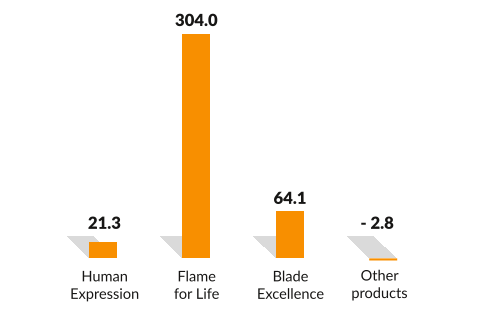

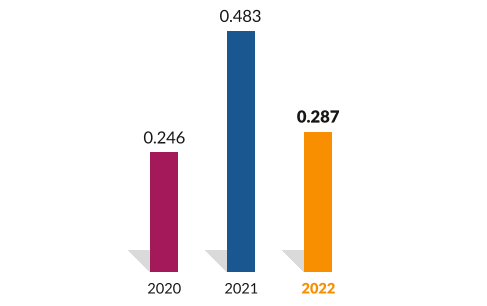

Earnings Before Interest and Taxes (EBIT)

2022 EBIT(1)

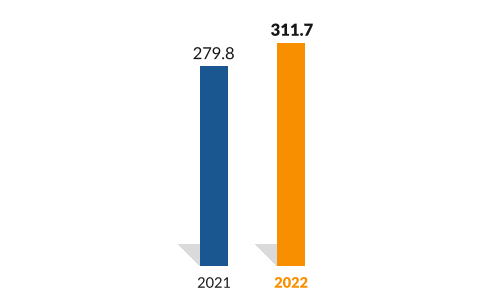

Adjusted Earnings Before Interest and Taxes (AEBIT)

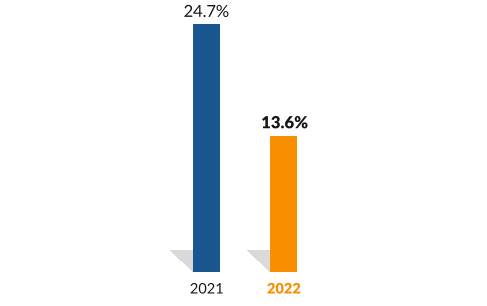

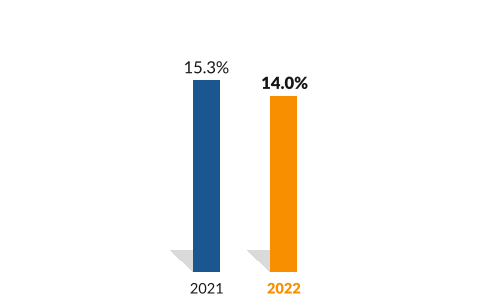

EBIT margin

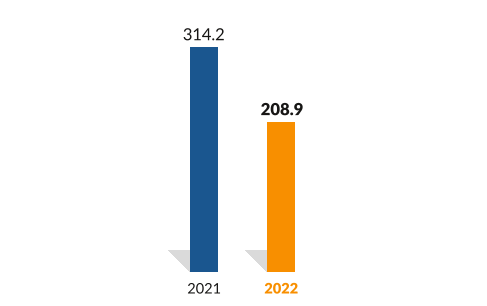

Net income group share

2022 Adjusted EBIT(2)

Adjusted EBIT margin

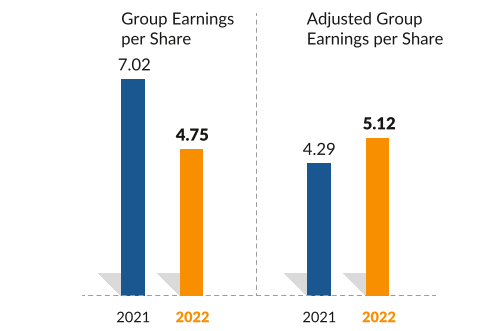

Group Earnings per share AND ADJUSTED GROUP EARNINGS PER SHARE

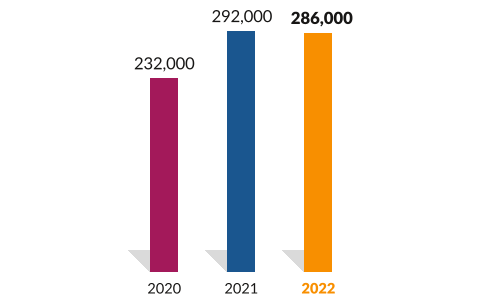

Sales volume trends

Production volume trends

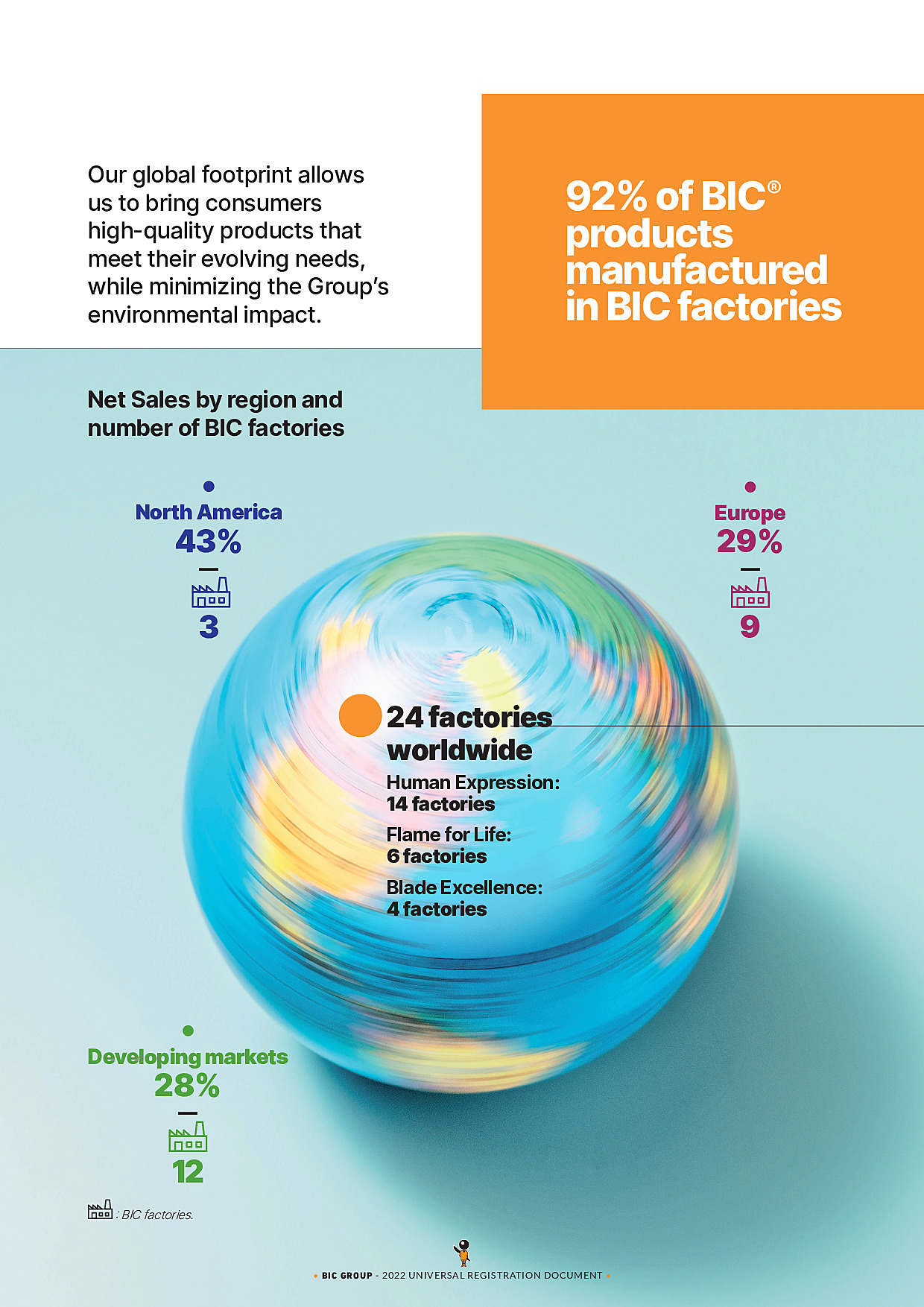

Net sales by region

(in million euros)

FY 2021

FY 2022

Change

as reportedChange on a comparative basis

Change at constant currencies

Group

Net Sales

1,831.9

2,233.9

+21.9%

+11.0%

+13.8%

Europe

Net Sales

570.6

636.7

+11.6%

+10.9%

+11.1%

North America

Net Sales

779.0

954.9

+22.6%

+6.7%

+9.2%

Latin America

Net Sales

275.9

390.6

+41.6%

+20.1%

+30.1%

Middle East & Africa

Net Sales

111.7

136.4

+22.1%

+16.6%

+16.6%

Oceania & Asia including India

Net Sales

94.8

115.3

+21.7%

+17.0%

+17.0%

Main income statement information

Condensed profit and loss account

(in million euros)

FY 2021

FY 2022

Net Sales

1,831.9

2,233.9

Cost of goods

901.1

1,155.9

Gross Profit

930.8

1,078.0

Administrative & other operating expenses

478.8

774.5

Earnings Before Interest and Taxes (EBIT)

452.0

303.5

Finance revenue/costs

(4.2)

(12.9)

Income before tax

447.8

290.6

Income tax expense

(133.6)

(81.7)

Net Income Group Share

314.2

208.9

Earnings per share Group share (in euros)

7.02

4.75

Average number of shares outstanding (net of treasury shares)

44,778,191

43,974,525

Key balance sheet aggregates

(in million euros)

December 31, 2021

December 31, 2022

Shareholders’ equity

1,723.8

1,876.3

Current borrowings and bank overdrafts

76.3

76.5

Non-current borrowings

23.8

42.8

Cash and cash equivalents – Assets

468.9

416.3

Other current financial assets and derivative instruments

1.7

17.3

Net cash position (a)

400.1

359.9

Goodwill and intangible assets

322.1

407.4

Total balance sheet

2,495.8

2,683.5

NB: SOCIÉTÉ BIC has not sought any rating from any credit rating agency. It also has not, to the best of its knowledge, been the object of any unsolicited rating by any credit rating agency.

(a) See Glossary.

Condensed cash flow statement

(in million euros)

2021

2022

Cash flow from operations

410.3

428.0

(Increase)/Decrease in net working capital

(20.0)

(29.2)

Other operating cash flows

(109.7)

(98.8)

Net cash from operating activities (a)

280.6

300.0

Net cash from investing activities

57.6

(172.5)

Net cash from financing activities

(148.3)

(175.2)

Net increase/(decrease) in cash and cash equivalents net of bank overdrafts

189.9

(47.6)

Closing cash and cash equivalents net of bank overdrafts

468.4

415.2

(a) See Glossary.

-

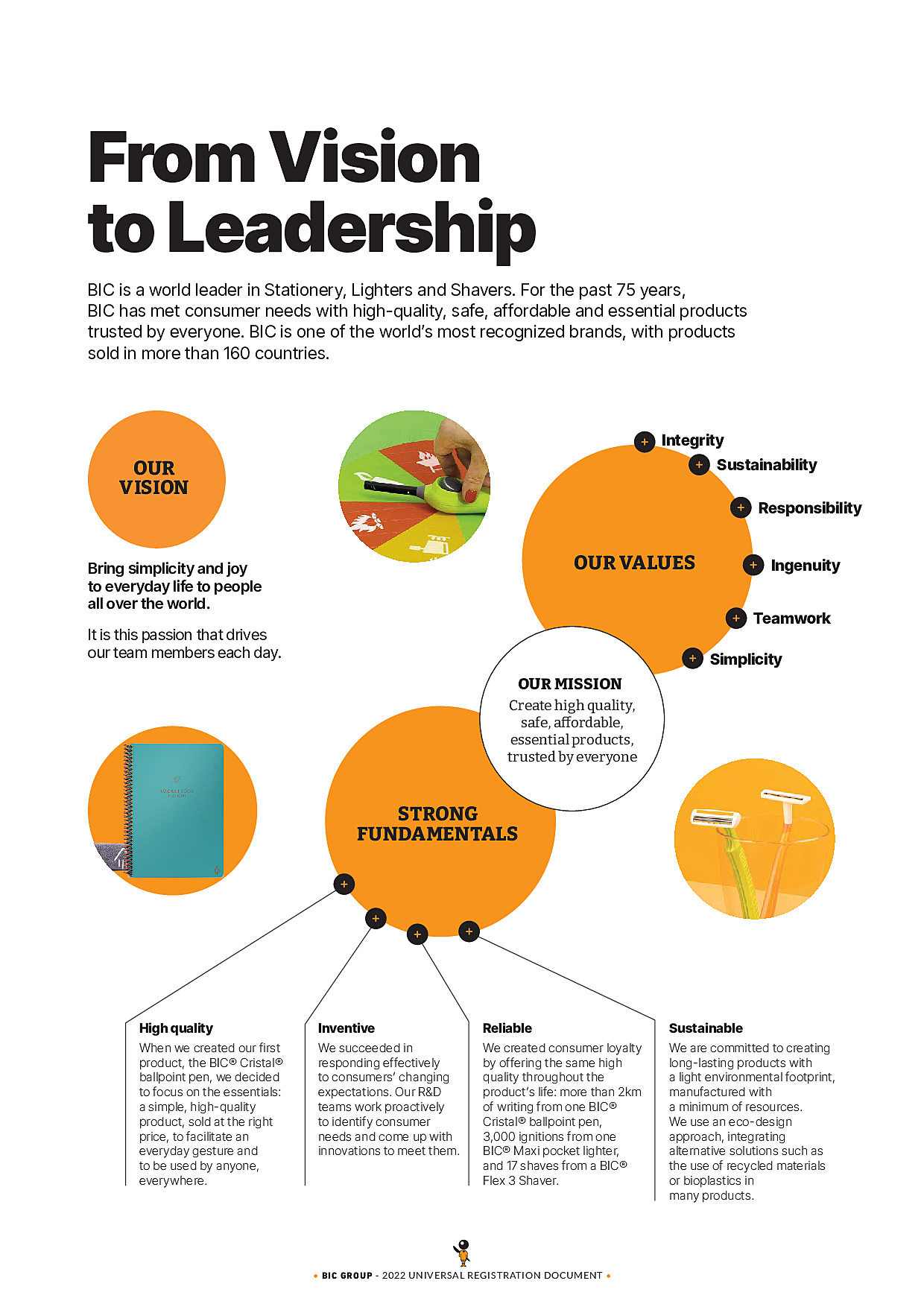

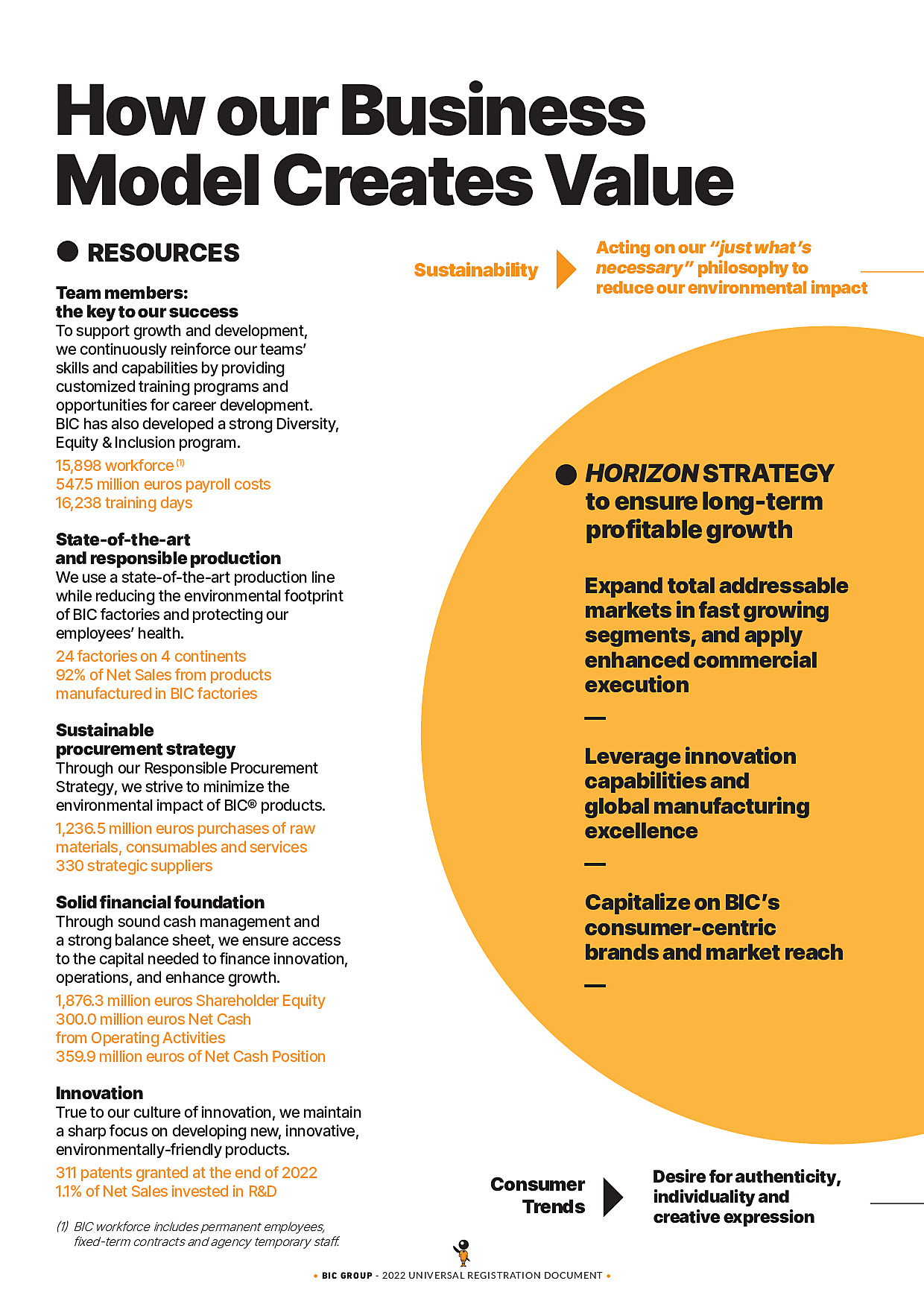

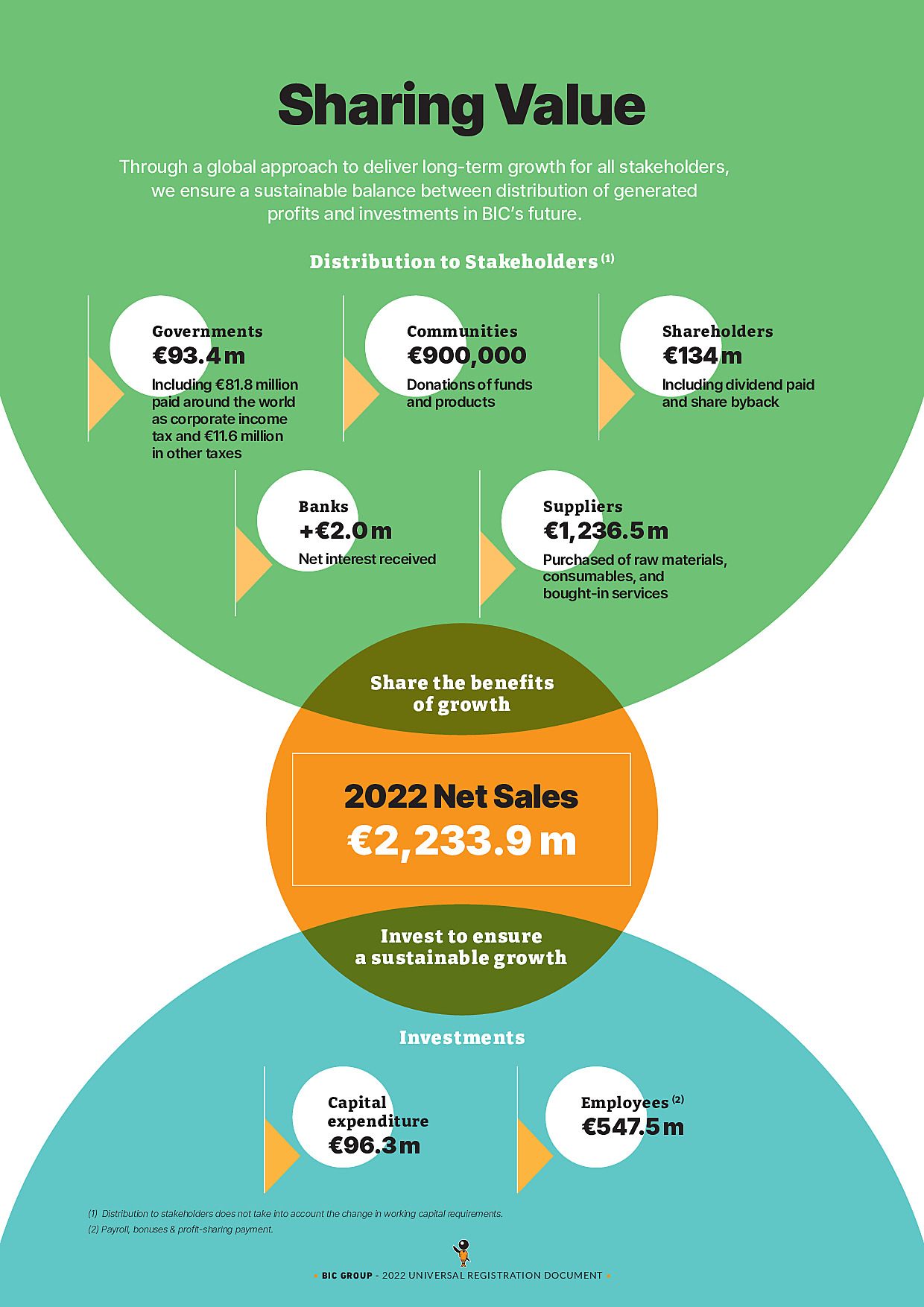

1.3.Strategy and objectives

For over 75 years, BIC® has met consumer needs and desires with high quality, simple, and affordable products and has become one of the most recognized global consumer goods brands, with products sold in more than 160 countries. Our vision is to bring simplicity and joy to everyday life, as we seek to create a sense of ease and delight in the millions of moments that make up the human experience.

Over time, the Group faced rapidly-changing industries and consumption trends affecting its three categories, as consumers habits and their interaction with brands continuously evolved. BIC’s mission to offer high quality products to consumers everywhere and meet their fast-changing needs, led the Group’ transformation from a manufacturing and distribution-led into a consumer-centric company.

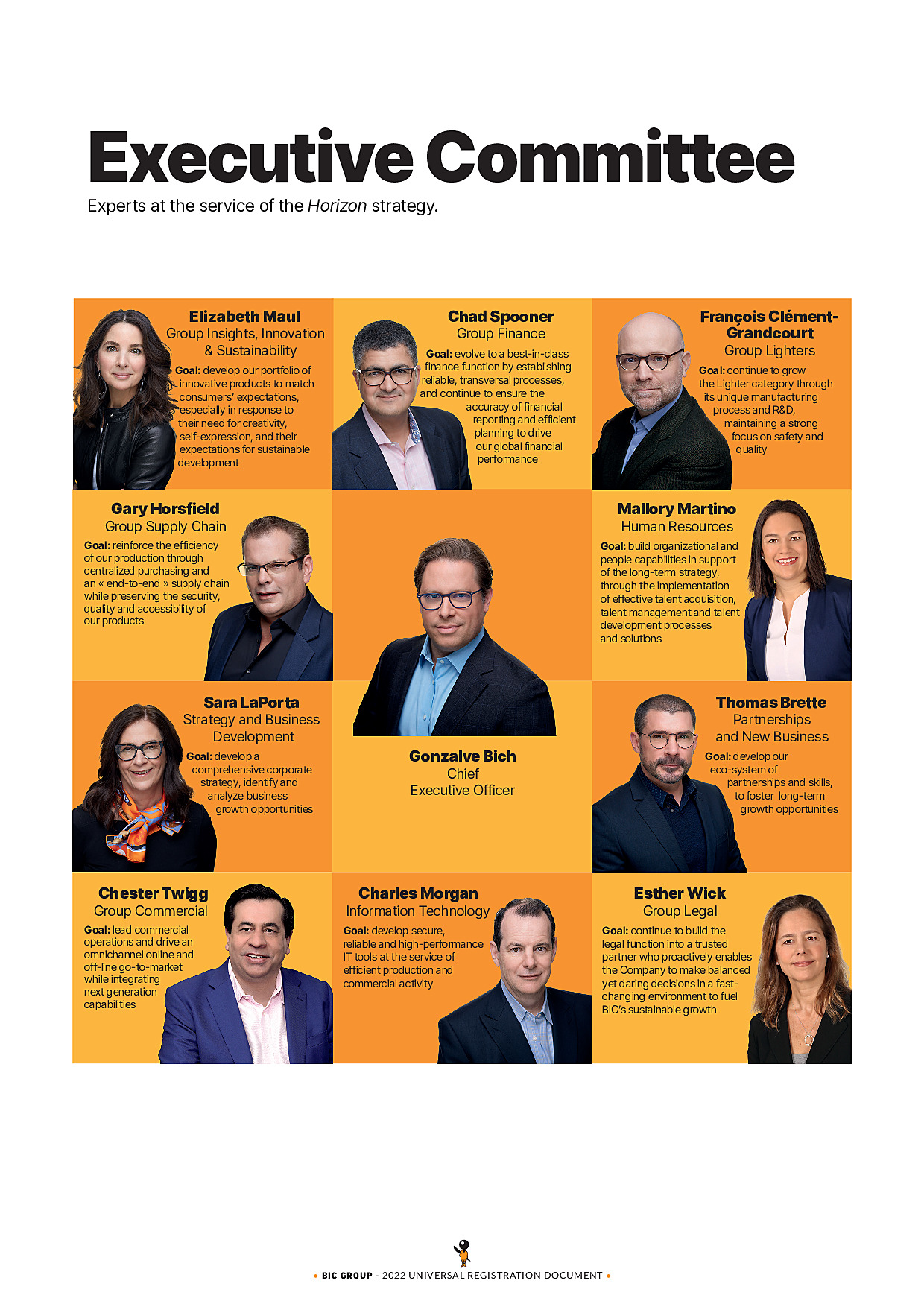

1.3.1BIC Horizon Strategic Plan

BIC’s Horizon strategy was launched in November 2020 to genuinely transform BIC’s business, creating innovative products and services of tomorrow with an increased focus on consumer needs and sustainability. The goal was not only to amplify our core capabilities, but to go beyond them into higher-growth adjacent segments to ensure long-term sustainable growth and profitability. Horizon is embedded in the Group’s everyday operations and strategic goals.

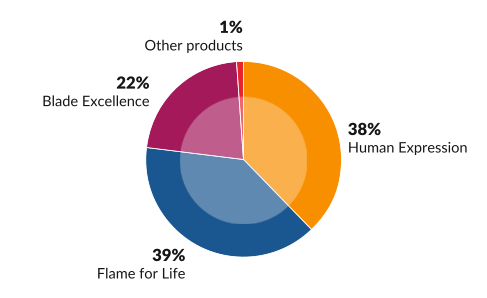

As part of this transformation, BIC reframed its three core categories through a heightened consumer lens to tap into a stronger growth trajectory:

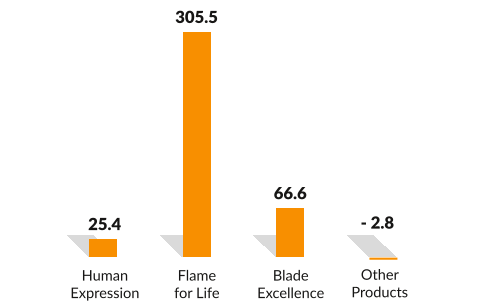

- ●in Stationery, BIC evolved its focus to “Human Expression”, responding to shifting consumer habits and expanding into the faster-growing Creative and Digital Expression markets;

- ●in Lighters, BIC expanded to “Flame for Life”, focusing on all consumer lighting occasions, including those non-related to tobacco, and driving towards a more balanced model between volume and value. Flame for Life is intended to drive incremental growth and maintain profitability, powered by trade-up and personalization, innovation, and a push toward sustainability;

- ●in Shavers, BIC decided to capitalize on its assets, ground-breaking innovation and manufacturing capabilities to leverage its “Blade Excellence” with the objective to maximize these assets by building a selective new business – named BIC Blade-Tech – as a high precision blade manufacturer for other brands.

Strategic and Financial Goals

Associated Targets

Growth

accelerationDeliver a mid-single-digit annual Net Sales growth trajectory

- ●Significantly expand total addressable markets in fast-growing adjacent segments, and evolve BIC’s business model to capture an increasing value share of our markets, with a strong focus on execution and return on investments.

- ●Leverage innovation capabilities and manufacturing excellence to generate incremental revenues through new routes-to-market.

- ●Capitalize on our brands in our core markets and build on new lifestyles to grow a comprehensive portfolio of consumer-led brands.

Cash flow

generationMaintain strong cash flow conversion.

Free Cash Flow is expected to be above 200 million euros in 2023

- ●Disciplined management of operational investments, with a target of 1 to 1.2 times Capex to Depreciation & Amortization.

- ●Strict control of Working Capital (Inventories, Receivables, and Payables).

Sustainable development

Take our sustainable development journey to the next level and transform our approach to plastics through two new commitments

- ●By 2025: 100% of packaging will be reusable, recyclable, or compostable.

- ●By 2030: Use of 50% non-virgin petroleum plastic in our products.

Capital allocation

Fund organic growth and acquisitions in adjacent markets while ensuring sustainable shareholder returns

- ●Investments into operations to sustain and enhance organic growth with approximately 100 million euros annual CAPEX investments. In 2023, CAPEX should be approximately 110-120 million euros.

- ●Targeted acquisitions to strengthen existing activities and develop in adjacent categories, with an average of 100 million euros invested annually.

- ●Objective of ordinary dividend pay-out ratio in the range of 40% to 50% of Adjusted EPS.

- ●Regular share buybacks. Up to 100 million euros Share Buyback program launched in 2023.

-

1.4.Business presentation

BIC is one of the leading players in the stationery, lighter, and shaver markets. Guided by our long-term vision, we provide high-quality, affordable products to consumers everywhere. This consistent focus has helped make BIC® one of the world’s most recognized consumer products goods company, with products sold in more than 160 countries.

1.4.1Business presentation by division

BIC’s Horizon strategic plan launched in November 2020, aimed at driving sustainable growth by reframing our three categories to expand our total addressable markets in fast-growing segments:

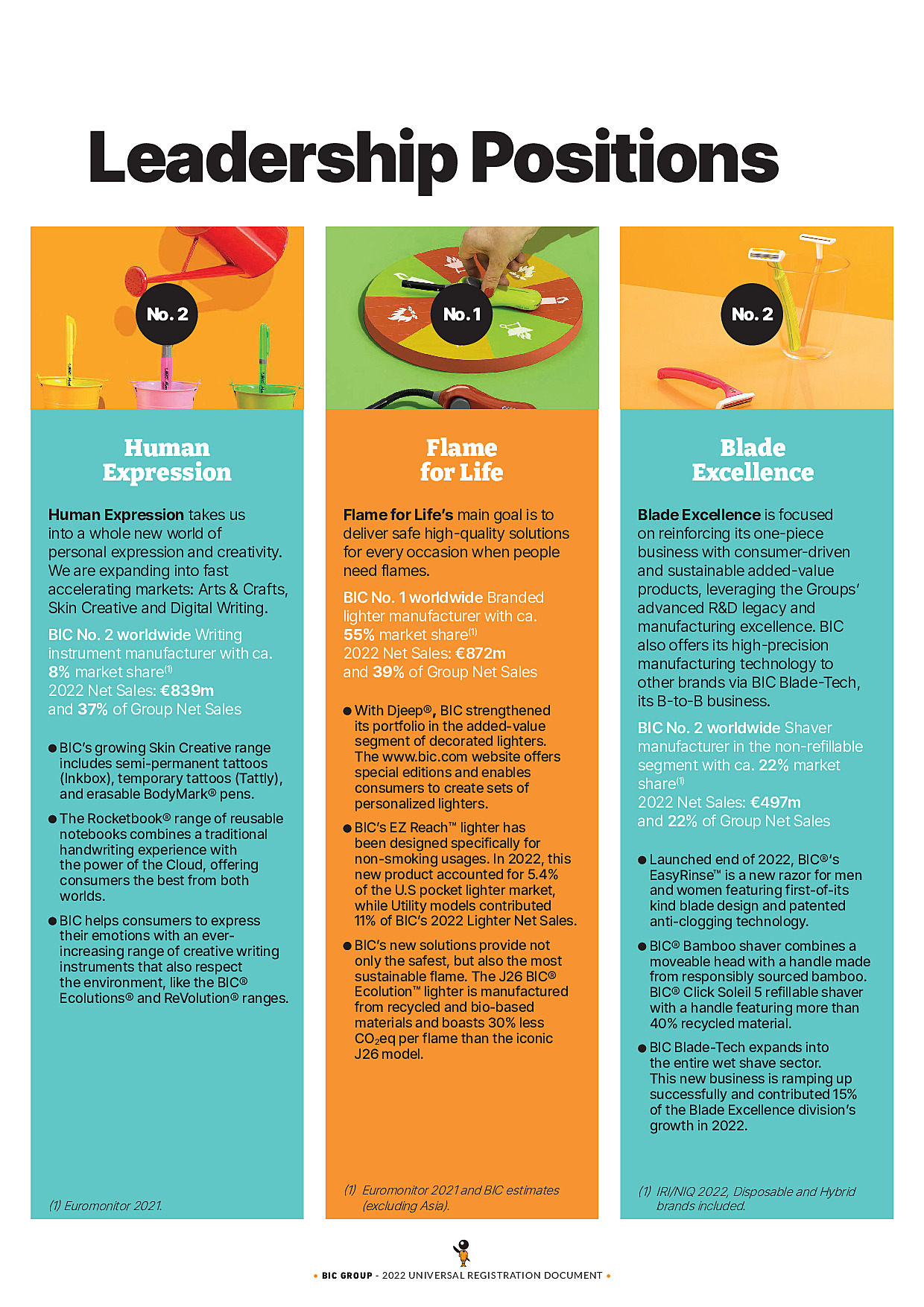

1.4.1.1Human Expression – Stationery

In line with its Horizon strategy, BIC’s historical Stationery category evolved towards “Human Expression” to go beyond core Writing Instruments into Creative and Digital Expression. BIC constantly innovates to further strengthen its presence in both existing and adjacent segments.

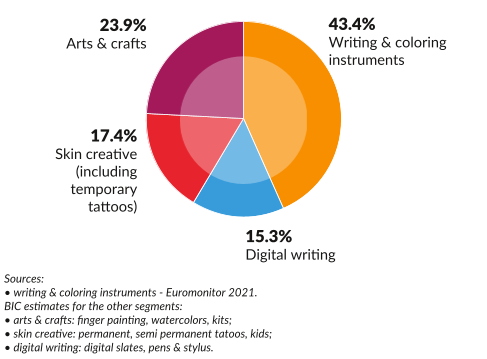

Human Expression encompasses Writing and Coloring Instruments, Creative Expression which includes Arts and Crafts, Skin Creative and Digital Expression. Human Expression is a mid- single-digit growth market, which should reach c.50 billion euros by 2025 (4).

Since the launch of the BIC® Cristal® pen in 1950, BIC has continuously diversified its Stationery product range through more added-value products and innovative launches and with an increased focus on sustainability.

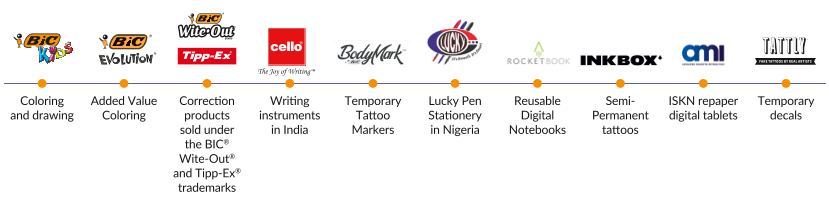

To name a few in the last three years, BIC launched an anti-bacterial pen BIC® Clic Stic® PrevaGuardTM, a tattoo body marker BIC® Bodymark, a new coloring range called Intensity, its first rechargeable metallic ball pen BIC® Cristal® Re’New™. In 2020, BIC acquired Rocketbook® the leading brand in Reusable Digital Notebooks. In 2022, BIC diversified further its brand portfolio, with the acquisition of Inkbox, the leading brand of high quality semi-permanent tattoos (high-quality 2-4 days decals), and Tattly, a US startup innovating in the field of high-quality temporary decals (2-4 days), which will diversify BIC's offering in the rapidly growing Skin Creative market. In the Digital Writing segment, BIC acquired AMI (Advanced Magnetic Interaction), a French innovative startup. AMI will strengthen BIC's R&D capabilities in Digital Expression.

In 2022, BIC’s global product portfolio included writing, marking (classic, permanent and temporary tattoo markers), correction, coloring, drawing instruments, semi-permanent tattoo, and smart reusable notebooks.

Breakdown OF the Human Expression market size per segment IN 2021

BIC’s markets and positioning

Core Writing & Coloring Instruments Market

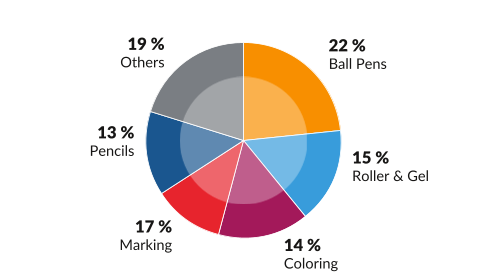

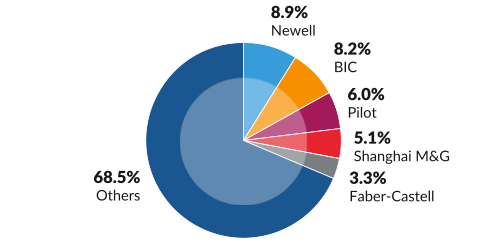

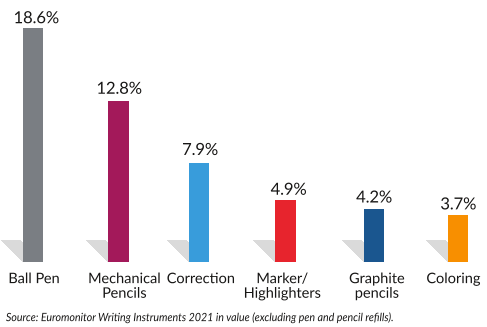

BIC’s historical market Writing and Coloring Instruments amounted to 18 billion(5) euros in 2021. The segment is expected to grow at around 5% CAGR 2021-2025(6) driven by the rising demand from developing countries and innovation which will fuel growth in the Developed countries. Although the market remains highly fragmented, with many local players and family-owned businesses, it is dominated by four players (BIC, Newell Brands, Pilot and Shanghai M&G Stationery) with each recording an estimated market share over 5%. BIC is the number 2 global manufacturer with 8.2% market share, benefiting from leading positions in both Developed and Developing Markets.

Over the years, BIC strengthened its presence in Writing and Coloring Instruments' market through innovative launches enabling market share gains in key countries, whether it be in core writing instruments or in added-value products.

Breakdown of the Writing Instruments market

By region

By product segment

main market leaders

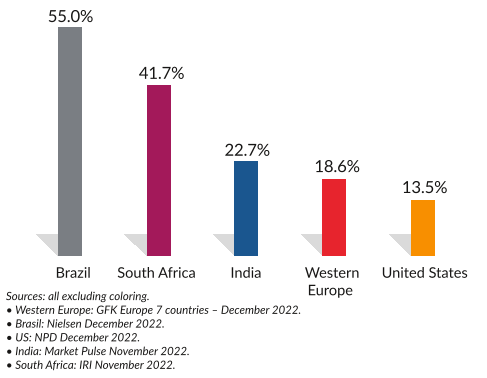

BIC’s market share by segment

BIC’s Market share by region - 2022

While BIC’s portfolio is currently concentrated in historical core Writing Instruments segments, the Group’s ambition is to shift towards more added-value and adjacent segments such as the Creative and Digital Expression markets. In 2022, 24% of Human Expression Net Sales came from the Creative and Digital Expression segments.

Creative Expression markets

The Arts and Crafts market is a large, mid-single-digit growth market (estimated at 10.6 billion euros in 2021)(7). The market is expected to grow by 3% (CAGR 2021 – 2025) thanks to the increasing demand of both kids’ and teens’ market as well as from adults asking for more creativity. Kids’ crafts account for more than 50% of the total. It includes a variety of sub-segments including Finger-painting, Watercolors, Kits, Crafting Accessories, Modeling Clay and Slime .

The Skin Creative market estimated at 7.4 billion euros(1) includes the permanent tattoos and the “Do it Yourself” Skin Creative segments. The fast-growing “Do it Yourself” Skin Creative segment includes temporary tattoo markers, temporary decals, henna tattoos and semi-permanent tattoos. It is expected to exceed 1.3 billion euros(1) in 2031, powered by the increasing desire of young consumers to be more fluid with their appearance and to express themselves using their body as a changeable canvas. Market players are mostly non-branded small companies.

- ●BIC entered the Skin creative market in 2018 through the launch of Bodymark®, an innovative temporary tattoo marker to address consumers’ attitudes shift towards self-expression, individuality and creativity.

- ●The acquisition of Inkbox in 2022 elevates BIC to a leadership position in the Do-It-Yourself Skin Creative industry and further enhances the Group’s existing portfolio of recognized consumer products, where different brands address diverse types of consumer groups. With its unique ability to customize, Inkbox further strengthens BIC’s DTC business and reinforces existing digital and social media engagement capabilities.

- ●In August 2022, the Group acquired Tattly, a US startup innovating in the field of small high-quality 2-4 days decals, diversifying BIC’s offering in the rapidly growing Skin Creative market and particularly in the kids' segment.

Digital Expression market

The Digital Writing market was estimated at 6 billion euros in 2021(1). As technology is improving and becoming more affordable, this market should grow by 6% CAGR 2021-2025(1) to weigh above 7 billion euros. It encompasses four main sub-segments: reusable notebooks, smart pens, slate tablets, and stylus for tablets:

- ●BIC’s entered into Digital Writing through the acquisition of Rocketbook® in 2020, the leading smart and reusable notebook brand in the U.S.;

- ●In 2022, BIC strengthened its R&D capabilities in Digital Writing with the acquisition of AMI (Advanced Magnetic Interaction), a French company specialized in the augmented interaction technology. AMI has designed the ISKN Repaper digital tablet, which allows users to capture paper writing and drawing in an electronic format.

BIC’s Brand Portfolio in Human Expression

BIC was built on the amazing power of its Brand, which is one of the world’s most popular household names. Over time, other brands have been added to our portfolio, most of them using BIC as an umbrella to drive attractiveness and consumer engagement, including Tippex®, WiteOut® and, more recently BodyMark® by BIC.

With Horizon, BIC started to migrate to a “house brands” strategy, where each brand has a different meaning for consumers. The acquisitions of Rocketbook and more recently Inkbox and Tattly further strengthens this approach. BIC’s Human Expression division now offers a diversified panorama of brands, where consumers can each see themselves reflected and find their “own” brand favorites.

BIC’s Distribution Channels

BIC’s mission is to offer products available to consumers every day and everywhere, supported by its historical strategy “A BIC seen is a BIC sold”.

BIC products are sold through a comprehensive range of channels worldwide as the Group pursues its objective to be an omnichannel specialist both offline and online. Products can be found in retail mass-market distributors, eCommerce channels (pure players, market places, B2B and B2C omnichannel retailers), traditional stores and Office Product suppliers (through contract or office superstores).

In the retail mass-market channel, Back-to-School season remains a key period. BIC offers consumers a tremendous range of school and college products through numerous displays, theatralization (for example the iconic school bus display in Europe) and merchandising tools.

Office & school supply remains a critical distribution channel where BIC has a strong position thanks to the quality, reliability and value for money positioning of its product, all even more important for companies, administrations and schools.

With the launch of BIC’s Invent The Future transformation plan in 2019, BIC strengthened its distribution network by reinforcing its e-commerce positions. In 2022, BIC maintained its leading positions in Stationery online in key markets: the Group ranked number 1 in France with 21% market share, number 2 in the UK with 18% market share, and number 3 in the U.S. with almost 13% market share (in value YTD December 2022).

1.4.1.2Flame for Life – Lighters

In line with its Horizon strategy, BIC’s historical Lighter category evolved to “Flame for Life”, focusing on all lighting occasions. Flame for Life aims to balance volume with a more value-driven model, powered by trade-ups, personalization and innovation, to respond to changing consumer trends, while focusing more on sustainability.

BIC’s market and positioning

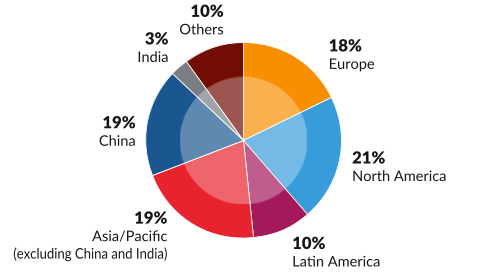

The worldwide pocket lighter market is estimated at 13.1 billion units (4.7 billion in value) (8).

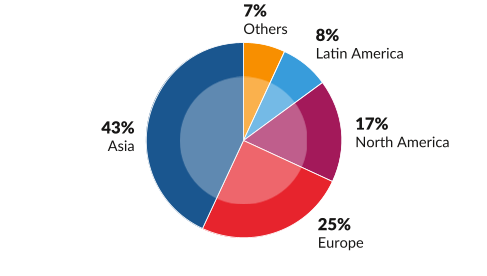

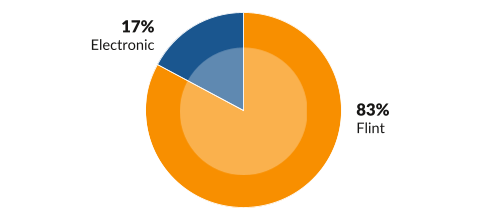

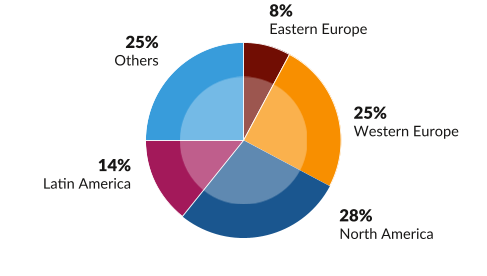

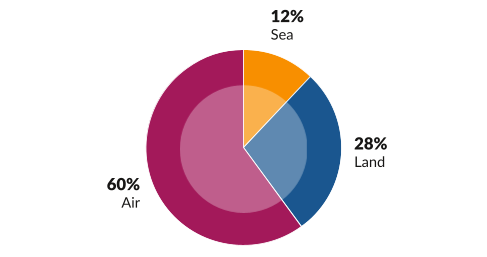

Breakdown of the global pocket lighter market in 2021

By region

By product segment

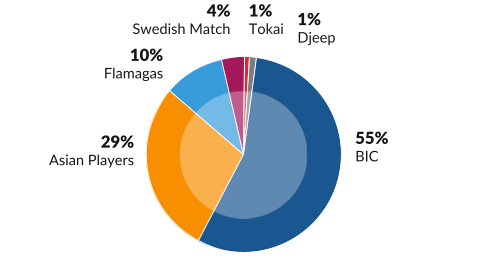

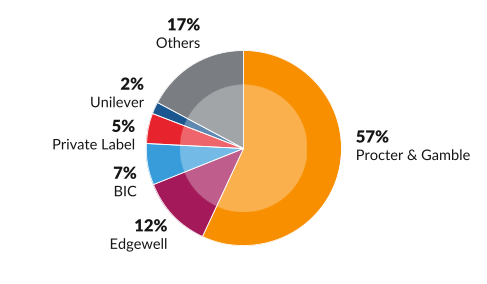

Market leaders (excluding ASIA)

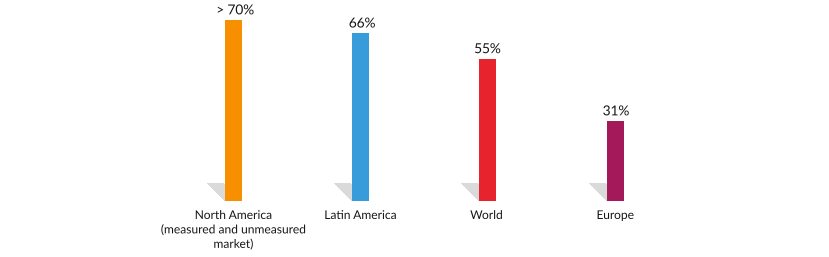

BIC’s leadership position and market shares

BIC is No. 1 worldwide in branded pocket lighters in value, with approximately 55% in value in 2021 (excluding Asia) with leading positions in key geographies including North America, Latin America and Europe. The competitive advantages supporting BIC’s leadership position include safety, quality, strong brand awareness, automated and highly efficient manufacturing process, and a solid distribution network.

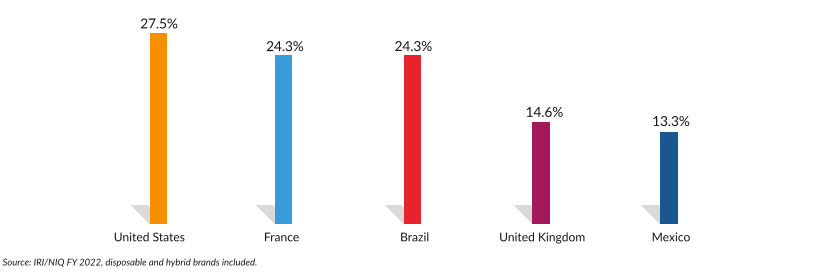

BIC® pocket lighter market share in value in 2021 (excluding Asia)

Safety and quality, a key differentiator for BIC

BIC is well-known for providing safe, high quality and compliant lighters to consumers worldwide. A lighter is pressurized gas in a plastic reservoir that is lit by a flame. It can present a real danger if it is not designed and manufactured properly. The consequences can be severe and are often unknown by consumers. International Safety Standards protect consumers from unsafe lighters.

- ●international lighter safety standard ISO 9994, which sets out the basic safety requirements for a lighter. ISO 9994 is mandatory in major markets such as Canada (1989), Russia (2000), Brazil (2002), South Africa (2002), Argentina (2003), Thailand (2003), Mexico (2004), South Korea (2005), the 27 members of the European Union (2006), Japan (2011), Indonesia (2011) and Turkey (2012);

- ●child-resistant requirements. A child-resistant lighter is purposely modified to make it more difficult to operate by children. Under this standard, the basic requirement is that a lighter cannot be operated by at least 85% of children under 51 months. Child-resistant legislation is mandatory in major countries such as the U.S. (1994), Canada (1995), Australia (1997), New Zealand (1999), the 27 members of the European Union (2006), Japan (2011), South Korea (2012) and Mexico (2016).

Low-cost lighters too often fail to comply with safety standards. Since the late 1980s, lighter models imported from Asian countries have gained market share. They currently account for over half of the global market (in volume).

BIC has been defending its position in this competitive landscape since its creation and advocates for enhanced lighter safety and quality. BIC® lighters comply with even more stringent safety, quality, and performance requirements. For example, the gas reservoirs of BIC® lighters are made from POM (PolyOxyMethylene), a high-performance resin with very high impact resistance. This means that BIC® lighters contain more gas, allowing more ignitions thanks to their wall’s thinness. They are also filled with pure isobutane, which ensures the flame’s stability throughout the lighter’s life.

Towards a more value-driven model through trade-up and innovation

BIC offers a wide range of high-quality Pocket and Utility lighters manufactured with the highest safety standards.

While BIC’s shift to balance more volume with value in the model for its Lighter business started years ago, this was accelerated with the launch of the Horizon plan. More recently the following developments were made to support this transformation:

- ●the acquisition of Djeep in June 2020, which strengthened BIC’s portfolio in the added-value segment of decorated lighters;

- ●the launch of EZ ReachTM, BIC’s first pocket Utility lighter, in July 2020. The product has already reached 5.4% of the US pocket lighter market (Source: IRI YTD December 2022). Utility lighters (including BIC® EZ ReachTM) accounted for 11% of BIC’s 2022 Lighter Net Sales;

- ●the deployment of Revenue Growth Management strategy to drive efficiency in promotional and pricing activities.

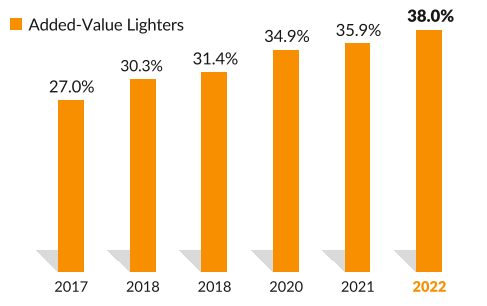

In 2022, added-value lighters, including BIC®EZ ReachTM, Djeep®, utility and decorated lighters, represented 38% of BIC’s total Lighter Net Sales, on track to reach the Group's 50% objective by 2025.

Added-Value lighters as a % of total Flame for Life DIVISION NET SALES

BIC lighter brand portfolio

Addressing all lighting occasions including non-related to tobacco flame usages

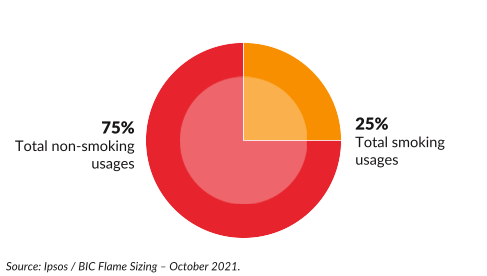

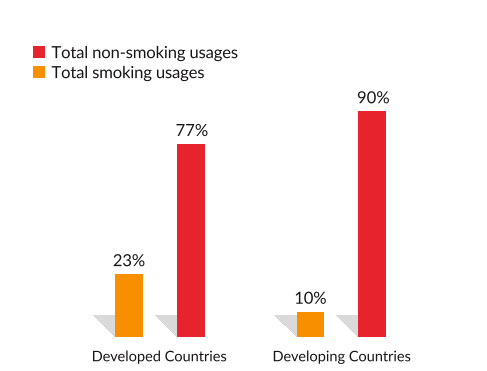

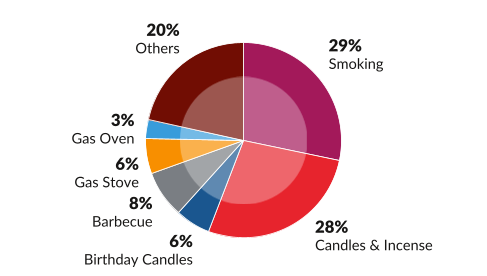

An important pillar of BIC’s Flame for Life strategy is to drive growth by expanding to all flame occasions through incremental usages, as lighters have extensive non-smoking-related usages among different consumer activities. For the last six years, BIC lighter teams have undertaken extensive research to deepen their knowledge of the different flame usages. One of the main findings confirmed that candles and cooking are the most important non-tobacco-related flame usages in developed and developing regions (Ipsos study for Calyxis – October 2021). These lighting occasions represent a growth opportunity for BIC, well-positioned to answer the usages non-related to tobacco through the strength of its brand.

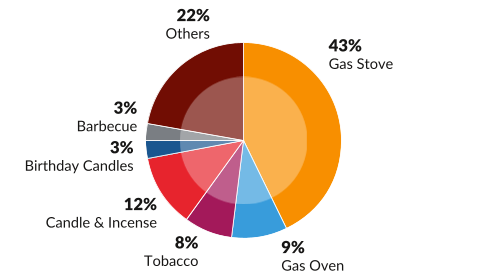

Total Flame Devices – Share of Lighting Occasion

DETAILED Breakdown of flame occasions in the U.S. and BRAZIL

U.S.

Brazil

BIC’s Distribution Channels

BIC® lighters are sold through traditional distribution channels (such as convenience stores and tobacconists), retail mass-market distribution stores, and online in the United States. Both online and offline, in-store visibility is key to driving impulse purchases, and part of BIC’s historical strategy “A BIC seen is a BIC sold”.

In the traditional channel, which is the leading channel for lighters, BIC is the undisputed leader driven by full-distribution based on strong routes-to-market, and relevant customer and consumer programs driving value to the business. Counter displays and trays help BIC showcase large ranges of decorated lighters and innovations such as BIC®EZ Reach, addressing everyday needs while generating impulse instore purchases.

In the mass-market channel, BIC focuses on relentless store visibility: at the check-out with classic pocket lighter ranges but also throughout affinity aisles such as candle and barbecue where EZ Reach and Utility lighters are highly attractive to consumers.

In e-commerce, in 2022, BIC continued to expand its BIC.com website in the U.S. driven by the “Design my BIC” offer enabling consumers to create sets of personalized lighters. They can also find exciting special editions, mono-color sets and brand new series of lighters.

1.4.1.3Blade Excellence – Shavers

BIC’s Blade Excellence division focuses on reinforcing its one-piece business with consumer-driven and sustainable added-value products and capitalizing on our advanced R&D and manufacturing capabilities through the creation of BIC Blade-Tech, the Group's B2B business for the wet shave market.

BIC’s markets and positioning

The wet shave market was about 10.9 billion euros in 2021 and accounted for around 48% of the hair removal segment(9) in value . The estimate 2021-2025 CAGR(10) for Total Wet-Shave market is +4.9%.

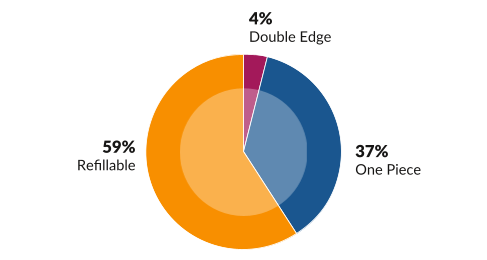

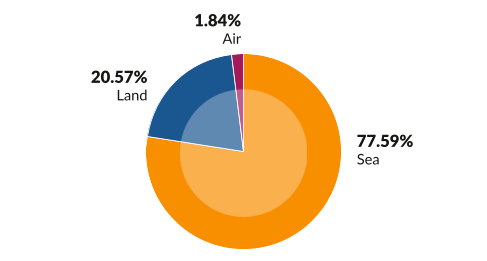

Global wet shave market

By region

By product segment

Market leaders

The Wet-Shave market is split into three product segments: double-edge, one-piece and refillable. On the highly competitive environment of the one-piece and refillable segments, growth is mostly driven by new products which offer improved performance and added features. A constant ability to innovate is key to maintain a leadership position. With that objective, BIC has made the shift towards premiumization to gain market share on value-added segments, while keeping BIC's strength in offering products at the right value.

The global landscape is dominated by three legacy brands (Gillette, BIC®, Edgewell) though over the last decade “disruptors”, primarily in the US launching as direct-to-consumer brands, have emerged. While such brands have expanded presence by securing distribution in brick and mortar, they are not directly competing with BIC given their refillable segment focus.

BIC’s market share in the non-refillable shavers segment

BIC is the No. 3 worldwide player, with almost 7% share(11) of the total wet shave segment. In the non-refillable segment (disposable), BIC ranks n°2 worldwide with 22% market share (12). The Group holds key positions in Europe, in the United States and in Latin America.

BIC’s product portfolio, towards more innovative and sustainable products

In the 1970s, BIC revolutionized wet shaving when it launched the first one-piece shaver: the single blade “classic”.

Over the last decade and supported by the implementation of the Horizon strategy, BIC has focused its innovation, sales and marketing efforts on the high performance three, four, and five-blade sub-segments, offering thus a complete range of female and male products:

- ●for Men: BIC® 3, BIC® Comfort 3®, BIC® Easy/Hybrid 3-blade, BIC® Flex range, and BIC® Flex Hybrid range;

- ●for Women: BIC® Pure 3® Lady, BIC® Soleil® range including Bella®, Glow®, Balance and Miss Soleil; BIC® Soleil Escape, BIC® Click Soleil 5;

- ●for Men and Women: at the end of 2022, BIC launched BIC® EasyRinse online in the US market, a new razor for men and women featuring a first-of-its-kind blade design and patented anti-clog technology. This new product will be rolled out throughout 2023, in stores in the U.S.

In line with Horizon strategy, BIC also innovates with new products centered on sustainability and tailored to consumer evolving trends. As such, BIC recently launched:

- ● BIC® BAMBOO shaver in 2021: a five-blade Hybrid Flex 5 with a movable head and a handle made from responsibly sourced bamboo;

- ●an innovative hybrid shaver range in Europe in 2021 made with recycled plastic handles and sold with recyclable packaging;

- ●BIC® Click Soleil 5 in 2022: a razor for women with a handle made from 40% recycled material and co-developed with the raw material supplier Avient.

BIC Blade-Tech

With Horizon, BIC created BIC Blade-Tech, aimed at leveraging BIC’s leadership position as a high precision manufacturer to power other brands and thus expand our addressable market into the total wet shave market, estimated to reach 13 billion euros for 2025(13). A team including a commercial sales force dedicated to this new business, was created in 2021. BIC Blade-Tech started to ship its first customers, including both new and already established brands, in September 2021. In August 2022, BIC added a third customer to its portfolio. Based in India, this customer sells “powered by BIC” products for men. Overall, the new B2B business is successfully ramping up and contributed to 15% to the Blade Excellence division's growth in 2022. As planned, BIC Blade Tech is also accretive to the overall division’s profitability.

Other products

-

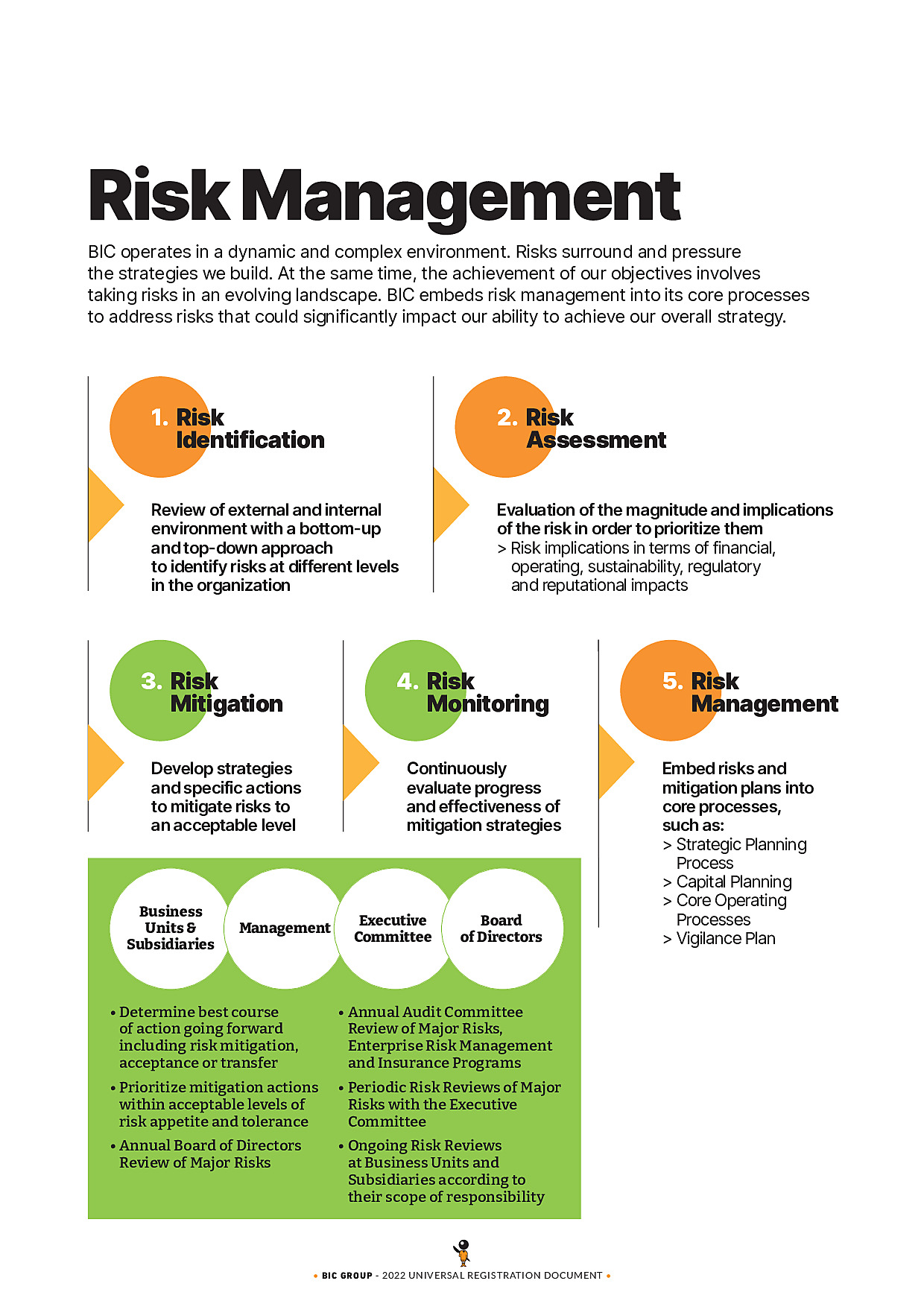

2. RISK MANAGEMENT

BIC actively and dynamically manages its risks. The goal is to enhance the Group’s ability to identify, manage, prevent, mitigate and monitor key risks that could affect the Group's:

- ●employees, customers, shareholders' interest, assets, environment or reputation;

- ●ability to achieve its targets;

- ●ability to stay true to its values; and

- ●ability to comply with laws and regulations including codes of ethics.

This approach is built around identifying and analyzing the main risks to which the Group is exposed.

A description of the risk management system can be found in Section 2.4. Risk management and internal control procedures implemented by the Company and Insurance.

-

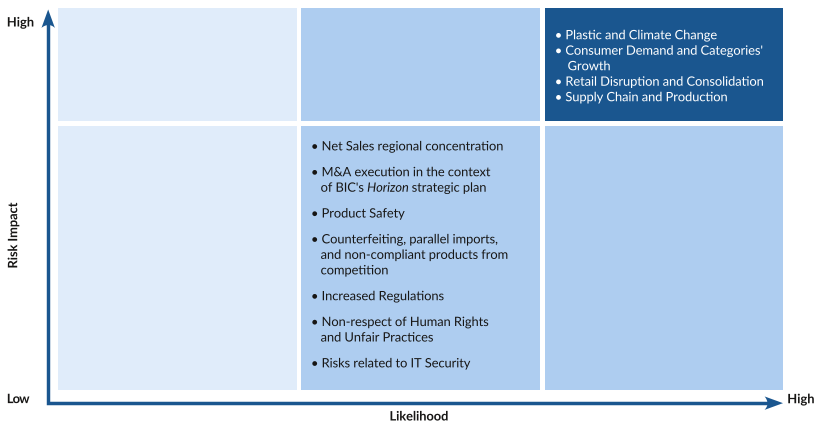

2.1.Main risks and risk assessment

Risk Impact

Low

Medium

High

Risks related to Plastic and Climate Change

X

Risks related to Consumer Demand and Growth in our three business categories

X

Risks related to Retail Disruption and Consolidation

X

Risks related to BIC’s Supply Chain and Production

X

Risks related to BIC’s Net Sales Regional Concentration

X

Risk related to M&A execution in the context of BIC’s Horizon strategic plan

X

Risks related to Product Safety

X

Risks related to counterfeiting, parallel imports, and non-compliant products from competition

X

Risks related to increased Regulations

X

Risks related to the non-respect of Human Rights and Unfair Practices

X

Risks related to IT Security

X

In 2022, Russia and Ukraine accounted for 2.8% of BIC total Net Sales. Following the onset of the war, BIC paused all media, advertising, hiring, and capital investment in Russia, with the goal to ensure that this business disruption had as little impact on affected team members as possible. Simultaneously, BIC limited its product selection at retail to basic essential items only and remained diligent in complying with all regulatory decisions, including European and U.S. sanctions. BIC remains in complete control of its brand and intellectual property in Russia to counter any potential moves for brand appropriation. The Group has no industrial presence in these two countries. Please refer to “Risks related to Supply Chain” and “Risks related to IT security”.

-

2.2.Description and mitigation of main risk factors

Risks related to plastics and climate change

Plastics and climate change are major risks for BIC:

- ●Risks related to plastics encompass:

- ●upstream risks: with this material being used in BIC® products, thereby depleting a non-renewable resource that is thus subject to rarefaction and price volatility, and

- ●downstream risks: with issues surrounding pollution from plastic waste. In addition, and although BIC® products are not single-use, the regulatory environment surrounding plastics is becoming increasingly stringent. Consumers and public opinion also hold increasingly negative views regarding such products.

- ●Risks related to climate change include:

- ●risk of an increase in raw material costs. Energy efficiency programs, carbon capture and other measures by suppliers might increase raw material production costs;

- ●risk of an increase in the cost of alternative plastic sourcing due to growing competition;

- ●increased cost of operations linked to the rise of carbon prices.

Level of risk impact: high

Potential Impact on BIC:

The potential impacts on BIC include:

- ●increased cost of raw materials;

- ●rarefaction and price volatility of plastics;

- ●brand image deterioration due to alleged “single-use” plastic products;

- ●heightened regulations on plastics, impacting BIC’s direct or indirect operations;

- ●carbon regulations affecting operating costs;

- ●disruption or interruption to production activities due to extreme weather events related to climate change;

- ●environmental labelling of products, thereby impacting sales.

Examples of Risk Mitigation:

- ●A comprehensive Sustainable Development Program designed to limit the environmental impact of BIC’s activities. This covers BIC’s activities, products and supply chain, supplemented in 2018 by the commitments in the Writing the Future, Together program, including:

- ●improving the environmental and/or societal footprint of BIC® products (2025 Commitment: #1 Fostering sustainable innovation in BIC® products).

- This goal is based on rolling out a comprehensive eco-design process as part of each product category’s innovation processes.

- This will allow BIC to mitigate the following risks:

- ●the plastics challenge, and

- ●the carbon footprint of its products;

- ●the use of 100% renewable electricity by 2025.

- With this, the Group is looking to reduce its greenhouse gas emissions by purchasing renewable energy. It will also study the potential production of renewable electricity on-site;

- ●a circular economy approach fully embedded into BIC’s historical approach to its products, including its 4R philosophy (Reduce, Recycled or Alternative, Refillable, Recyclable).

- ●Ambitious commitments on plastics:

- ●by 2030: BIC aims for 50% non-virgin petroleum plastic for its products, with a goal of 20% by 2025;

- ●by 2025: 100% of BIC’s consumer plastic packaging will be reusable, recyclable or compostable.

In 2022, BIC undertook a study to review the physical risks from climate change to all its facilities and those of some contract manufacturers and suppliers. The analysis included 248 facilities globally, including manufacturing centers, offices, residential buildings, warehouses and land owned by a third-party supplier or owned and leased by BIC.

The climate hazards included in the analysis were heat stress, water stress, floods, sea-level rise, and hurricanes and typhoons (tropical cyclones).

The most prevalent hazards for BIC were found to be floods and heat stress. Many of the exposed facilities are owned by third parties or leased.

All these initiatives and those mentioned in the Group’s Sustainable Development Strategy in Chapter 3 help mitigate the risks.

Risks related to Consumer Demand and Growth

BIC is exposed to changing consumer trends for its products as a result of consumer preferences and attitudes to its products across all three categories – Human Expression, Flame for Life and Blade Excellence.

Global consumer trends may include:

- ●growth in Digital Writing technology;

- ●reduced tobacco use;

- ●changing shaving habits.

Level of risk impact: high

Potential Impact on BIC:

- ●A lack of viable responses would impact sales and profitability.

- ●Changing consumer habits impacting BIC’s three categories might result in:

- ●a shift to e-learning in stationery;

- ●lower tobacco consumption in lighters;

- ●less frequent shaving in shavers.

Examples of Risk Mitigation:

- ●Focus Research & Development (R&D) on product innovations and brand positioning to address the decline and change in consumer demand.

- ●Adopt a Consumer-lens to category expansion.

- ●Expand in fast-growing Creative Expression and Digital Writing markets.

- ●Focus on sales growth in Developing Markets.

- ●Increase total addressable markets.

Risks related to Retail Disruption and Consolidation

BIC® product sales may be adversely impacted by:

- ●the consolidation of retail customers via e-commerce; and

- ●the potential reduction in pricing power related to pressure from retailers for lower pricing, increased promotional programs and direct-to-consumer channels.

Level of risk impact: high

Potential Impact on BIC:

- ●Changing consumer buying habits may reduce pricing power through e-commerce channels and impact BIC’s sales.

Examples of Risk Mitigation:

- ●Serve consumers wherever they shop across all channels from e-commerce to hypermarkets, stationery stores and small traditional trade stores.

- ●Expand in e-commerce by covering the spectrum from Pure-Play e-retailers to omni-retailers and rolling out the Direct To Consumer offering.

- ●Roll out of compelling consumer displays in retail stores and strengthen search efforts in e-commerce to drive sales conversion.

Risks related to BIC’s supply chain and production

As a consumer products manufacturing, distribution, and sales-oriented organization, BIC is exposed to the risk of interruptions to production and internal and external supply chains issues. These may arise from raw material shortages or operational disruptions at suppliers. This is particularly true during critical seasonal buying periods like “back-to-school” in Stationery.

BIC operates a number of manufacturing and warehousing facilities across the globe. Nevertheless, certain products may be concentrated within specific regions, which may be impacted by a catastrophic event.

BIC is exposed to specific risks associated with the storage and use of hazardous substances. These include:

- ●gas for lighters;

- ●solvents for permanent markers and dry-wipe markers;

- ●solvents for industrial cleaning processes.

Level of risks impact: high

Potential impact on BIC:

- ●A reliance on the supply chains of outside vendors may result in a shortage of raw materials if the vendor suffers a catastrophic event and/or disruption.

- ●A lengthy supplier qualification process may impact the availability of potential suppliers.

- ●A risk of losing key input materials if a supplier changes a formulation.

- ●A significant supply chain disruption may lead to BIC’s inability to meet consumer demand and/or commitments.

- ●Certain plastics used in BIC products may see significant competition from other sectors. This may reduce the availability of raw materials and inventory.

- ●Reliance on specific raw materials and a significant cut in plastics from suppliers due to environmental regulations may impact product development.

- ●Interdependencies between BIC facilities may be impaired if a peril causes an inability to ship products from a manufacturing facility to distributors. This may affect the ability to supply goods to consumers.

- ●The continuing presence of Covid-19 could impact BIC’s Global Supply Chain.

- ●The current crisis in Ukraine may continue to affect the supply and prices of certain raw materials.

Examples of Risk Mitigation:

- ●The BIC Procurement team focuses on supplier acquisition, supplier qualification and onboarding. It is also responsible for alternative sourcing and materials.

- ●Mitigating controls are in place to look for multi-supplier sourcing.

- ●An enhanced communications platform between sales and production teams allows to “right-size” product quantities and locations.

- ●BIC Logistics teams developed a logistics supplier mitigation strategy and warehousing optimization plan to minimize disruptions to distribution (sea and road freight).

- ●People and Capabilities programs are in place to enhance the strategy and maturity of functions required for global supply chain disruptions.

In all BIC factories:

- ●attention is paid to implementing and monitoring preventive measures and safety systems for gas and solvent storage areas;

- ●suitable control devices and equipment are in place to minimize risks from hazardous chemical substances;

- ●priority is given to the use of appropriate fire prevention systems including fire detection and control equipment;

- ●hazard and risk assessments are undertaken;

- ●procedures are put in place to identify, assess and prevent incidents and accidents;

- ●the workforce is trained to recognize potential hazards, as well as to take preventive and corrective action;

- ●compliance with local regulatory requirements is an integral part of the daily management of facilities;

- ●strategic inventories are held in some factories to cover critical materials and components;

- ●training programs are in place in all factories to back up the critical processes and ensure flexibility to cover market needs;

- ●maintenance programs are in place in all factories to protect key equipment and technical processes.

Certain Group factories are subject to the European Union SEVESO Directive, that identifies industrial sites that could pose significant accident risks. The SEVESO plants have emergency procedure protocols (plan d’opération interne and plan particulier d’intervention) and a major hazard prevention policy. Both SEVESO plants (BJ75 lighter factory and BIMA stationery factory) have also implemented a safety management system.

All other plants have equivalent emergency plans to address risks with potential off-site consequences.

Risks related to BIC’s Net Sales regional concentration

BIC's Net Sales are concentrated in a few key markets, notably the U.S., Brazil and France.

Level of risk impact: medium

Potential impact on BIC:

- ●Such concentration of revenue generation potentially exposes BIC to risks of shifting consumer demand or regulatory environment in those markets.

Examples of Risk Mitigation:

- ●Ongoing focus on sales in future growth markets.

- ●Roll-out of a portfolio approach.

Risk related to M&A execution in the context of BIC’s strategic plan Horizon

BIC’s Horizon strategic roadmap includes targeted acquisitions to strengthen BIC’s existing activities and develop into adjacent businesses.

Level of risk impact: medium

Potential impact on BIC:

- ●Execution of the deal, including the valuation and due diligence of the target businesses.

- ●Integration planning and execution of the acquired companies, including failure to capture synergies.

Examples of Risk Mitigation:

- ●A dedicated centrally-led M&A team is in-place with professionals with extensive M&A backgrounds.

- ●A clear operating model has been established with strong governance and clear accountability.

- ●A disciplined process supports due diligence and execution to identify and assess value creation.

- ●A strong planning process governs integration, focusing on delivering the synergies identified during the due diligence process.

- ●Creation of an integration team to ensure we capture the synergies and execute the underwriting plan.

Risks related to product safety

The risk related to product safety and consumer health and safety is placing non-compliant or unsafe products on the market.

Level of risk impact: medium

Potential impact on BIC:

- ●Impact on consumer health and safety.

- ●Impact on the Brand image (consumers), BIC’s reputation and business interests.

- ●Potential costs associated with possible market withdrawal or recall and/or fines.

Examples of Risk Mitigation:

- ●The Product Safety Policy includes commitments to ensure that products designed and manufactured by the Group are safe for health and the environment.

- ●BIC embeds regulatory compliance and product safety risk management into its strategy through a rigorous set of processes. The millions of consistent quality products that BIC supplies every day are verified by multiple tests and risk assessments.

- ●Consumer health and safety concerns are part of product design and manufacturing. Since 2019, the BIC Watch List has been factored into product ratings in EMA. The product safety team works closely with the product design teams to stay abreast of changes to the list and ensure its incorporation into product improvement.

For further information please see Section 3.3.4 Product Safety.

Risks related to counterfeiting/gray goods, parallel imports and non-compliant products from competitors

Counterfeits of the best known BIC products circulate throughout Africa, the Middle East, Eastern Europe and South America. They are mostly manufactured in Asia. These counterfeits, often of low quality, are mainly focused on our products’ shape and on the BIC® trademark. Additionally, gray goods (i.e., genuine BIC products made for specific markets and smuggled into another country) that violate U.S. regulations pose product recall risks.

The Group faces competition from low-cost lighters that often do not comply with safety standards, the ISO 9994 international safety standard, and the EN 13869 child resistance standard.

Level of risk impact: medium

Potential impact on BIC:

- ●Impact on the Brand image (Consumers).

- ●Unfair competition with non conform or counterfeit products.

- ●Costs associated with possible market withdrawal or recall and/or fines.

Examples of Risk Mitigation:

- ●The Legal Department decides on relevant courses of action against such counterfeits, gray goods and non-compliant products by closely working with local authorities and law enforcement agencies. These courses of action include:

- ●judicial and administrative actions;

- ●monitoring program of leading e-commerce platforms;

- ●market surveillance, traceability measures, and collaboration with local authorities to prevent illegal importation of gray goods to the U.S.

- ●BIC also targets non-compliant lighters through communication efforts geared toward stakeholders (customers, market surveillance authorities, EU Commission, EU Parliament, etc.).

- ●The Group continues to advocate to reinforce market surveillance in Europe. Some of the Group’s proposals have been included in the EU Commission’s General Product Safety Regulation proposal (June 30, 2021). An almost final draft was issued in December 2022. It lacks key elements to allow any significant improvement in enforcing safety requirements.

- ●In 2022, BIC worked to improve lighter safety standards in Mexico, advocated in Brazil for the maintenance of strict legislation on lighter market surveillance and strengthened market surveillance campaigns in Argentina .

- ●In 2022, the ISO 9994 safety standard has become mandatory for the first time in a U.S. State (Connecticut).

Risks related to heightened regulations

Restrictions, prohibitions and proposed prohibitions are increasingly common in the fields of chemical substances and plastics, particularly in North America and Europe. In the EU, the “New Green Deal for Europe” scheme aiming at making Europe the first carbon neutral continent by 2050, includes an ambitious plan "the Ecodesign plan for Sustainable Products Regulation" (ESPR). The purpose of the regulation is to define rules to make products more reliable, sustainable.

Level of risk impact: medium

Potential impact on BIC:

- ●Impact on manufacturing processes and business interests.

Examples of Risk Mitigation:

BIC closely monitors announced regulatory changes and voices relevant technical and legal arguments:

- ●Together with other European manufacturers, BIC continues to object to the EU Commission’s interpretation of the scope of the EU’s CLP regulation (Classification, Labelling, Packaging).

- This regulation would require putting warning phrases on each writing instrument and lighter regarding the chemical substances in the containers.

- It would also require safety data sheets for each product. If BIC articles were considered as mere containers of mixtures, this could also trigger the application of laws relating to packaging and packaging waste;

- ●BIC regularly makes proposals as part of the ongoing revision of the EU’s CLP regulation. BIC also makes proposals in respect of the ecodesign of products (ESPR).

Risks related to IT Security

The Group is exposed to risks stemming from cyberattacks and the failure of IT and telecommunications systems.

Personal data protection regulations, including the General Data Protection Regulations (GDPR), have increased the risks related to regulatory non-compliance.

The risk and cost of cyber threats continue to increase as more sophisticated attack capabilities are leveraged by malicious actors to initiate cyber breaches, with the intent to extort and/or disrupt businesses. In addition, changing work practices such as hybrid work/office attendance and the extension of digital connections between businesses increases the number of vulnerabilities that must be managed.

Level of risk impact: medium

Potential Impact on BIC:

- ●Loss of strategic or confidential information.

- ●Failure of IT and telecommunication systems.

- ●Disruption of business operations, including manufacturing facilities or distribution centers.

Examples of Risk Mitigation:

- ●Dedicated IT security & data governance resources and processes have been established, including creating a Security Council and the appointment of IT Security & Risk Leaders.

- ●Cyber security mitigation has been aligned with BIC’s internal control framework, and updates are regularly sent to the Audit Committee.

- ●IT security policies & standards have been implemented across the organization.

- ●Investments continue to be increased in cyber defense tools and services.

Risk related to the non-respect of Human Rights and Unfair Practices

This risk includes non-compliance with fundamental human rights such as child labor, discrimination or forced labor, as well as corruption and unfair practices.

Level of risk impact: medium

Potential Impact on BIC:

- ●Legal actions against BIC and significant consequences in terms of reputation and attractiveness.

Examples of Risk Mitigation:

- ●BIC has adopted a Code of Conduct to ensure respect for Human Rights at work. This Code of Conduct has been revised and will be published in 2023. It applies to BIC factories as well as to contract manufacturers and suppliers.

- BIC regularly monitors its implementation through audits and tools.

- ●BIC’s reliance on contract manufacturing is relatively low but does give BIC greater flexibility.

- Overall, 92% of its net sales come from products made in its factories.

- 60% of its factories in 2022 were located in countries with no human rights violation risk according to Freedom House.

- ●BIC has reinforced its expectations towards its suppliers by issuing in 2020 a Supplier Code of Conduct in addition to the more generally applicable Code of Conduct. Besides, suppliers and business partners are requested to comply with applicable national and international legislation. This includes laws regarding anti-corruption, anti-trust, anti-bribery, fair competition and human rights.

Further information can be found in Chapter 3 Non-financial performance statement: our environmental, social and societal responsibility (Section 3.3.2.2 Ensuring respect of Human Rights in the workplace).

- ●Risks related to plastics encompass:

-

2.3.Vigilance Plan

2.3.1Regulatory framework

In accordance with French Act no. 2017-399 of March 27, 2017, on the duty of vigilance of parent companies (“the Act”), BIC developed and implemented the following elements of a Vigilance Plan:

-

2.4.Risk Management and Internal Control Procedures implemented by the Company and Insurance

2.4.1Risk Management and Internal Control definitions and objectives

2.4.1.1Adoption of the Principles of the AMF’s(1) Reference Framework for Risk Management and Internal Control Systems

For the purposes of this section, the Group complies with the principles outlined in Part II of the Risk Management and Internal Control Systems – Reference Framework updated in July 2010 by the Working Group chaired by Olivier Poupart-Lafarge and established by the AMF. This represents a partial adoption of the full text that also provides an Application Guide for Internal Control Procedures for the Accounting and Financial Information Published by the Issuer.

The related specific control activities are the responsibility of the local subsidiaries. Those subsidiaries continuously adapt them in response to current circumstances, drawing guidance from the Group Accounting and Controllers’ Manuals. The Application Guide has not been formally compared to existing procedures and processes, but the Group does not expect material differences given the similarities between the Application Guide and these two manuals.

a)Risk management

Risk management is a continuously evolving system that looks to the Group’s activities, processes and assets.

Risk management encompasses a set of resources, behaviors, procedures and actions that are tailored to the characteristics of the Company and that enable managers to keep the Group’s risks at an acceptable level.

- ●the Company’s ability to achieve its business goals and core strategy;

- ●the Company’s ability to abide by its values, ethics, laws and regulations;

- ●the Company’s personnel, assets, environment or reputation.

- ●create and preserve the Company’s value, assets and reputation;

- ●safeguard decision-making and the Company’s processes to achieve its objectives;

- ●ensure that the Company’s actions are consistent with its values;

- ●mobilize the Company behind a shared vision of the main risks.

b)Internal control

The process also incorporates the definition of internal control as a Company-wide system, defined and implemented by the Company to ensure that:

- ●laws and regulations are complied with;

- ●the instructions and guidelines issued by Executive Management are followed;

- ●the Company’s internal processes are working properly, particularly those involving the protection of its assets. Assets are understood to be both tangible and intangible (know-how, brand, image or reputation) and are used throughout existing Company processes;

- ●financial information is reliable.

- ●corporate oversight;

- ●the efficiency of its operations; and

- ●the efficient utilization of its resources.

The first objective refers to all applicable laws and regulations governing the Company and that are part and parcel of its daily activities to ensure compliance.

The second addresses the guidance given to staff to ensure they understand what is expected of them, and their scope of responsibility. This communication process is built around the Company’s objectives, cascaded down to the team members.

The final objective relates to the preparation of reliable financial statements (2). The reliability of such information depends on the quality of the associated internal control procedures and system (see reporting procedures Section 2.4.2.4 Internal Control procedures) that should ensure:

- ●the segregation of duties principle, enabling a clear separation between input, operating and retention duties;

- ●that function descriptions provide guidance regarding the identification of the source of the information and materials produced;

- ●the ability to check that operations have been performed in accordance with general and specific instructions and have been accounted for to produce financial information that complies with relevant accounting standards.

2.4.1.2Scope of Risk Management and Internal Control

Risk management and internal control, as defined in this report, apply to SOCIÉTÉ BIC as Group parent company and all Group consolidated entities.

- ●the existing organization;

- ●the objectives set out by the Board of Directors and the Executive Committee (see Section 2.4.3 Risk Management and Internal Control Participants, Specific Structure(s) in Charge/Respective Roles and Interactions); and

- ●compliance with laws and regulations.

Supporting principles and systems have been set up in all relevant areas and subsidiaries, considering local specificities and regulations. These principles are also known to and followed by the various centralized Group departments.

The Risk Management principles also apply to any entity joining the Group. Whenever possible, the Group asks its subcontractors and suppliers to also comply with these principles. For instance, SOCIÉTÉ BIC asks its suppliers to follow the safety rules for team members that apply within the Group.

2.4.1.3Limitations of Risk Management and Internal Control Systems

Even with the most efficient organization there are inherent limitations in risk management and internal control. Risk management and internal control systems cannot therefore provide an absolute guarantee that the Company’s objectives will be met. The major existing limitations are outside developments and uncertainties, the subjective nature of people’s decisions and potential human error.

-

3. NON-FINANCIAL PERFORMANCE STATEMENT: SUSTAINABLE RESPONSIBILITY

For convienience please see below the items required by French executive order No. 2017-1265 of August 9, 2017(1) in the following chapters of BIC's management report:

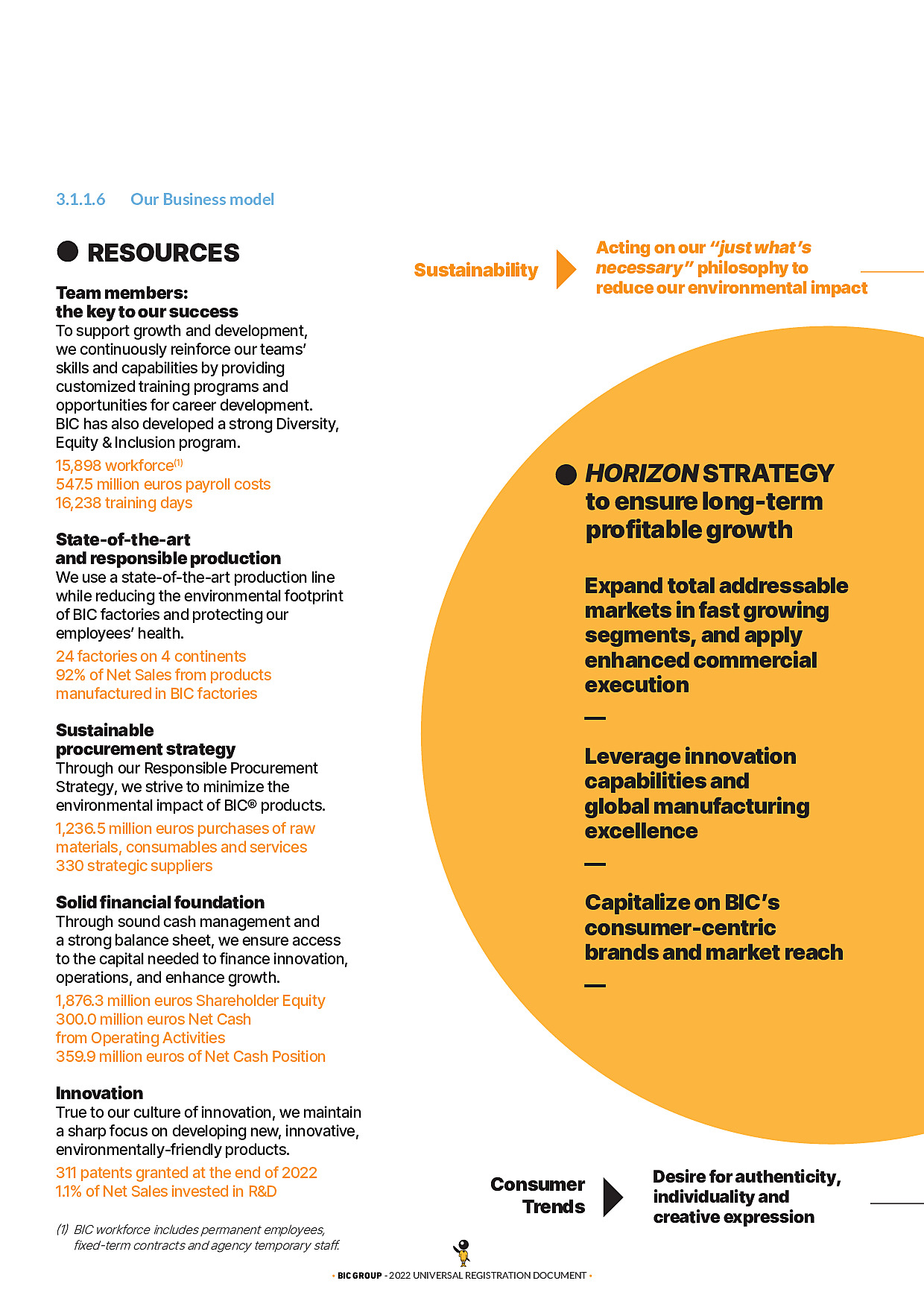

Business Model

BIC’s business model is presented in Section 3.1.1.6 Our Business model page 80-81

Major Risks

Major risks for BIC are also discussed in Chapter 2.1.

CSR Risks

The CSR risks identified under the Non-Financial Performance Statement (NFPS) are listed and described in Section 3.1.3

Chapter 3

This chapter provides:

- ●a description of the sustainable development challenges in the introduction to each section;

- ●the risks identified in the Non-Financial Performance Statement and the related opportunities in the “Risks and Opportunities” sections;

- ●a description of the policies and actions in place under the “Policies, actions taken, results and outlook” sections.

These include due diligence work to identify, prevent and reduce the frequency of risks or to take the opportunities identified. Also included are the results of these policies, including key performance indicators and, where applicable, the relevant outlook.

In 2020, BIC released its first Climate-Related Performance Report in keeping with the guidelines proposed by the Task Force on Climate-related Financial Disclosure (TCFD). This report is now part of Section 3.2.1. Consequently, this section follows the headings suggested by the TCFD.

BIC identifies information expressly required in the Non-Financial Performance Statement with the initials [NFPS] and [NFPS Risk X]. The Group also includes all the action plans related to its Sustainable Development Program including those that do not directly help prevent or reduce a major risk. The Group has, however, reorganized this chapter to prioritize the information directly relating to the Non-Financial Performance Statement.

-

3.1.Strategy and business model overview [NFPS]

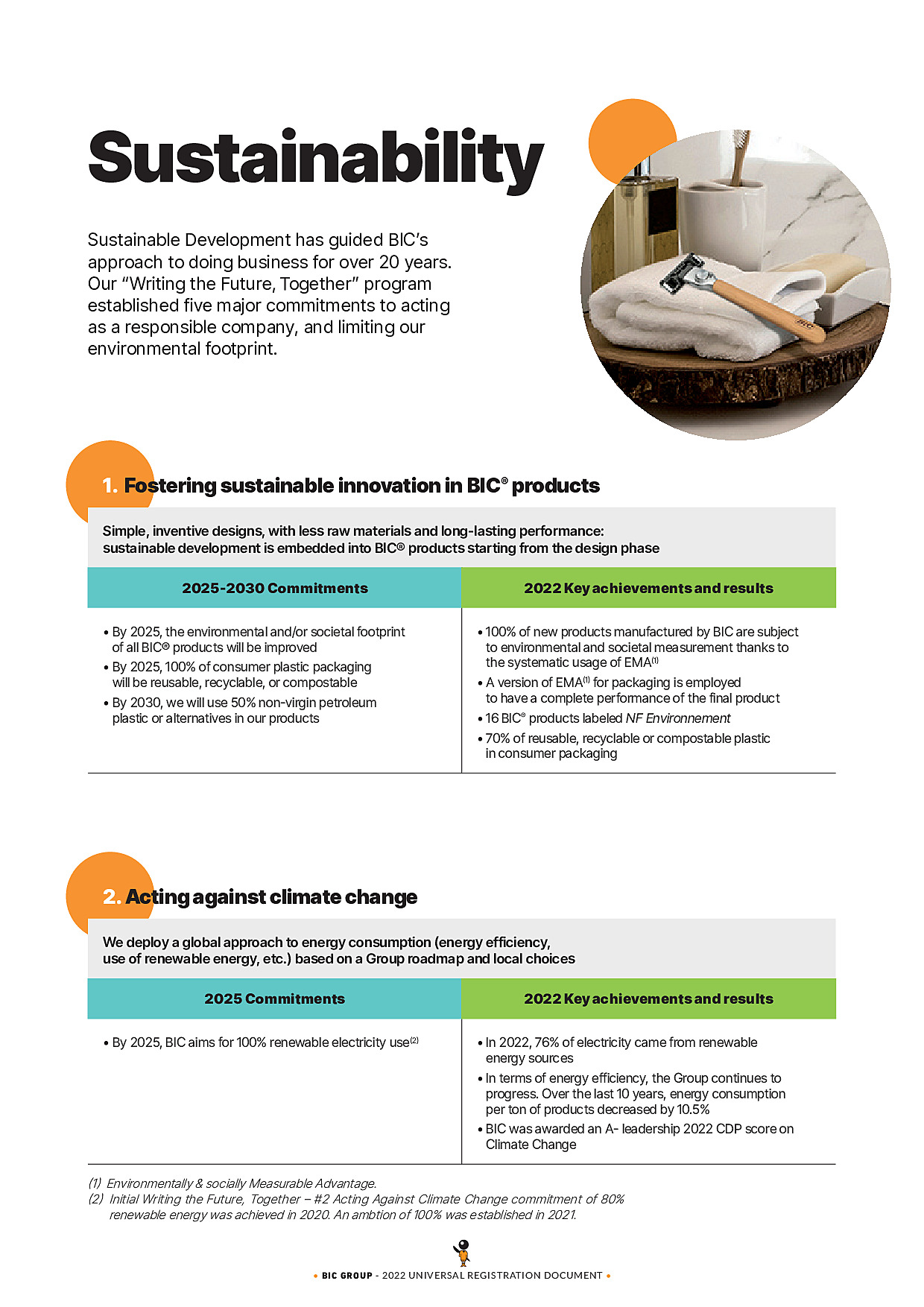

Sustainability is deeply rooted in BIC’s Values and is an integral part of its day-to-day operations. For over to 20 years, it has played a fundamental role in guiding BIC’s strategy, especially its social and societal actions.

In keeping with its core mission, the Group’s ambition is to ensure that it has a limited impact on the environment and society, while making a meaningful contribution to the consumers and team members' lives as well as the long-term well being of our planet.

In its “Writing the Future, Together” program, BIC seeks to build on its long-standing sustainable development efforts and to bolster its engagement by pledging to five commitments for the 2018 to 2025 period (see Section 3.1.1.3).

3.1.1Strategy and business model [NFPS]

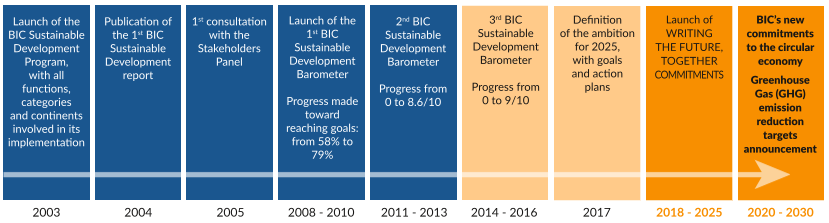

3.1.1.1The history of BIC’s Sustainable Development Program

Launched in 2003, BIC’s Sustainable Development Program continues to evolve and address major environmental and human issues as well as stakeholder expectations. It also benefits from advances in R&D, innovation, and evolutions in the Group’s operations.

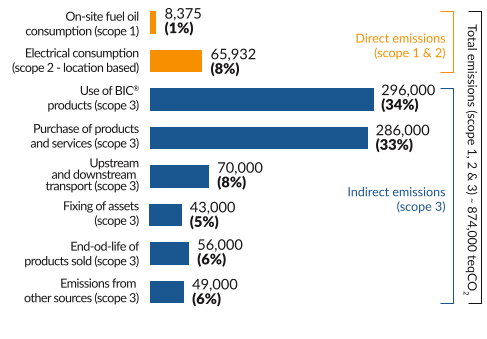

This exhaustive program encompasses all key sustainability issues as well as related risks(2) that BIC must address to fulfil its Corporate Responsibilities. A unique reporting system is used to monitor the Group’s performance for continual improvement. Since 2018, the program has been guided by the five ambitious commitments that make up “Writing the Future, Together”. In 2020, this program was reinforced with additional commitments that will fundamentally transform the way the Group uses plastic. Furthermore, in 2022, BIC announced its Greenhouse Gas (GHG) emission reduction targets, taking the Group a step further in its consumer-centric approach, grounded in Sustainable Innovation, to respond faster and more impactfully to consumer demands and the important topics of this generation.

Through its Sustainable Development Program, the Group also contributes to the United Nations (UN) Sustainable Development Goals (see Section 3.1.1.5).

3.1.1.2BIC’s ambition

“At BIC, we believe in providing simple, inventive, reliable choices for everyone, everywhere, every time. And we believe in doing so responsibly with the planet, society and future generations in mind.

Our approach to sustainability is one of our Values and is an integral part of our day-to-day operations. Staying true to our philosophy of honoring the past and inventing the future, we want our ongoing commitment to sustainable development to be long-lasting and far-reaching.

Our ambition is to ensure that we limit our impact on the planet and make a meaningful contribution to the lives of our employees and society over the long term, simply because it is the right thing to do.

To shape our business tomorrow and ensure we create a sustainable future for all we believe it is essential to:

- ●promote sustainable innovation in our products;

- ●act against climate change;

- ●provide our team members with a safe workplace;

- ●make our supply chain more responsible; and

- ●reinforce our commitment to education.”

3.1.1.3Writing the Future, Together, a commitment for 2025

In 2017, BIC defined ambitious commitments that enable the Group to create value over the long-term for the benefit of all stakeholders. This effort is based on the principles of its Sustainable Development Program, namely assessing the materiality of the issues and incorporating the UN Sustainable Development Goals. It also takes into account regulatory requirements and consultations with stakeholders, as well as lessons drawn from regular benchmarking.

The vision defined is set out in “Writing the Future, Together,” driven by BIC’s ambition for sustainability (see Section 3.1.1.2) and comprises five commitments which are an integral part of the Group’s strategic Horizon plan.

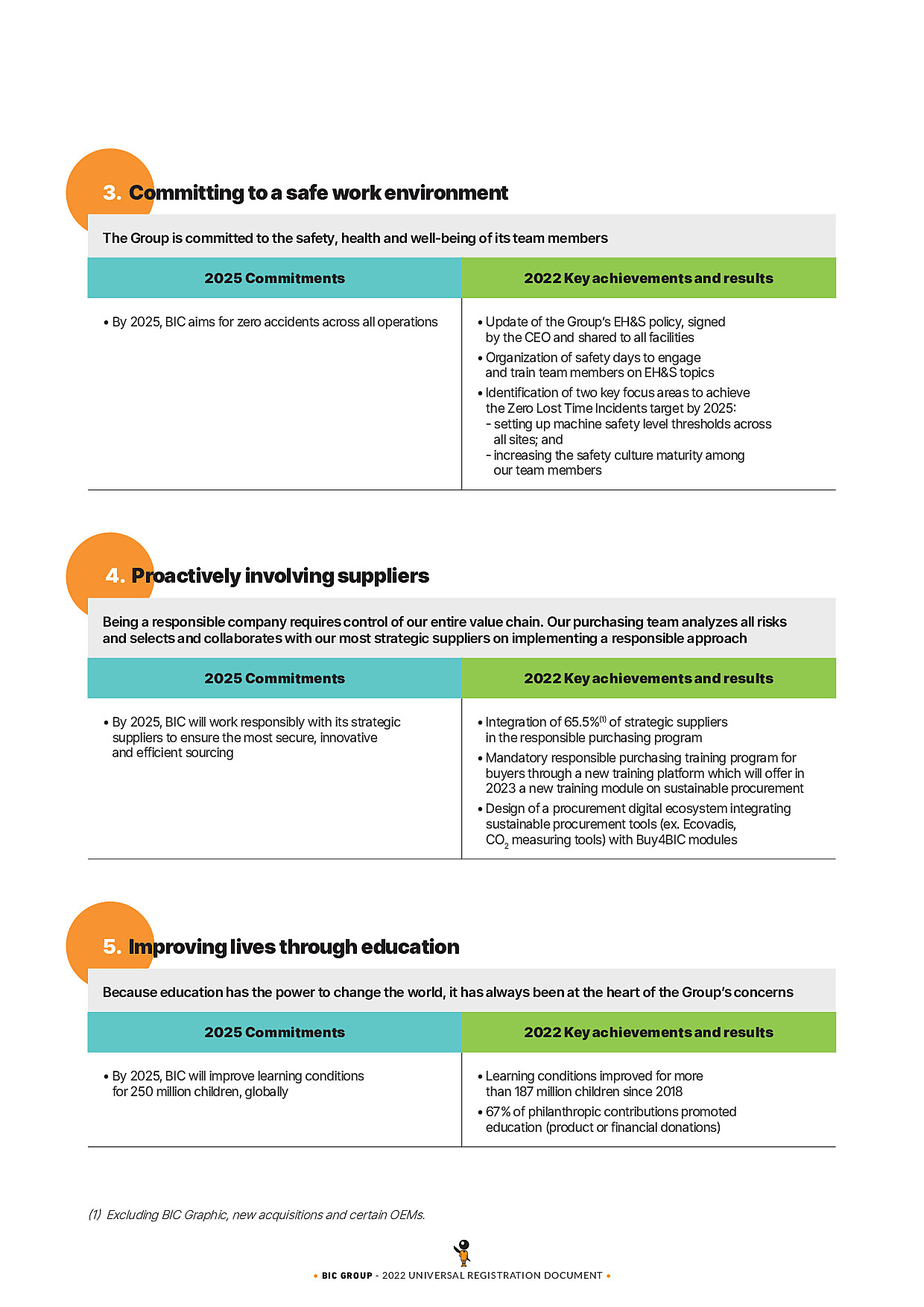

#1 Fostering sustainable innovation in BIC® products (SDG 3, 6, 8, 12, 14, 15):

- ●by 2025, the environmental and/or societal footprint of BIC® products will be improved (SDG 3, 6, 8, 12);

- ●by 2030, BIC aims for 50% use of non-virgin petroleum plastic in its products, and 20% by 2025 (SDG 14, 15);

- ●by 2025, BIC will use 100% reusable, recyclable or compostable plastic packaging (SDG 14, 15).

#2 Acting against climate change: By 2025, BIC will use 100% renewable electricity (SDG 7, 8, 9, 12, 13).

#3 Committing to a safe work environment: By 2025, BIC is aiming for zero accidents across all operations (SDG 3, 8).

#4 Proactively involving suppliers: By 2025, BIC will work responsibly with its strategic suppliers to ensure the most secure, innovative and efficient sourcing (SDG 8, 12, 16).

#5 Improving lives through education: By 2025, BIC will improve learning conditions for 250 million children globally (SDG 1, 4, 5, 6, 8, 13).

Fully aligned with “Writing the Future, Together”, the Flame for Life division’s Sustainable Development program is driven by innovation and exploration. Its approach is based on the following principles:

- ●adopting a science-based approach;

- ●exploring new avenues and questioning all options;

- ●improving practices through pilot projects;

- ●considering social and environmental impacts;

- ●promoting open dialogues and partnerships;

- ●transparency.

The transformation of internal practices is carried out at each stage of the life cycle. This approach allows BIC to address three major issues: climate change, resource depletion and a decrease in plastic pollution. In addition, the Group has launched pilot projects to support some of its suppliers in improving their CSR approach.

The Flame for Life sustainability program was created through pilot projects. They evolve as feedback is received and, when satisfactory scalable results are obtained. One of the program key achievements is the design of the BIC® Maxi Ecolutions® lighter, whose components were reviewed to see which ones had the most impact and improved by using recycled or bio-based materials and avoiding certain dyes. This range is manufactured in a factory supplied with 100% renewable electricity.

3.1.1.4Writing the Future, Together – Progress chart [NFPS]

WRITING THE FUTURE, TOGETHER

5 commitments

Progress as of Dec. 2022

Other factors: approach and performance

Section

UN SDG(a)

Issues and risks addressed(b)

By 2025, the environmental and/or societal footprint of BIC® products will be improved.

By 2030, BIC aims for 50% non-virgin petroleum plastic in its products, with a goal of 20% by 2025.

By 2025, 100% of BIC consumer plastic packaging will be reusable, recyclable, or compostable.

100% of new products manufactured by BIC are subject to environmental and societal measurement thanks to the systematic usage of EMA(c).

3 products were improved in 2022.

A version of EMA(c) for packaging is employed to have a complete performance of the final product.

- ●5.7% of non-virgin petroleum plastic in BIC® products (4.0% in 2021).

- ●70% of reusable, recyclable or compostable plastic in consumer packaging.

- ●54.7% recycled content of plastic packaging.

- ●96.2% PVC-free packaging.

- ●97.7% of BIC cardboard packaging comes from a certified and/or recycled source.

- ●16 BIC® products with the NF Environnement ecolabel.

- ●At end-2022, over 73,3 million pens collected through TerraCycle.

- ●34 alternative materials tested.

3.2.3

[NFPS Risk 3]: risks related to product safety and consumer health & safety.

[NFPS Risk 1]: risks related to plastics.

[NFPS Risk 2]: risks related to climate change.

(a) UN Sustainable Development Goals.

(b) Risks identified within the framework of the NFPS.

(c) Environmentally & socially Measurable Advantage.

WRITING THE FUTURE, TOGETHER

5 commitments

Progress as of Dec. 2022

Other factors: approach and performance

Section

UN SDG(a)

Issues and risks addressed(b)

By 2025, BIC will use 100% renewable electricity.

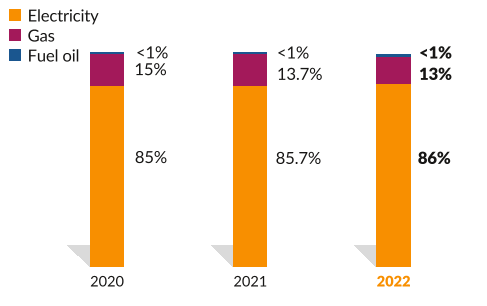

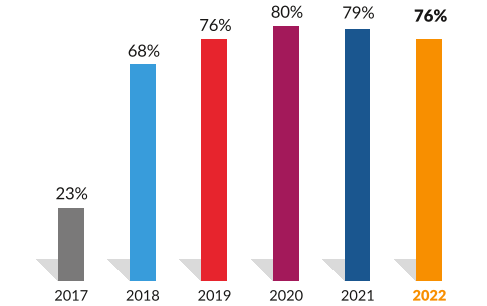

76% of electricity comes from renewable sources.

BIC’s use of renewable electricity is part of a comprehensive energy approach that also encompasses energy efficiency in operations.

21 energy efficiency projects were launched in 2022 of which 12 were completed during the year. The projects included light bulb replacement with LED bulbs, processes optimization, energy studies and new energy efficient equipment installation.

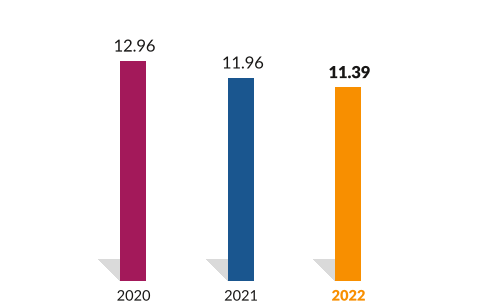

In terms of energy efficiency, the Group continues to progress. Over the last 10 years, energy consumption per ton of products has decreased by 10.5%.

Slight decrease in renewable electricity due to an increase in electricity consumption from factories that have yet to employ renewable sources (Cello, Kenya, Bizerte and Nigeria).

3.2.1

[NFPS Risk 2]: risks related to climate change.

[NFPS Risk 1]: risks related to plastics.

(a) UN Sustainable Development Goals.

(b) Risks identified within the framework of the NFPS.

WRITING THE FUTURE, TOGETHER

5 commitments

Progress as of Dec. 2022

Other factors: approach and performance

Section

UN SDG(a)

Issues and risks addressed(b)

By 2025, BIC aims for zero accidents across all operations.

The Health-Safety approach roll-out continues within the whole Group.

Identification of two key focus areas to achieve the Zero Lost Time Incidents target by 2025:

- ●setting up machine safety level thresholds across all sites, and;

- ●increasing the safety culture maturity among our team members.

Update of the Group’s EH&S policy, signed by the CEO and shared to all facilities.

Organization of safety days to engage and train team members on EH&S topics

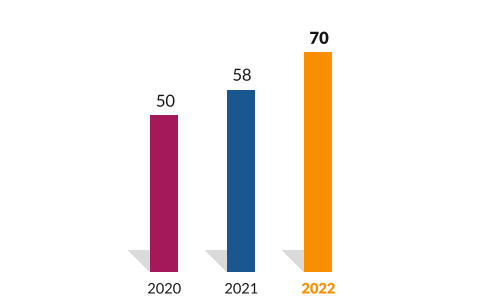

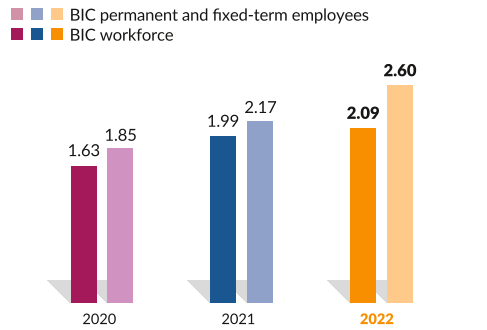

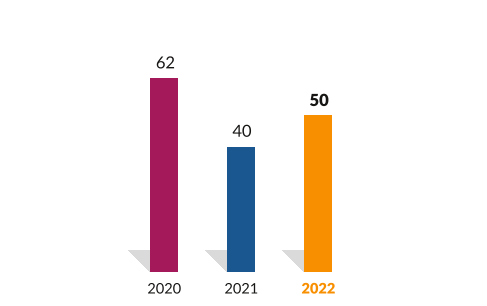

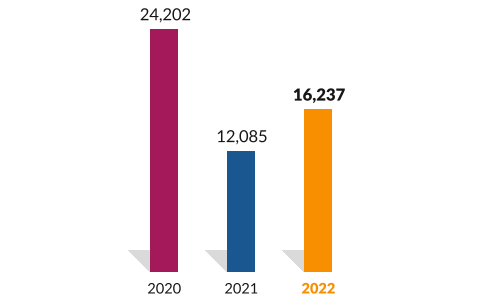

- ●60 lost time incidents for permanent and fixed-term employees and 10 lost time incidents for external temporary workers.

- ●2.09 on-site lost time incidence rate – BIC workforce.

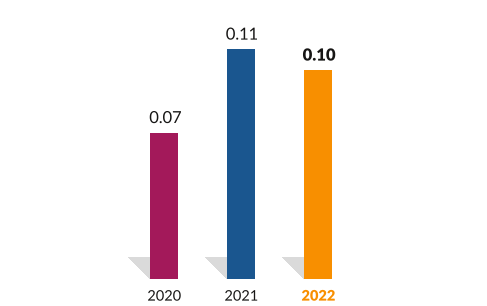

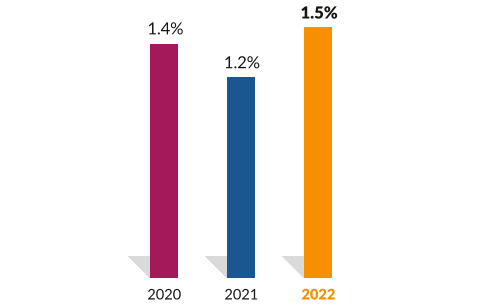

- ●0.10 severity rate of on-site lost time incidents-per thousand hours worked – BIC permanent and fixed-term employees.

- ●50 facilities with 0 lost time incidents.

3.3.1.3

[NFPS Risk 4]: risks related to the health and safety of team members.

(a) UN Sustainable Development Goals.

(b) Risks identified within the framework of the NFPS.

WRITING THE FUTURE, TOGETHER

5 commitments

Progress as of Dec. 2022

Other factors: approach and performance

Section

UN SDG(a)

Issues and risks addressed(b)

By 2025, BIC will work responsibly with its strategic suppliers to ensure the most secure, innovative and efficient sourcing.

By the end of 2022, 65.5% of strategic suppliers integrated the responsible purchasing program(d).

ESG evaluations (EcoVadis tool) of strategic suppliers since 2011. Implementation of innovative new tools such as:

- ●Buy4BIC global procurement platform;

- ●PowerBI for sustainable procurement activities and actions reporting;

- ●the design of a procurement digital ecosystem integrating sustainable procurement tools (ex. Ecovadis, CO2 measuring tools) with Buy4BIC modules.

Mandatory responsible purchasing training program for buyers through a new training platform which will offer in 2023 a new training module on sustainable procurement.

3.3.2

[NFPS Risk 5]: risks related to non-respect of Human Rights (child labor, ILO(e)’s international conventions).

By 2025, BIC will improve learning conditions for 250 million children globally.

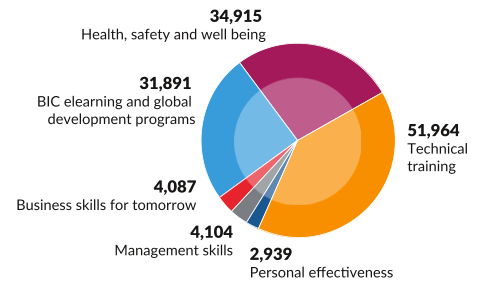

Learning conditions for over 187 million children have been improved since 2018 through direct actions with children or with teachers and parents.

Development of activity sheets and workshops for teachers such as motor development, coding, sustainable development and writing exercises.

Promoting education among the communities in need through the Global Education Week. This event has grown into one of the Group’s largest corporate giving initiatives.

Activities and workshops in schools such as awareness raising on the importance of education and writing, creativity, production of texts or thematic coloring contests for younger children.

64% of philanthropic contributions (product or financial donations, skills) by local entities for local communities or by the BIC Corporate Foundation promote education (67% in financial value)(c).

3.3.3

(a) UN Sustainable Development Goals.

(b) Risks identified within the framework of the NFPS.

(c) This indicator includes all educational sponsorship, even that done as part of commitment #5.

(d) Excluding BIC Graphic, new acquisition and certain Original Equipment Manufacturers (OEM).

(e) International Labour Organization

3.1.1.5BIC contributes to the UN Sustainable Development Goals (SDGs) throught its “Writing the Future, Together" commitments

The table shown above charts how “Writing the Future, Together” contributes to the UN SDGs. The Group primarily contributes to the two SDGs below, mainly through the products it manufactures and markets, and through its monitoring and compliance program, which ensures that its products are safe and comply with health and environmental standards (see Section 3.3.4).

SDG 8. Decent work and economic growth. BIC contributes through the development of products and production modes that favor the efficient use of resources, including recycled materials (see Section 3.2.3.2).

SDG 12. Responsible consumption and production. BIC contributes through the Company’s eco-design program, which provides consumers with information to help them make their purchasing choices.

Furthermore, the Group contributes to the following UN Sustainable Development Goals within the direct scope of its operations or its sphere of direct influence:

- ●making simple, reliable products that meet essential needs available to everyone;

- ●undertaking initiatives that provide support for its team members;

- ●offering various products and programs to promote access to education;

- ●reducing the environmental impact of its factories;

- ●ensuring respect for Human Rights in its own factories and by its suppliers and subcontractors; and

- ●through the actions of the BIC Corporate Foundation.

3.1.1.7Stakeholders’ views, interests and expectations

Listening to investors and Shareholders

BIC’s stakeholders’ engagement strategy is executed by the Head of Investors Relations and BIC’s management. The strategy’s objective is to establish and strengthen relationships with financial investors and multi-stakeholder initiatives by regularly participating in ESG conferences, roadshows and webinars. This strategy serves to anticipate stakeholders’ expectations and identify future collaborations as well.

- ●UN Global Compact Communication on Progress submission;