URD 2023

-

Group presentation, Outlook, and strategy

1.1.History

Marcel Bich acquires a factory in Clichy, France, and starts a Writing Instruments business with his partner Édouard Buffard.

Launch of the “Pointe BIC®” in France, a revolutionary improved version of the Ball Pen invented by Hungarian Laslo Biro.

Acquisition of the Waterman Pen company in the United States. Expansion into Africa and the Middle East.

Diversification into the leisure industry through its subsidiary, BIC Sport, specializing in windsurf boards.

Acquisition of Tipp-Ex®, the leading European correction products brand, and Sheaffer®, a high-end brand in Writing Instruments.

Mario Guevara becomes Chief Executive Officer of BIC in May.

Acquisition of PIMACO, Brazil’s leading manufacturer and distributor of adhesive labels.

November: opening of a new shaver packaging facility in Mexico.

December: acquisition of Antalis Promotional Products (Sequana Group).

March: Acquisition of 40% of six (of the seven) Cello group entities, a leading stationery group in India.

June: Acquisition of Norwood Promotional Products, a U.S. leader in calendars and promotional products.

First-half: Disposals of the PIMACO B-to-B division in Brazil and the REVA Peg-Making business in Australia.

November: Acquisition of Angstrom Power Incorporated, a company specialized in portable fuel cell technology.

September: Launch of BIC® Education, an educational solution for elementary schools, combining handwriting and digital technology. Completion of the share purchase following the call option exercised on September 17 on Cello. Increase of BIC’s stake in Cello’s seven entities from 40% to 55%.

October: Acquisition of land in Nantong, China (130 km North of Shanghai) to build a Lighter production facility.

April: Sale of BIC’s Portable Fuel Cell Technology business to Intelligent Energy.

December: Cello sells its remaining stake in Cello to BIC. This raises BIC’s stake in Cello to 100%.

May: Mario Guevara retires from his position as Chief Executive Officer. The Board of Directors decides to combine the roles of Chairman and Chief Executive Officer and appoints Bruno Bich as Chairman and Chief Executive Officer.

June: Sale of BIC Graphic North America and Asian Sourcing operations to HIG Capital.

October: Opening of the new Writing Instruments facility in Samer (France).

May: Bruno Bich retires from his position as CEO. The Board of Directors decides to split the roles of Chairman and Chief Executive Officer. Pierre Vareille is appointed Chairman of the Board and Gonzalve Bich becomes Chief Executive Officer.

October: Filing by BIC of an infringement complaint with the European Commission for lack of surveillance of non-compliant Lighters that are either imported into or sold in France and Germany.

December: Acquisition of manufacturing facilities of Haco Industries Ltd. in Kenya and its distribution activities of Stationery, Lighters, and Shavers. Disposal of BIC Sport, BIC’s water sports subsidiary, to Tahé Outdoors and discontinuation of its Writing Instruments manufacturing operations in Vannes.

January: Inauguration of BIC’s Indian subsidiary BIC Cello, in Vapi (Gujarat state).

March: Inauguration of BIC’s East Africa Facility in Kasarani, Nairobi.

July: BIC filed a complaint with the European Ombudsman claiming maladministration by the European Commission of the infringement procedure initiated in 2010 against the Netherlands due to their lack of actions to impose lighters safety standards compliance.

October: Completion of the acquisition of Lucky Stationary in Nigeria (LSNL).

July: Acquisition of Djeep, one of the leading manufacturers of quality Lighters, reflecting BIC’s strategy of greater premiumization and personalization.

December: Acquisition of Rocketbook, the leading smart and reusable notebook brand in the United States, expanding BIC’s business into the Digital Expression segment.

December: Signature of agreement to sell its Brazilian adhesive label business, PIMACO, to Grupo CCRR, reflecting BIC’s portfolio rotation strategy and focus on fast-growing consumer segments.

February: Completion of the sale of BIC’s headquarters in Clichy-La-Garenne-based (France) and BIC Technologies sites for 175 million euros.

February: Completion of the divestiture of the Brazilian adhesive label business, PIMACO, to Grupo CCRR for 40 million Brazilian Real.

January: Acquisition of Inkbox, the leading brand of semi-permanent tattoos.

May: Appointment of Nikos Koumettis as Chair of the Board.

August: Acquisition of Tattly, a leading decal brand based in the U.S.

September: Acquisition of AMI (Advanced Magnetic Interaction), a French start-up pioneer in augmented interaction technology.

March: Héla Madiouni was appointed as Director representing the employees for the Board of Directors of Société BIC. She replacd Inna Kostuk who resigned on October 14, 2022.

May: Véronique Laury and Carole Callebaut Piwnica were appointed as Directors. Candace Matthews, Jacob (Jake) Schwartz and Timothée Bich were renewed as Directors.

September: The BIC 2023 Investor Update event took place in Paris, France, where BIC delivered an interim update on its five-year Horizon Strategic Plan, launched back in 2020.

October: Pascal Chevallier was appointed as Director representing the employees to the Board of Directors of Société BIC. He replaced Vincent Bedhome, whose term has expired.

-

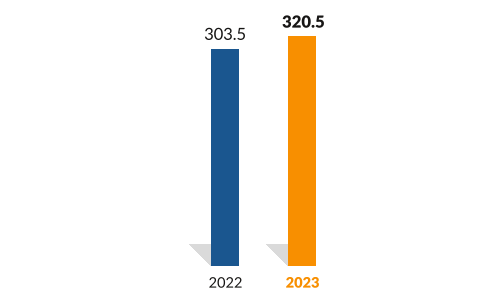

1.2.Key figures

1.2.1Key financial figures

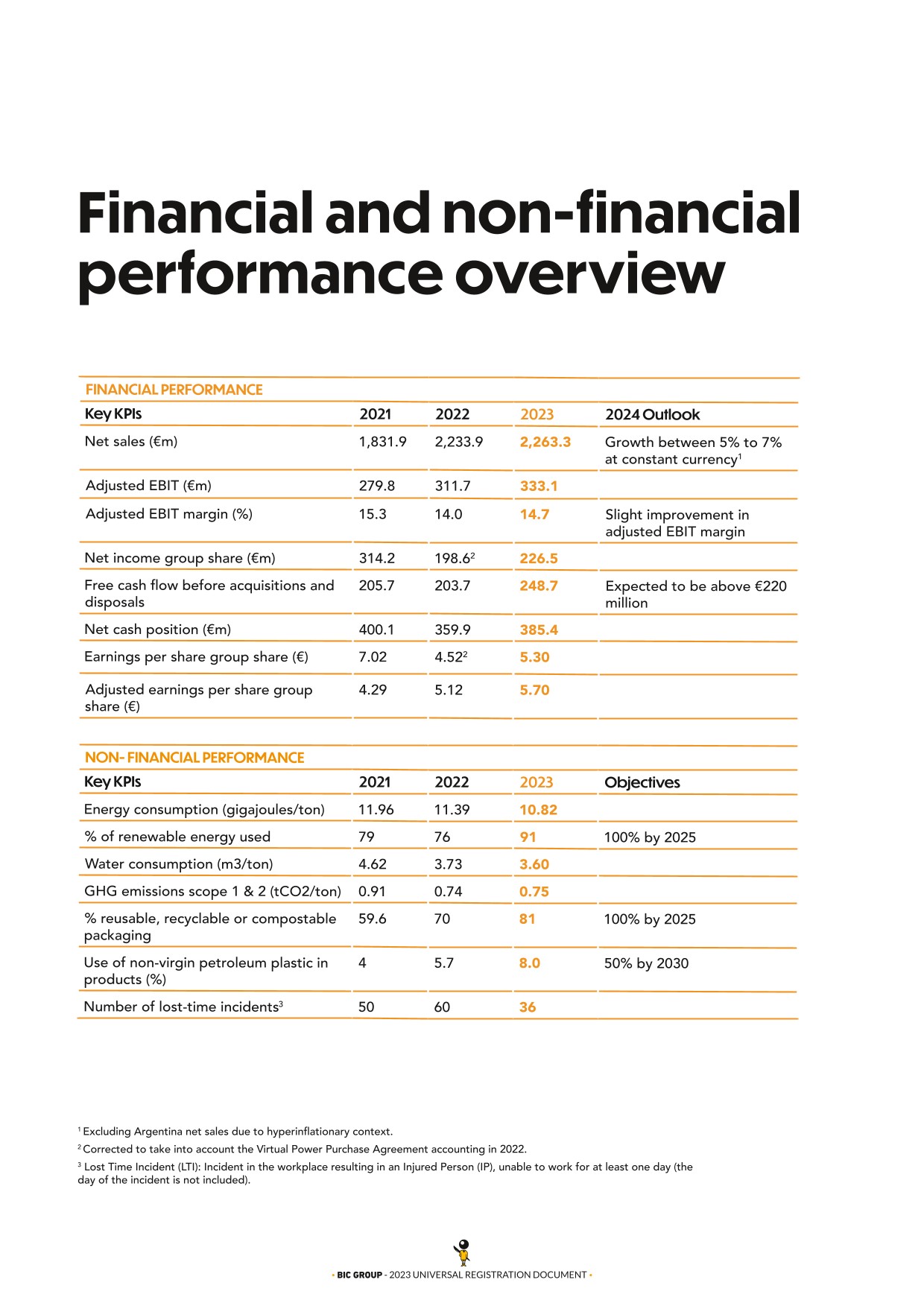

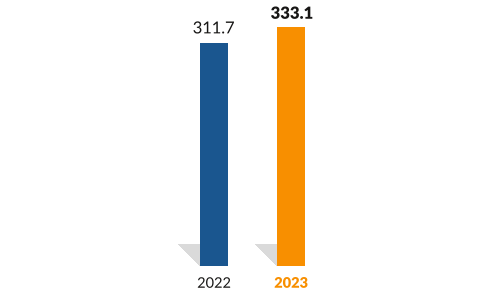

Net sales

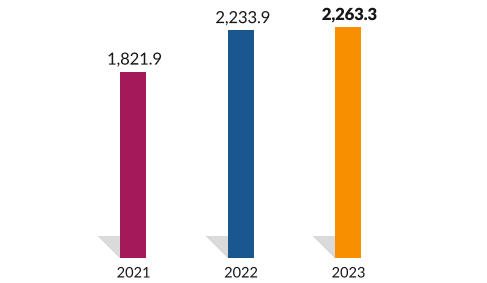

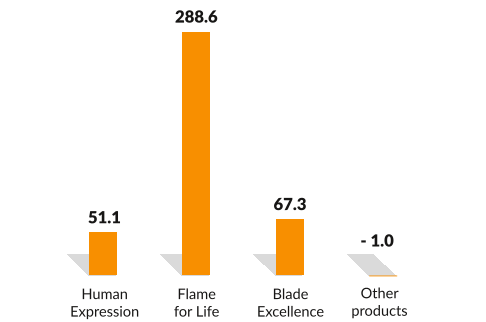

2023 net sales by division

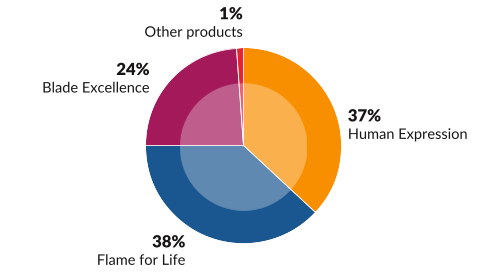

Earnings Before Interest and Taxes (EBIT)

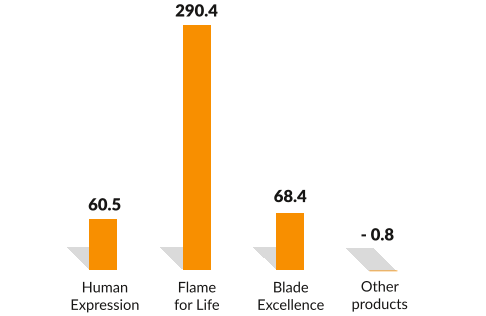

Adjusted Earnings Before Interest and Taxes (aDJUSTED EBIT)

2023 EBIT by division

(in million euros)(1)

2023 Adjusted EBIT BY DIVISION

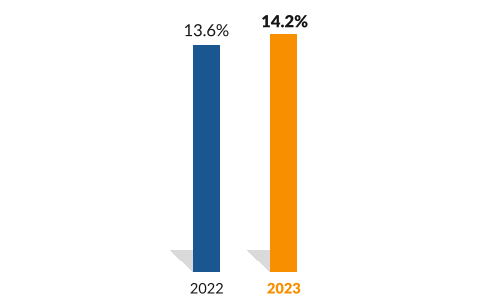

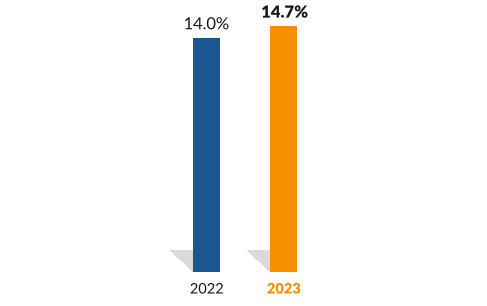

EBIT margin

Adjusted EBIT margin

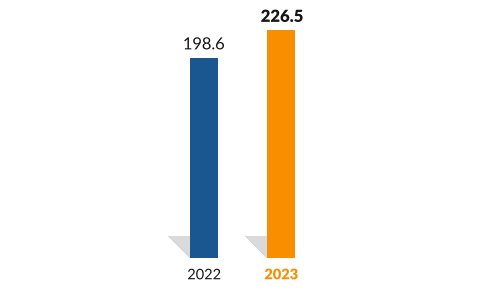

Net income group share

Group Earnings per share and adjusted Group earnings

per shareSales volume trends

Production volume trends

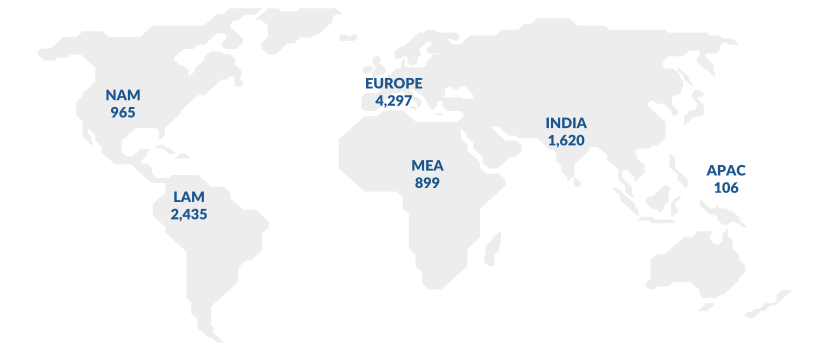

Net sales by region

(in million euros)

FY 2022

FY 2023

Change as reported

Change on a comparative basis

Change at constant currencies

Group

Net Sales

2,233.9

2,263.3

+1.3%

+9.2%

+3.5%

Europe

Net Sales

636.7

665.9

+4.6%

+9.0%

+8.9%

North America

Net Sales

954.9

882.9

(7.5)%

(4.8)%

(5.1)%

Latin America

Net Sales

390.6

461.7

+18.2%

+42.6%

+12.0%

Middle East & Africa

Net Sales

136.4

154.2

+13.1%

+26.6%

+26.6%

Asia & Oceania (including India)

Net Sales

115.3

98.6

(14.6)%

(7.9)%

(7.9)%

Main income statement information

Condensed profit and loss account

(in million euros)

FY 2022 (a)

FY 2023

Net Sales

2,233.9

2,263.3

Cost of goods

1,155.9

1,115.2

Gross Profit

1,078.0

1,148.1

Administrative & other operating expenses

774.5

827.6

Earnings Before Interest and Taxes (EBIT)

303.5

320.5

Finance revenue/costs

(26.1)

(7.5)

Income before tax

277.4

313.0

Income tax expense

(78.8)

(86.5)

Net Income Group Share

198.6

226.5

Earnings per share Group share (in euros)

4.52

5.30

Average number of shares outstanding (net of treasury shares)

43,974,525

42,740,269

- ( a )Corrected to take into account the Virtual Power Purchase Agreement accounting

Key balance sheet aggregates

(in million euros)

December 31, 2022 (a)

December 31, 2023

Shareholders’ equity

1,866.0

1,846.6

Current borrowings and bank overdrafts

76.5

109.4

Non-current borrowings

42.8

46.8

Cash and cash equivalents – Assets

416.3

467.7

Other current financial assets and derivative instruments

17.3

19.8

Net cash position (b)

359.9

385.4

Goodwill and intangible assets

407.4

382.3

Total balance sheet

2,686.9

2,647.3

NB: Société BIC has not sought any rating from any credit rating agency. It also has not, to the best of its knowledge, been the object of any unsolicited rating by any credit rating agency.

- ( a )Corrected to take into account the Virtual Power Purchase Agreement accounting

- ( b )See Glossary.

Condensed cash flow statement

(in million euros)

2022

2023

Cash flow from operations

428.0

469.2

(Increase)/Decrease in net working capital

(29.2)

(27.4)

Other operating cash flow

(98.0)

(88.5)

Net cash from operating activities (a)

300.0

353.3

Net cash from investing activities

(172.5)

(114.1)

Net cash from financing activities

(175.2)

(192.1)

Net increase/(decrease) in cash and cash equivalents net of bank overdrafts

(47.6)

47.2

Closing cash and cash equivalents net of bank overdrafts

415.2

467.7

- ( a )See Glossary.

-

1.3.Strategy and objectives

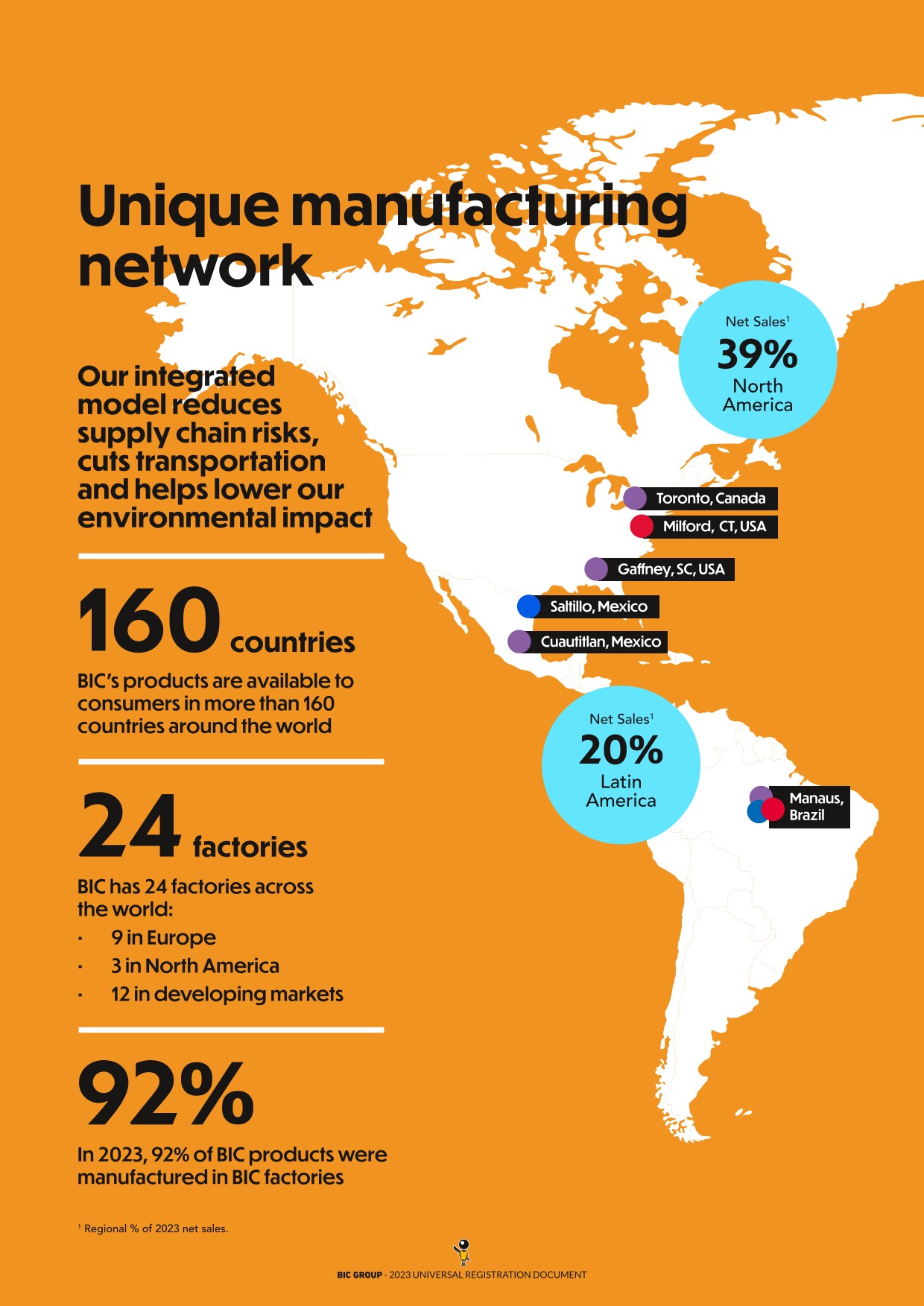

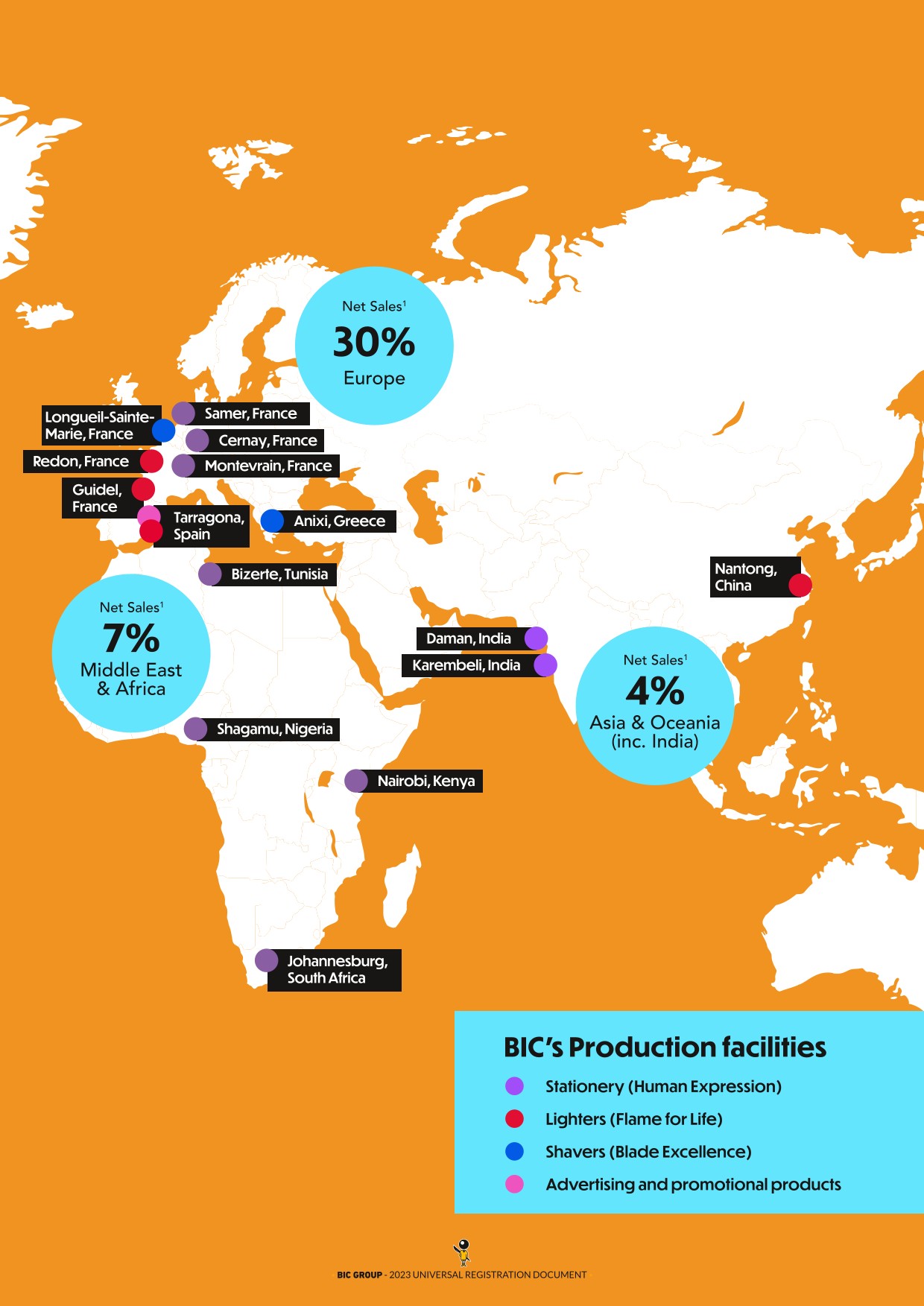

For over 75 years, BIC® has met consumer needs and desires with high quality, simple, and affordable products and has become one of the most recognized global consumer goods brands, with products sold in more than 160 countries. Our vision is to bring simplicity and joy to everyday life, as we seek to create a sense of ease and delight in the millions of moments that make up the human experience.

Over time, the Group faced rapidly-changing industries and consumption trends affecting its three categories, as consumers habits and their interaction with brands continuously evolved. BIC’s mission to offer high quality products to consumers everywhere and meet their fast-changing needs, drove the Group's transformation from a manufacturing and distribution-led company into a consumer-centric one.

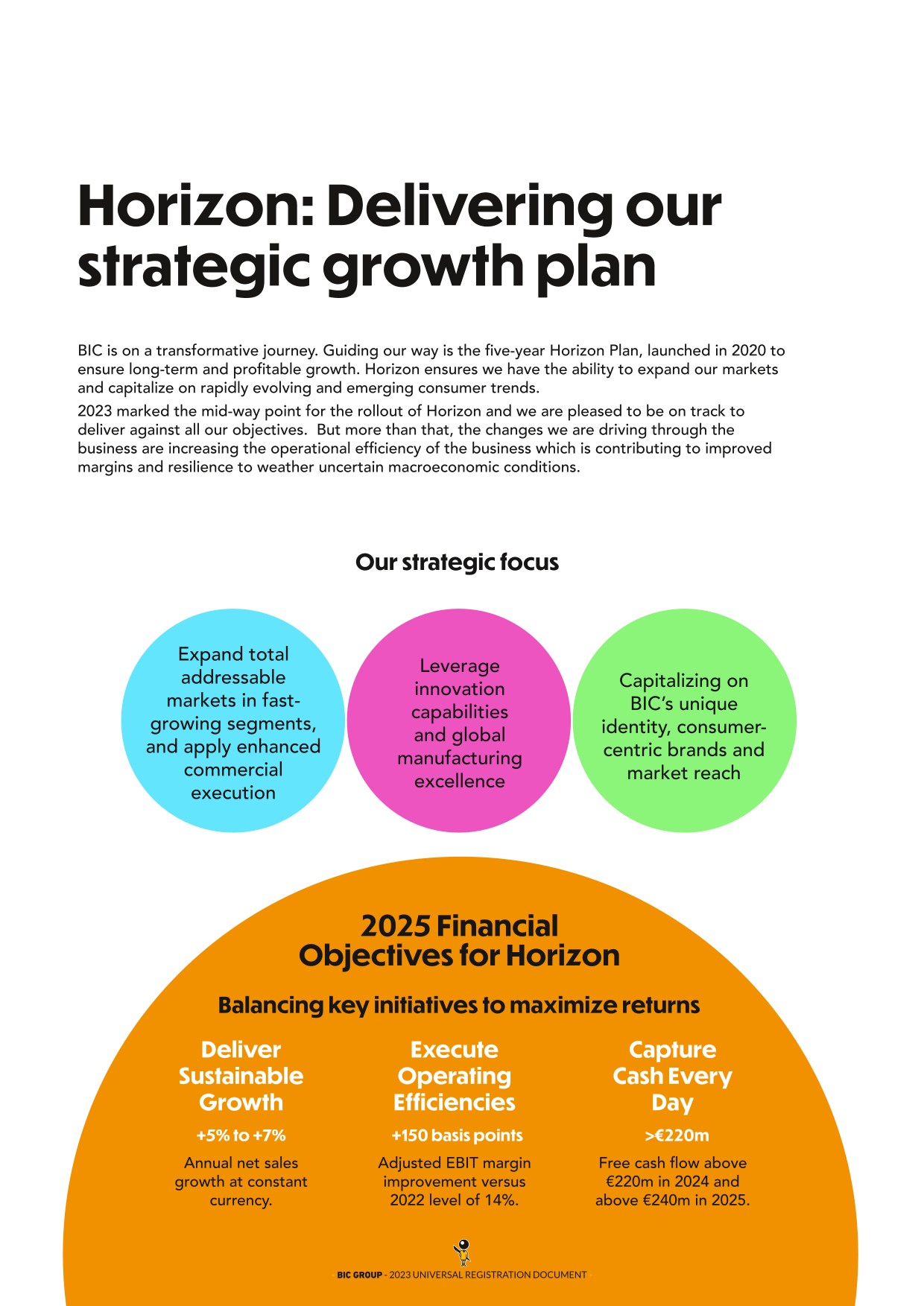

1.3.1BIC Horizon Strategic Plan

BIC’s Horizon strategy was launched in November 2020 to spur an in-depth transformation of BIC’s business and create the innovative products and services of tomorrow with more focus on consumer needs and sustainability. The goal was not only to amplify our core capabilities, but to go beyond them into higher-growth adjacent segments to ensure long-term sustainable growth and profitability. Horizon is embedded in the Group’s everyday operations and strategic goals.

As part of this transformation, BIC reframed its three core categories through a heightened consumer lens to tap into a stronger growth trajectory:

- ●in Stationery, BIC evolved its focus to “Human Expression”, responding to shifting consumer habits and expanding into the faster-growing Creative and Digital Expression markets;

- ●in Lighters, BIC expanded to “Flame for Life”, focusing on all consumer lighting occasions, including those non-related to tobacco, and driving towards a more balanced model between volume and value. Flame for Life is intended to drive incremental growth and maintain profitability, powered by trade-up and personalization, innovation, and a push toward sustainability;

- ●in Shavers, BIC decided to capitalize on its assets, ground-breaking innovation and manufacturing capabilities to leverage its “Blade Excellence” with the objective to maximize these assets by building a selective new business – named BIC Blade-Tech – as a high precision blade manufacturer for other brands.

Strategic and Financial Goals

Associated Targets

Growth acceleration

Deliver a mid-single-digit annual Net Sales growth trajectory

- ●Significantly expand total addressable markets in fast-growing adjacent segments, and evolve BIC’s business model to capture an increasing value share of our markets, with a strong focus on execution and return on investments.

- ●Leverage innovation capabilities and manufacturing excellence to generate incremental revenues through new routes-to-market.

- ●Capitalize on our brands in our core markets and build on new lifestyles to grow a comprehensive portfolio of consumer-led brands.

Cash flow generation

Improve efficiency and robust Free Cash Flow generation

- ●Disciplined management of operational investments, with a target of 1 to 1.2 times Capex to Depreciation & Amortization.

- ●Strict control of Working Capital (Inventories, Receivables, and Payables).

Sustainable development

Take Sustainable Development to the next level and transform approach to recycling and plastics

- ●By 2025: 100% of packaging will be reusable, recyclable, or compostable.

- ●By 2030: Use of 50% non-virgin petroleum plastic in our products.

Capital allocation

Fund organic growth and acquisitions in adjacent markets while ensuring sustainable shareholder returns

- ●Investments into operations to sustain and enhance organic growth with approximately 100 million euros annual CAPEX investments. In 2024, CAPEX should be approximately 110 million euros.

- ●Targeted acquisitions to strengthen existing activities and develop in adjacent categories, with an average of 100 million euros invested annually.

- ●Objective of ordinary dividend pay-out ratio in the range of 40% to 50% of Adjusted EPS.

- ●Regular share buybacks. Up to 40 million euros Share Buyback program to be executed in 2024.

At our Investor Update on September 11, 2023, we outlined how our Horizon Plan has shaped the future of our business and accelerated sustainable, profitable growth since its launch in November 2020.

- ●annual net sales: growth of 5-7% at constant currencies;

- ●adjusted EBIT margin: approx. 150bps improvement from the 2022 level of 14.0%;

- ●free cash flow: above €220 million in 2024, above €240 million in 2025(2).

- ●We reinforced our marketing capabilities and innovative campaigns to drive category growth. In the US, EZ Reach utility pocket lighters reached 5.8% of market share in value, up +0.4 points fueled by strong distribution and in-store visibility in the Modern Mass market. In the Blade Excellence division, our latest shaver innovations Easy Rinse and Soleil Escape both outpaced the market and gained a combined total of 1.8 pts in value share.

- ●Innovation continued to flourish, with 9.5% of sales coming from new products introduced in the last three years, up 0.5 pts versus last year. The number of patents granted, one of our input indicators which reflects our innovation pipeline, remains strong and in line with our Horizon aspirations.

- ●We continued to focus on expanding our presence both offline and online. eCommerce online sales represented 12.7% of the Group’s net sales in 2023, growing 13% at constant currency driven by the B2B channel in key countries notably US, France and Brazil.

- ●In line with our Revenue Growth Management discipline, our strategic emphasis on crafting a consumer-focused product lineup led to a Net Sales per SKU growth of 21.4% and a 9% reduction of total SKU count, outpacing our objectives. The resulting price and mix benefit successfully outpaced volume and inflation headwinds.

- ●Our B2B business BIC Blade Tech was impacted by clients’ revised business plans. However, in the fourth quarter it secured agreements with three new clients. These partnerships are promising and are expected to bear fruit in 2024. Additionally, we have reached an agreement with our largest customer to test additional product launches in 2024.

- ●We continued to drive excellence in procurement in 2023. We delivered additional direct and indirect savings mainly driven by plastics and packaging value engineering, as well as electricity hedging in France. This contributed, in part, to our strong gross profit margin improvement of 240 basis points in 2023.

- ●After a strong start in 2022, we intensified our efforts in value engineering, identifying close to €10 million of savings validated to date.

-

1.4.Business presentation

BIC is one of the leading players in the stationery, lighter, and shaver markets. Guided by our long-term vision, we provide high-quality, affordable products to consumers everywhere. This consistent focus has helped make BIC® one of the world’s most recognized consumer products goods companies, with products sold in more than 160 countries.

1.4.1Business presentation by division

BIC’s Horizon strategic plan launched in November 2020, aimed at driving sustainable growth by reframing our three categories to expand our total addressable markets in fast-growing segments.

1.4.1.1Human Expression – Stationery

In line with its Horizon strategy, BIC’s historical Stationery category evolved towards “Human Expression” to go beyond core Writing Instruments into Creative and Digital Expression. BIC constantly innovates to further strengthen its presence in both existing and adjacent segments.

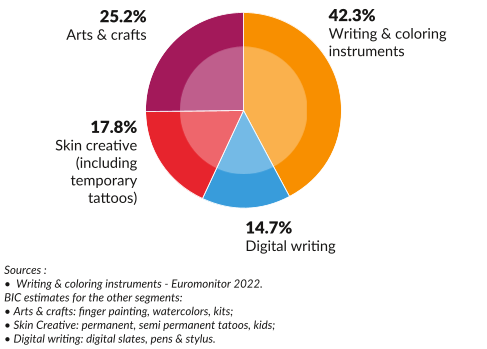

Human Expression encompasses Writing and Coloring Instruments, Creative Expression which includes Arts and Crafts, Skin Creative and Digital Expression. Human Expression is a mid- single-digit growth market, which should reach c.52 billion euros by 2026 (5).

Since the launch of the BIC® Cristal® pen in 1950, BIC has continuously diversified its Stationery product range through more added-value products and innovative launches and with an increased focus on sustainability, simplicity and joy.

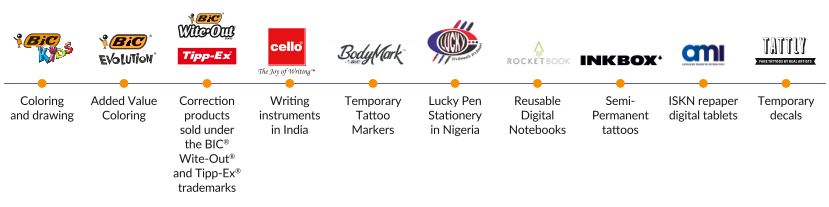

To name a few in the last three years, BIC launched BIC® Break-Resistant, a mechanical pencil with lead that is 75% stronger than the leading U.S. competitor, a BIC® Ecolutions Gel Pen made of 78% ocean-bound plastic, anti-bacterial pen BIC® Clic Stic® PrevaGuard™ a new coloring range called Intensity, its first rechargeable metallic ball pen BIC® Cristal® Re’New™. In 2020, BIC acquired Rocketbook® the leading brand in Reusable Digital Notebooks. In 2022, BIC diversified further its brand portfolio, with the acquisition of Inkbox, the leading brand of high quality semi-permanent tattoos (high-quality 10-14 days decals), and Tattly, a U.S. startup innovating in the field of high-quality temporary decals (2-4 days), which will diversify BIC’s offering in the rapidly growing Skin Creative market. In the Digital Writing segment, BIC acquired AMI (Advanced Magnetic Interaction), a French innovative startup. AMI will strengthen BIC’s R&D capabilities in Digital Expression.

In 2023, BIC’s global product portfolio included writing, marking (classic, permanent and temporary tattoo markers), correction, coloring, drawing instruments, semi-permanent tattoo, and smart reusable notebooks.

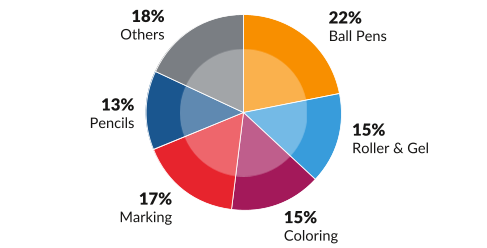

Breakdown of the Human Expression market size per segment IN 2022

BIC’s markets and positioning

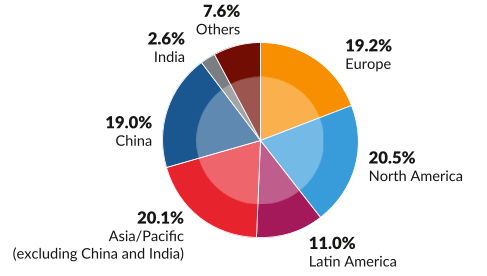

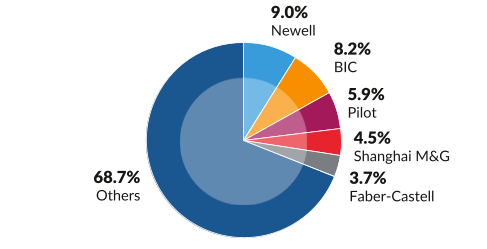

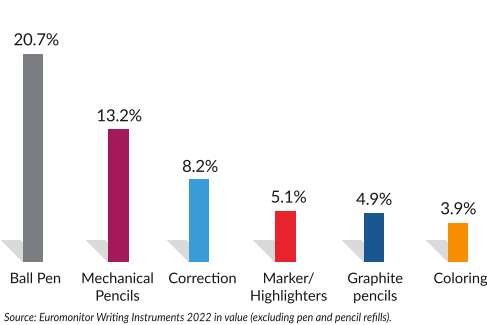

Core Writing & Coloring Instruments Market

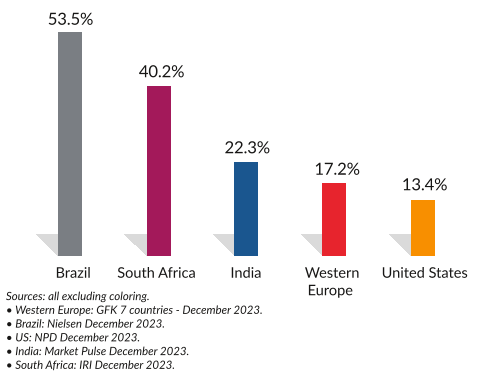

BIC’s historical market Writing and Coloring Instruments amounted to 20.3 billion (6) euros in 2022. The Category is expected to grow at around 4.0% CAGR 2022-2026(7) driven by the rising demand from developing countries and innovation which will fuel growth in the Developed countries. Although the market remains highly fragmented, with many local players and family-owned businesses, it is dominated by three players (BIC, Newell Brands and Pilot) with each recording an estimated market share of over 5%. In 2022, BIC attained the #2 global manufacturer position with 8.2% market share, benefiting from good positions in both Developed and Developing Markets.

Over the years, BIC strengthened its presence in Writing and Coloring Instruments’ market through innovative launches enabling market share gains in key countries, whether it be in core writing instruments or in added-value segments. In 2023, BIC notably gained share in the Coloring segment in France, the UK and the US.

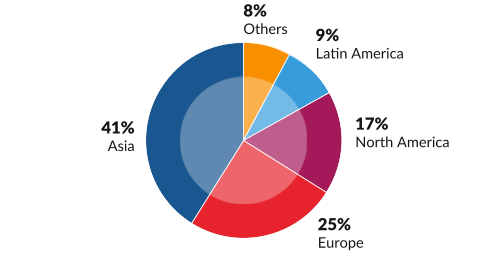

Breakdown of the Writing Instruments market

By region

By product segment

main market leaders

BIC’s market share by segment

BIC’s Market share by region -2023

Although BIC’s portfolio is currently concentrated in historical core Writing Instruments segments, the Group’s ambition is to shift towards more added-value and adjacent segmentswhich are in growing. In 2023, 23% of Human Expression Net Sales came from the Creative and Digital Expression segments.

Creative Expression markets

The Arts and Crafts market is a large market experiencing mid-single-digit growth (estimated at 10.9 billion euros in 2022) (8). The market is expected to grow by 3% (CAGR 2021 – 2026) thanks to the increasing demand of both kids’ and teens’ market as well as from adults asking for more creativity. Kids’ crafts account for more than 50% of the total. It includes a variety of sub-segments including Finger-painting, Watercolors, Kits, Crafting Accessories, Modeling Clay and Slime .

The Skin Creative market estimated at 7.7 billion euros includes the permanent tattoos and the “Do it Yourself” Skin Creative segments. The fast-growing “Do it Yourself” Skin Creative segment includes temporary tattoo markers, temporary decals, henna tattoos and semi-permanent tattoos. It is expected to exceed 1.3 billion euros in 2035, powered by the increasing desire of young consumers to be more fluid with their appearance and to express themselves using their body as a changeable canvas. Market players are mostly non-branded small companies:

- ●BIC entered the Skin creative market in 2018 through the launch of Bodymark®, an innovative temporary tattoo marker to address consumers’ attitudes shift towards self-expression, individuality and creativity;

- ●the acquisition of Inkbox in 2022 elevates BIC to a leadership position in the Do-It-Yourself Skin Creative industry (high-quality 10-14 days decals) and further enhances the Group’s existing portfolio of recognized consumer products, where different brands address diverse types of consumer groups. With its unique ability to customize, Inkbox further strengthens BIC’s DTC business and reinforces existing digital and social media engagement capabilities;

- ●in August 2022, the Group acquired Tattly, a U.S. startup innovating in the field of small high-quality 2-4 days decals, diversifying BIC’s offering in the rapidly growing Skin Creative market and particularly in the kids’ segment.

Digital Expression market

The Digital Writing market was estimated at 6.4 billion euros in 2022 (1). As technology is improving and becoming more affordable, this market should grow by 6% CAGR 2021-2026(1) to weigh above 8 billion euros. It encompasses four main sub-segments: reusable notebooks, smart pens, slate tablets, and stylus for tablets:

- ●BIC’s entered into Digital Writing through the acquisition of Rocketbook® in 2020, the leading smart and reusable notebook brand in the U.S.;

- ●in 2022, BIC strengthened its R&D capabilities in Digital Writing with the acquisition of AMI (Advanced Magnetic Interaction), a French company specialized in the augmented interaction technology. AMI has designed the ISKN Repaper digital tablet, which allows users to capture paper writing and drawing in an electronic format;

- ●in 2023, BIC launched new products in its Rocketbook range.

BIC’s Brand Portfolio in Human Expression

BIC was built on the amazing power of its Brand, which is one of the world’s most popular household names. Over time, other brands have been added to our portfolio, most of them using BIC as an umbrella to drive attractiveness and consumer engagement, including Tipp-ex®, Wite-Out® and, more recently BodyMark® by BIC.

With Horizon, BIC started to migrate to a “house brands” strategy, where each brand has a different meaning for consumers. The acquisitions of Rocketbook and more recently Inkbox and Tattly further strengthens this approach. BIC’s Human Expression division now offers a diversified panorama of brands, where consumers can each see themselves reflected and find their “own” brand favorites.

BIC’s Distribution Channels

Echoing its historical strategy “A BIC seen is a BIC sold”, BIC’s mission is to offer products available to consumers every day and everywhere.

BIC products are sold through a comprehensive range of channels worldwide as the Group pursues its objective to be an omnichannel specialist both offline and online. Products can be found in retail mass-market distributors, eCommerce channels (pure players, market places, B2B and B2C omnichannel retailers), traditional stores and Office Product suppliers (through contract or office superstores).

In the retail mass-market channel, Back-to-School season remains a key period. BIC offers consumers a tremendous range of school and college products through numerous displays, theatralization (for example the iconic school bus display in Europe) and merchandising tools.

Office and school supply companies remains a critical distribution channel where BIC has a strong position thanks to the quality, reliability and value for money positioning of its product, all even more important for companies, administrations and schools.

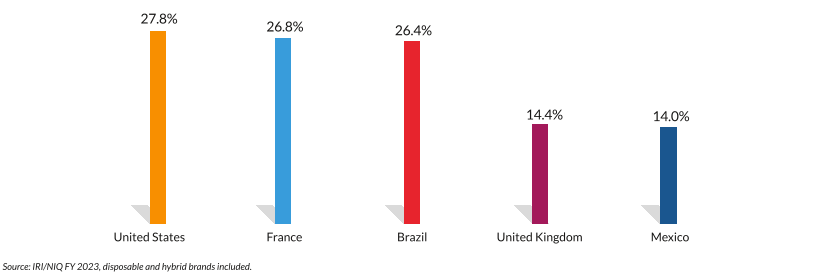

In the last few years, BIC strengthened its distribution network by reinforcing its e-commerce positions. In 2023, BIC maintained its leading positions in Stationery online in key markets: the Group ranked number 1 in France with 21% market share, number 2 in the UK with 21% market share, and number 3 in the U.S. with almost 14% market share (in value YTD December 2023).

1.4.1.2Flame for Life – Lighters

In line with its Horizon strategy, BIC’s historical Lighter category evolved to “Flame for Life”, focusing on all lighting occasions. Flame for Life aims to balance volume with a more value-driven model, powered by trade-ups, personalization and innovation, to respond to changing consumer trends, while focusing more on sustainability.

BIC’s market and positioning

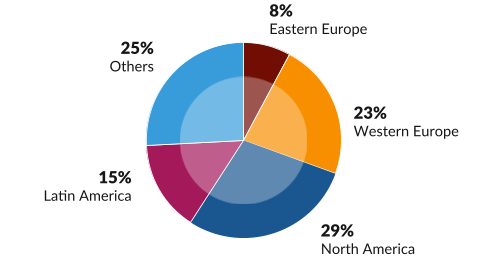

The worldwide pocket lighter market is estimated at 13.4 billion units (€4.9 billion in value) (9).

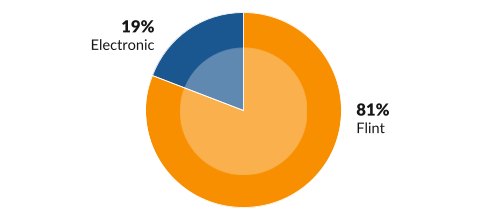

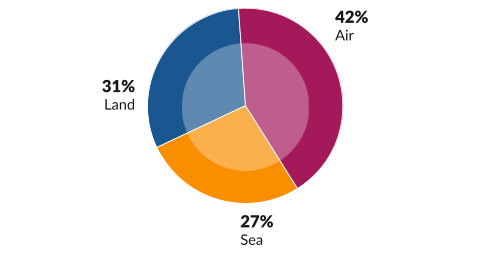

Breakdown of the global pocket lighter market in 2022

By region

By product segment (excluding Asia)

Market leaders (excluding Asia)

BIC’s leadership position and market shares

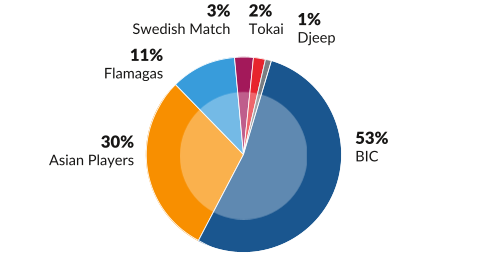

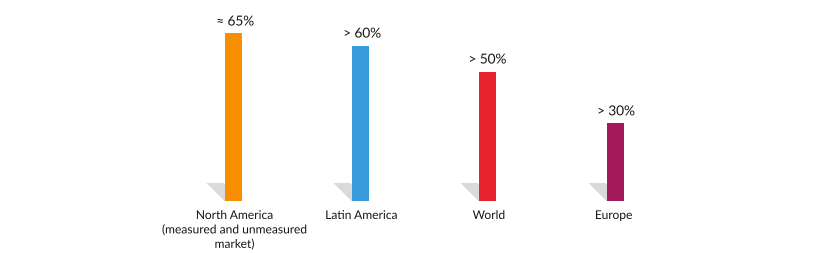

BIC is #1 worldwide in branded pocket lighters in value, with more than a 50% share in value in 2022 (excluding Asia) and leading positions in key geographies including North America, Latin America and Europe. The competitive advantages supporting BIC’s leadership position include safety, quality, strong brand awareness, automated and highly efficient manufacturing processes, and a solid distribution network.

BIC® pocket lighter market share in value in 2022 (excluding Asia)

Safety and quality, key differentiators for BIC

BIC is well-known for providing safe, high quality and compliant lighters to consumers worldwide. A lighter is a plastic reservoir filled with pressurized gas that is lit by a flame. It can present a real danger if it is not designed and manufactured properly. The consequences can be severe and are often unknown to consumers. International Safety Standards protect consumers from unsafe lighters.

- ●international lighter safety standard ISO 9994, which sets out the basic safety requirements for a lighter. ISO 9994 is mandatory in major markets such as Canada (1989), Russia (2000), Brazil (2002), South Africa (2002), Argentina (2003), Thailand (2003), Mexico (2004), South Korea (2005), the 27 European Union member states (2006), Japan (2011), Indonesia (2011) and Turkey (2012);

- ●child-resistant requirements. A child-resistant lighter is purposely modified to make it more difficult to operate by children. Under this standard, the basic requirement is that a lighter cannot be operated by at least 85% of children under 51 months. Child-resistant legislation is mandatory in major countries such as the U.S. (1994), Canada (1995), Australia (1997), New Zealand (1999), the 27 members of the European Union (2006), Japan (2011), South Korea (2012) and Mexico (2016).

All too often, low-cost lighters too often fail to comply with safety standards. Since the late 1980s, lighter models imported from Asian countries have gained market share. They currently account for over half of the global market (in volume).

BIC has been defending its position in this competitive landscape since its creation and advocates for enhanced lighter safety and quality. BIC® lighters comply with even more stringent safety, quality, and performance requirements. For example, the gas reservoirs of BIC® lighters are made from POM (PolyOxyMethylene), a high-performance resin with very high impact resistance. This means that BIC® lighters contain more gas, allowing more ignitions thanks to their wall’s thinness. They are also filled with pure isobutane, which ensures the flame’s stability throughout the lighter’s life.

Towards a more value-driven model through trade-up and innovation

BIC offers a wide range of high-quality Pocket and Utility lighters manufactured with the highest safety standards.

While BIC’s shift to balance more volume with value in the model for its Lighter business started years ago, this was accelerated with the launch of the Horizon Plan. More recently the following developments were made to support this transformation:

- ●the acquisition of Djeep in June 2020, which strengthened BIC’s portfolio in the added-value segment of decorated lighters;

- ●the launch of BIC EZ Reach™, BIC’s first pocket Utility lighter, in July 2020. The product has already reached 5.8% of the U.S. pocket lighter market (Source: IRI YTD December 2023). In Europe, The EZ Reach™ lighter which was launched into most major markets in Europe accounted for almost 20% of total division’s growth versus last year;

- ●the deployment of Revenue Growth Management strategy to drive efficiency in promotional and pricing activities.

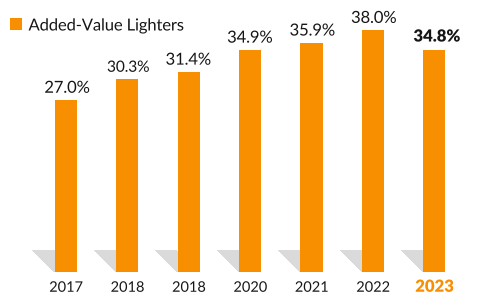

In 2023, added-value lighters, including BIC® EZ Reach™, Djeep®, utility and decorated lighters, represented 35% of BIC’s total Lighter Net Sales.

Added-Value lighters as a % of total Flame for Life DIVISION NET SALES

BIC lighter brand portfolio

Addressing all lighting occasions including non-related to tobacco flame usages

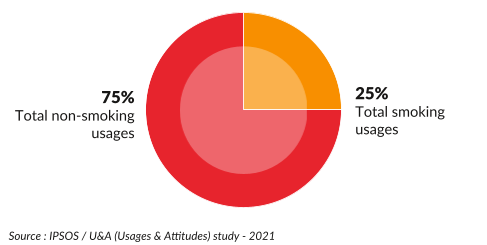

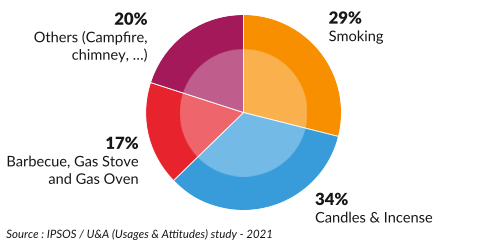

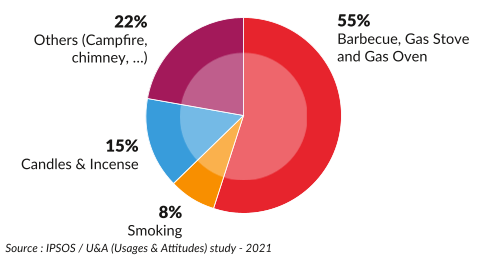

An important pillar of BIC’s Flame for Life strategy is to drive growth by expanding to all flame occasions through incremental usages, as lighters have extensive non-smoking-related usages among different consumer activities. For the last six years, BIC lighter teams have undertaken extensive research to deepen their knowledge of the different flame usages. One of the main findings confirmed that candles and cooking are the most important non-tobacco-related flame usages in developed and developing regions (Ipsos study – October 2021). These lighting occasions represent a growth opportunity for BIC, well-positioned to answer the usages non-related to tobacco thanks to the strength of its brand.

Total Flame Devices – Share of Lighting Occasion

Detailed breakdown of flame occasions in the U.S. and Brazil

U.S.

Brazil

BIC’s Distribution Channels

BIC® lighters are sold through traditional distribution channels (such as convenience stores and tobacconists), retail mass-market distribution stores, and online in the United States. Online and offline, in-store visibility is key to driving impulse purchases, and part of BIC’s historical strategy “A BIC seen is a BIC sold”.

In the traditional channel, which is the leading channel for lighters, BIC has strong positions driven by full-distribution based on efficient routes-to-market, and relevant customer and consumer programs driving value to the business: BIC offers a large range of decorated lighters as well as bringing new products to market such as BIC® EZ Reach™, addressing everyday needs while generating impulse instore purchases.

In the mass-market channel, BIC focuses on relentless store visibility based on a multi-location presence in store: at the check-out but also throughout affinity aisles such as candle and barbecue.

In e-commerce, in 2023, BIC continued to expand its BIC.com website in the U.S., driven by the “Design my BIC” offer, enabling consumers to create sets of personalized lighters. They can also find appealing special editions, monochrome sets and brand-new series of lighters.

1.4.1.3Blade Excellence – Shavers

BIC’s Blade Excellence division focuses on reinforcing its one-piece business with consumer-driven and sustainable added-value products and capitalizing on our advanced R&D and manufacturing capabilities through the creation of BIC Blade-Tech, the Group’s B2B business for the wet shave market.

BIC’s markets and positioning

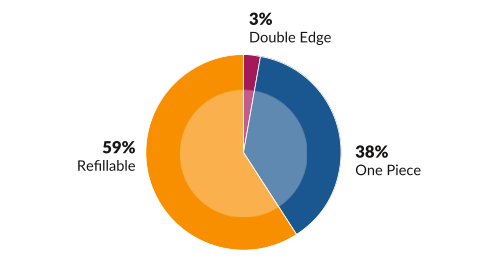

The wet shave market was about 12.5 billion euros in 2022 and accounted for around 49% of the hair removal segment (10) in value. The estimate 2022-2026 CAGR (11) for Total Wet-Shave market is +7.6%.

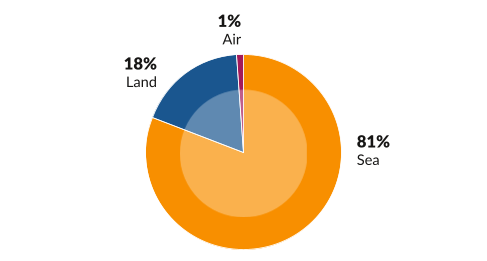

Global wet shave market

By region

By product segment

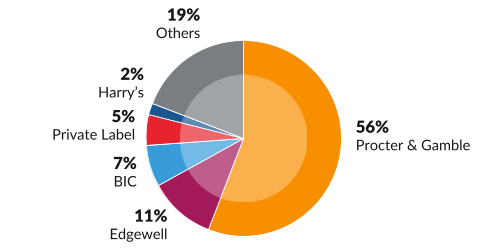

Market leaders

The Wet-Shave market is split into three product segments: double-edge, one-piece and refillable. On the highly competitive environment of the one-piece and refillable segments, growth is mostly driven by new products which offer improved performance and added features. A constant ability to innovate is key to maintain a leadership position. With that objective, BIC has made the shift towards premiumization to gain market share on value-added segments, while keeping BIC’s strength in offering products at the right value.

The global landscape is dominated by three legacy brands (Gillette, BIC®, Edgewell) though over the last decade “disruptors”, primarily in the U.S. launching as direct-to-consumer brands, have emerged. While such brands have expanded presence by securing distribution in brick and mortar, they are not directly competing with BIC given their refillable segment focus.

BIC’s market share in the non-refillable shavers segment

BIC is the #3 worldwide player, with almost 7%(12) of the total wet shave segment. In the non-refillable segment (disposable), BIC ranks #2 worldwide with a 23.7% market share (13). The Group holds key positions in Europe, in the United States and in Latin America.

BIC’s product portfolio aiming for more innovative and sustainable products

In the 1970s, BIC revolutionized wet shaving when it launched the first one-piece shaver: the single blade “classic”.

Over the last decade and supported by the implementation of the Horizon strategy, BIC has focused its innovation, sales and marketing efforts on the high performance three, four, and five-blade sub-segments, offering thus a complete range of female and male products:

- ●for Men: BIC® 3, BIC® Comfort 3®, BIC® Easy/Hybrid 3-blade, BIC® Flex range, and BIC® Flex Hybrid range;

- ●for Women: BIC® Pure 3® Lady, BIC® Soleil® range including Bella®, Glow®, Balance and Miss Soleil; BIC® Soleil Escape, BIC® Click Soleil 5;

- ●for Men and Women: at the end of 2022, BIC launched BIC® EasyRinse online in the U.S. market, a new razor for men and women featuring a first-of-its-kind blade design and patented anti-clog technology. This new product has been rolled out throughout 2023, in stores in the U.S.

In line with Horizon strategy, BIC also innovates with new products centered on sustainability and tailored to consumer evolving trends. As such, BIC recently launched:

- ●an innovative hybrid shaver range in Europe in 2021 made with recycled plastic handles and sold with recyclable packaging;

- ●BIC® Click Soleil 5 in 2022: a razor for women with a handle made from 40% recycled material and co-developed with the raw material supplier Avient.

BIC Blade-Tech

With Horizon, BIC created BIC Blade-Tech, aimed at leveraging BIC’s leadership position as a high precision manufacturer to power other brands and thus expand our addressable market, in the wet shavers category, estimated to reach 14.9 billion euros for 2025 (14). A team including a commercial sales force dedicated to this new business, was created in 2021. BIC Blade-Tech started to ship its first customers, including both new and already established brands, in September 2021. In 2023, our B2B business BIC Blade Tech was impacted by clients’ revised business plans. However, in the fourth quarter it secured agreements with three new clients. These partnerships are promising and are expected to bear fruit in 2024.

Other products

-

Risk management

Introduction

BIC maintains a proactive approach to identify, assess, mitigate, monitor and manage key risks that could impact:

- ●employees, customers, shareholders’ interest, assets, environment or reputation;

- ●ability to achieve its targets and strategy;

- ●ability to stay true to its values; and

- ●ability to comply with laws and regulations including codes of ethics.

The assessment of the main risks takes into account the control measures implemented to reduce the risk (net or residual risk).

The risk factors set forth below regard matters that could have an adverse effect, including a material one, on our business, financial condition, results of operations and cash flows. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our business, financial condition, results of operations and cash flows.

-

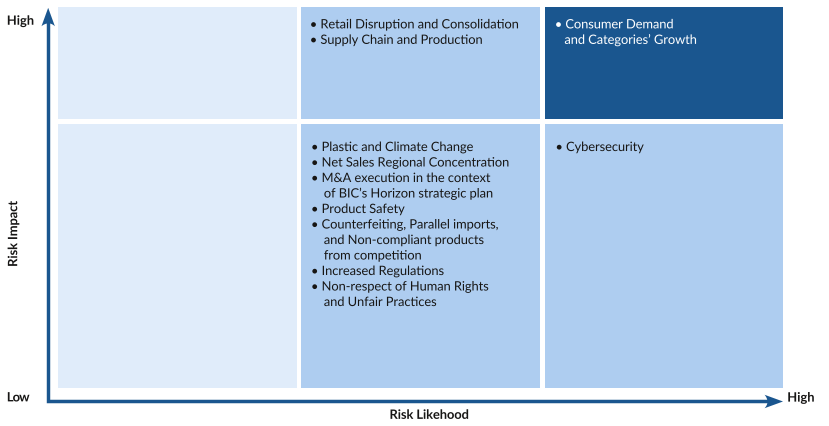

2.1.Main risks and risk assessment

Risk Category

Risk Type

Risk Rating (a)

Low

Medium

High

Industrial and Commercial Risks

Consumer Demand and Growth (b)

X

Retail Disruption and Consolidation (b)

X

Supply Chain and Production (b)

X

Cybersecurity (b)

X

Net Sales Regional Concentration

X

Mergers & Acquisitions within BIC’s Horizon Strategic Plan

X

Product Safety

X

Environmental Risks

Plastic and Climate Change

X

Intellectual, Brand and Image Risks

Counterfeiting, Parallel Imports, and Non-compliant Products from Competition

X

Legal and Regulatory Risks

Increased Regulations

X

Social and Human Risks

Non-respect of Human Rights and Unfair Practices

X

- ( a )Risk Rating is the product of Impact x Likelihood.

- ( b )Most material risks.

Geopolitical Landscape

The Group continues to closely monitor and mitigate the impact of geopolitical tensions and wars on our people and operations globally. The Group has no industrial presence in Russia and Ukraine. In 2023, Russia and Ukraine accounted for less than 3% total BIC Net Sales.

BIC does not manufacture product in or directly sources raw material from Russia. At this time, BIC has restricted its product range to cover essential grooming, writing, and household items only, such as lighters, and has paused all advertising, promotion, and capital investment in Russia. As the situation evolves, we will continue to monitor and comply with any new regulatory decisions, such as sanctions, and remain diligent in protecting our team members in the region. BIC maintains complete control of its brand and intellectual property in Russia to counter any potential moves for brand appropriation.

-

2.2.Description and mitigation of main risk factors

Consumer Demand and Growth

BIC is exposed to changing consumer trends, preferences and needs impacting all three categories – Human Expression, Flame for Life and Blade Excellence. Global consumer trends may include:

- ●growth in Digital Writing technology;

- ●reduced tobacco use or switch to e-cigarettes;

- ●changing shaving habits.

Risk Rating: High

Potential Impact on BIC:

- ●A lack of viable responses would impact sales and profitability.

- ●Changing consumer habits impacting BIC’s three categories might result in:

- ●a shift to digital versus Stationery,

- ●lower tobacco consumption and e-cigarettes impacting Lighters use,

- ●less frequent shaving in Shavers.

Examples of Risk Mitigation:

- ●Focus Research & Development (R&D) on product innovations and brand positioning to address changes in consumer demand and needs (e.g. Lighter decors, personalization through BIC Graphic and Design my BIC).

- ●Adopt a Consumer-lens to category expansion (e.g. EZ ReachTM Lighter, Skin Creative).

- ●Expand in fast-growing Creative Expression and Digital Writing markets (e.g. Rocketbook and AMI acquisitions, Skin Creative: BodyMark Innovation plus Inkbox, and Tattly acquisitions).

- ●Focus on sales growth in Developing Markets including Nigeria and West Africa, Morocco, and Romania.

Retail Disruption and Consolidation

BIC® product sales may be adversely impacted by:

- ●the consolidation of retail customers via e-commerce; and

- ●the potential reduction in pricing power related to pressure from retailers for lower pricing, increased promotional programs and direct-to-consumer channels.

Risk Rating: Medium

Potential Impact on BIC:

- ●Changing consumer buying habits may reduce pricing power through e-commerce channels and impact BIC’s sales.

- ●Retail Consolidation (e.g. buying alliances).

Examples of Risk Mitigation:

- ●Serve consumers wherever they shop across all channels from e-commerce to hypermarkets, stationery stores and small traditional trade stores.

- ●Expand in e-commerce by covering the spectrum from Pure-Play e-retailers to omni-retailers as well as Direct to Consumer (DtC).

- ●Compelling consumer displays in retail stores and strengthen search efforts in e-commerce to drive sales conversion.

Supply Chain and Production

As a consumer products manufacturing, distribution, and sales-oriented organization, BIC is exposed to the risk of interruptions to production and internal and external supply chains issues including:

- ●raw material shortages or operational disruptions at suppliers, particularly during “back-to-school” season in Stationery;

- ●manufacturing and warehousing facilities disruption. Certain products may be concentrated within specific regions, which may be impacted by a catastrophic event;

- ●storage and use of hazardous substances including gas for lighters, solvents for permanent markers and dry-wipe markers; and solvents for industrial cleaning processes.

Risk Rating: Medium

Potential impact on BIC:

- ●Shortage of raw materials due to supplier business disruption. Potential causes include catastrophic event, changes in formulation, environmental regulations.

- ●Significant supply chain disruption may lead to BIC’s inability to meet consumer demand and/or commitments.

- ●Manufacturing business disruption and interdependencies between manufacturing sites might impact finished goods distribution.

- ●The current crisis in Ukraine may continue to affect the supply and prices of certain raw materials.

Examples of Risk Mitigation:

- ●Focus on raw materials and packaging supplier risk management, seeking alternative suppliers sources.

- ●Integrated Business Plan platform to ensure sales and production product portfolio is “right-sized” by location.

- ●Focus on logistics supplier risk management and warehousing optimization plan to minimize disruptions to distribution (sea and road freight).

- ●People and Capabilities programs are in place to enhance the strategy and maturity of functions required for global supply chain disruptions.

- ●Continuous footprint review process in place to reduce business continuity risk by bringing manufacturing closer to markets where appropriate.

In all BIC factories:

- ●implementation and monitoring of preventive and safety measures for gas and solvent storage areas;

- ●suitable control devices and equipment are in place to minimize risks from hazardous chemical substances;

- ●prioritization of fire prevention systems including fire detection and control equipment;

- ●perform hazard and risk assessments;

- ●identify, assess and prevent incidents and accidents;

- ●on going compliance with local regulatory requirements;

- ●strategic inventories are held in some factories to cover critical materials and components;

- ●training programs to back up the critical processes, ensure flexibility to cover market needs; to recognize potential hazards, as well as to take preventive and corrective action;

- ●maintenance programs to protect key equipment and technical processes.

The European Union SEVESO Directive identifies industrial sites that could pose significant accident risks. The SEVESO classified plants have emergency procedure protocols (plan d’opération interne and plan particulier d’intervention) and a major hazard prevention policy. All our SEVESO plants (BJ75 and Tarragona lighter factory plus BIMA stationery factory) have implemented a safety management system according to SEVESO standards.

All other plants have equivalent emergency plans to address risks with potential local consequences.

Cybersecurity

In today’s digitally connected world, the frequency and sophistication of cyber-attacks is increasing, and BIC depends on resilient information technology (IT) systems and networks to operate our business and deliver quality products to consumers.

A cyber-attack could result in:

- ●operational delays or production downtimes;

- ●loss, corruption or compromise of data, confidential information, intellectual property, or otherwise protected information;

- ●security or data breaches;

- ●failure, manipulation, or improper use of BIC or third-party systems and networks;

- ●inaccurate financial reporting, financial losses from remedial actions, loss of business, or potential liability, regulatory fines and/or reputational damage.

Risk Rating: Medium

Potential Impact on BIC:

- ●Unauthorized access, use, or disclosure of confidential or sensitive information, such as customer data, trade secrets, intellectual property, or personal information.

- ●Disruption, misappropriation or damage to information systems, networks, or devices due to cyber-attacks, such as ransomware, malware, phishing, denial-of-service, or other malicious activities.

- ●Financial loss, data breach, reputational damage, or legal and regulatory consequences from cyber fraud, such as business email compromise (BEC).

Examples of Risk Mitigation:

- ●Established a cybersecurity organization and executing a multi-year strategy aligned with IT transformation.

- ●Application of preventative security controls (e.g., multifactor authentication and email filtering), detection and response capabilities.

- ●Require all employees to complete annual security awareness training and reinforce the training with periodic phishing and awareness campaigns.

- ●Conducted internal risk assessments and partnered with third parties to perform security assessments of BIC IT infrastructure and applications.

- ●Strict application of incident response plans and playbooks to minimize the impact and speed recovery from a cyber-attack.

Net Sales Regional Concentration

BIC’s Net Sales are concentrated in a few key markets, notably the U.S., Brazil, and France.

Risk Rating: Medium

Potential impact on BIC:

- ●Such concentration of revenue generation potentially exposes BIC to risks of shifting consumer demand or regulatory environment in those markets.

Examples of Risk Mitigation:

- ●Ongoing focus on sales in Developing Markets (Middle East and Africa, India, Mexico) and diversification in Europe.

- ●Roll-out of a portfolio approach (e.g. Europe focus on strengthening Lighters).

Mergers & Acquisitions within BIC’s Horizon Strategic Plan

BIC’s Horizon strategic roadmap includes targeted acquisitions to strengthen BIC’s existing activities and expand into adjacent growth businesses.

Risk Rating: Medium

Potential impact on BIC:

- ●Challenge to identify and successfully execute strategic acquisitions at attractive valuations.

- ●Difficulty to efficiently integrate acquired companies, resulting in a lower value capture impacting return on investment.

Examples of Risk Mitigation:

- ●Dedicated, centrally led M&A, Value Capture and Integration (VCI) teams are in place, made up of professionals with extensive M&A backgrounds.

- ●Disciplined M&A and Value Capture & Integration Processes & Playbooks have been established with strong governance and clear accountability.

- ●Disciplined governance process supports pipeline development, due diligence and financial return expectations of deals.

- ●Application of a VCI planning and execution process to govern cross-functional integration, focused on establishing the adequate Operating Model to enable delivery of the synergies and value capture initiatives.

Product Safety

The risk related to product safety and consumer health and safety by placing non-compliant or unsafe products on the market.

Risk Rating: Medium

Potential impact on BIC:

- ●Impact on consumer health and safety.

- ●Impact on the Brand image (consumers), BIC’s reputation and business interests.

- ●Potential costs associated with possible market withdrawal, recall, fines and lawsuits.

Examples of Risk Mitigation:

- ●The Product Safety Policy includes commitments to ensure that products designed and manufactured by the Group and sourced by the Original Equipment Manufacturers (OEM) suppliers are safe for health and the environment.

- ●BIC embeds regulatory compliance and product safety risk management into its strategy through a rigorous set of processes. The quality of the million products that BIC supplies every day are systematically controlled by multiple tests.

- ●Consumer health and safety concerns are part of product design and manufacturing. The Product Safety Team collects and shares crucial information about the chemicals used by the Product Development Team to ensure that responsible chemistry criteria are being met. The product Safety team works closely with the product Development teams and legal to stay abreast of regulatory changes and act proactively.

For further information please see Section 3.3.4.2 Product Safety.

Plastics and Climate Change

Major risks for BIC are:

- ●risks related to plastics encompass:

- ●upstream risks: with this material being used in BIC® products this is subject to price volatility, and

- ●downstream risks: with issues surrounding pollution from plastic waste. In addition, and although BIC® products are not single-use, the regulatory environment surrounding plastics is becoming increasingly stringent. Consumers and public opinion also hold increasingly negative views regarding such products;

- ●risks related to climate change include:

- ●risk of an increase in raw material costs. Energy efficiency programs, carbon capture and other measures by suppliers might increase raw material production costs,

- ●risk of an increase in the cost of alternative plastic sourcing due to growing competition,

- ●increased cost of operations linked to the rise of carbon prices.

Risk Rating: Medium

Potential Impact on BIC:

The potential impacts on BIC include:

- ●increased cost of raw materials;

- ●rarefaction and price volatility of plastics;

- ●brand image deterioration due to plastic in our products;

- ●heightened regulations on plastics, impacting BIC’s direct or indirect operations;

- ●carbon regulations affecting operating costs;

- ●disruption or interruption to production activities due to extreme weather events or flooding related to climate change;

- ●environmental labelling of products, thereby impacting sales.

Examples of Risk Mitigation:

- ●A comprehensive sustainable development Program designed to limit the environmental impact of BIC’s activities. This covers BIC’s activities, products and supply chain, and it is embedded in our Horizon Plan strategy and commitments, including:

- ●improving the environmental and/or societal footprint of BIC® products (2025 Commitment: #1 Fostering sustainable innovation in BIC® products),

- ●rolling out a comprehensive eco-design process as part of each product category’s innovation processes.

- ●This will allow BIC to mitigate the following risks:

- ●the plastics challenge, and

- ●the carbon footprint of its products,

- ●the use of 100% renewable electricity by 2025,

- ●reduce BIC’s greenhouse gas emissions by purchasing renewable energy and evaluating potential production of renewable electricity on-site,

- ●embrace a circular economy approach embedded into BIC’s historical approach to its products, including its 4R philosophy (Reduce, Recycled or Alternative, Refillable, Recyclable).

- ●Ambitious commitments on plastics:

- ●by 2030: BIC aims for 50% non-virgin petroleum plastic for its products, with a goal of 20% by 2025,

- ●by 2025: 100% of BIC’s consumer plastic packaging will be reusable, recyclable or compostable.

In 2022, BIC undertook a study in accordance with Task Force on Climate-related Financial Disclosures (TCFD) to review the physical risks from climate change to all its facilities and those of some contract manufacturers and suppliers. The analysis included 248 facilities globally, including manufacturing centers, offices, residential buildings, warehouses and land owned by a third-party supplier or owned and leased by BIC.

The climate hazards included in the analysis were heat stress, water stress, floods, sea-level rise, and hurricanes and typhoons (tropical cyclones).

The most prevalent hazards for BIC were found to be floods and heat stress.

Many of the exposed facilities are not owned by the Group.

All these initiatives and those mentioned in the Group’s sustainable development Strategy in Chapter 3 help mitigate the risks.

Counterfeiting/gray goods, Parallel Imports and Non-compliant Products from Competitors

Counterfeits of the well-known BIC products circulate throughout Africa, the Middle East, Eastern Europe and South America. They are mostly manufactured in Asia. These counterfeits, often of low quality, are mainly focused on our products’ shape and on the BIC® trademark. Gray goods (i.e., genuine BIC products made for specific markets and smuggled into another country) that violate regulations pose product recall risks, particularly in the U.S.

The Group also faces competition from low-cost lighters that often do not comply with safety standards, the ISO 9994 international safety standard, and the child resistance standard.

Risk Rating: Medium

Potential impact on BIC:

- ●Impact on the Brand image (Consumers) BIC reputation.

- ●Unfair competition with non-conform or counterfeit products.

- ●Costs associated with possible market withdrawal or recall and/or fines.

Examples of Risk Mitigation:

- ●The Legal Department leads the relevant courses of action against such counterfeits, gray goods and non-compliant products by closely working with local authorities and law enforcement agencies including:

- ●judicial and administrative actions,

- ●monitoring program of leading e-commerce platforms,

- ●market surveillance, traceability measures, and collaboration with local authorities to prevent illegal imports of gray goods to the U.S.

- ●BIC also targets non-compliant lighters through stakeholder engagement efforts geared towards customers, market surveillance authorities, European Union (EU) Commission, EU Parliament, etc.

- ●The Group continues to advocate to reinforce market surveillance in Europe and help shape regulations such as the EU’s General Product Safety Regulation issued in 2023.

- ●Over the past years, BIC worked to improve lighter safety standards in Mexico, advocated in Brazil for the maintenance of strict legislation on lighter market surveillance and strengthened market surveillance campaigns in Argentina. For example, in 2023, following fruitful engagements, lighters should be placed again on the priority list for surveillance in Brazil, while in Mexico, an agreement was reached to enhance the ISO (International Standards Organization) lighter safety standard requirements.

- ●The ISO 9994 safety standard has become mandatory for the first time in a U.S. State (Connecticut) as of 2022.

Increased Regulations

Restrictions, prohibitions and proposed prohibitions are increasingly common in the fields of chemical substances and plastics, particularly in North America and Europe. In the EU, the “European Green Deal” scheme aiming at making Europe the first carbon neutral continent by 2050, includes an ambitious plan “the Ecodesign plan for Sustainable Products Regulation” (ESPR). The purpose of the regulation is to define rules to make products more reliable, sustainable.

Risk Rating: Medium

Potential impact on BIC:

- ●Impact on manufacturing processes and business interests.

Examples of Risk Mitigation:

BIC closely monitors announced regulatory changes and voices relevant technical and legal arguments:

- ●Together with other European manufacturers, BIC continues to sustain its interpretation of the scope of the EU’s CLP regulation (Classification, Labelling, Packaging).

- ●BIC participated in the revision process of this CLP regulation during 2023.

Non-respect of Human Rights and Unfair Practices

This risk includes non-compliance with fundamental human rights such as child labor, discrimination or forced labor, as well as corruption and unfair practices.

Risk Rating: Medium

Potential Impact on BIC:

- ●Reputation Loss.

- ●Legal actions against BIC.

- ●Fines.

Examples of Risk Mitigation:

- ●BIC has a Code of Conduct to ensure respect for Human Rights. This Code of Conduct is regularly updated. It applies to BIC worldwide as well as to contract manufacturers and suppliers.

- ●BIC efficiently applies the principles of the Code of Conduct and regularly monitors their implementation through audits.

- ●92% of BIC’s net sales come from products made in its factories, thus, reliance on contract manufacturing is relatively low.

- ●BIC’s Code of Conduct applies to suppliers and business partners, who are at all times requested to comply with applicable national and international legislations. This includes laws regarding anti-corruption, anti-trust, anti-bribery, fair competition and human rights.

Further information can be found in Chapter 3 Non-financial performance statement: our environmental, social and societal responsibility (Section 3.3.2.2.1 BIC's human rights in the workplace policy).

-

2.3.Vigilance Plan

2.3.1Introduction

2.3.1.1Regulatory framework

The French Law no. 2017-399 of March 27, 2017, on the duty of vigilance of parent companies (“the Vigilance Law”) applies to French companies employing, for at least two consecutive years, at least 5,000 employees including in their direct or indirect subsidiaries whose registered office is located in France or at least 10,000 employees including in their direct or indirect subsidiaries whose registered office is located in France or abroad.

In accordance with the Vigilance Law, and with Article L. 225-102-4 of the French Commercial Code, BIC implemented, through its Vigilance Plan, the necessary due diligence measures to identify, as an obligation of means, risks and preventive measures relating to the following themes:

- ●Human Rights and Fundamental Freedoms infringements;

- ●Health and Safety hazards; and

- ●Environmental damage.

- ●BIC Group activities, which may include activities of the Group’s parent company, and subsidiaries controlled directly or indirectly by BIC within the meaning of Article L. 233-16 of the French Commercial Code (the “Subsidiaries”); and

- ●Third-Party Risks related to the activities of its subcontractors and suppliers with whom Group companies have an “established business relationship” (1).

-

2.4.Risk Management and Internal Control Procedures implemented by the Company and Insurance

2.4.1Risk Management and Internal Control definitions and objectives

2.4.1.1Adoption of the Principles of the AMF’s(1) Reference Framework for Risk Management and Internal Control Systems

For the purposes of this section, the Group complies with the principles outlined in Part II of the Risk Management and Internal Control Systems – Reference Framework updated in July 2010 by the Working Group chaired by Olivier Poupart-Lafarge and established by the AMF. This represents a partial adoption of the full text that also provides an Application Guide for internal control procedures for the accounting and financial information published by the issuer.

The related specific control activities are the responsibility of the local subsidiaries. Those subsidiaries continuously adapt them in response to current circumstances, drawing guidance from the Group Accounting and Controllers’ Manuals. The Application Guide has not been formally compared to existing procedures and processes, but the Group does not expect material differences given the similarities between the Application Guide and these two manuals.

a)Risk management

Risk management encompasses a set of resources, behaviors, procedures and actions that are tailored to the characteristics of the Company and its employees while observing legal requirements.

- ●the Company’s ability to achieve its business goals and core strategy;

- ●the Company’s ability to abide by its values, ethics, laws and regulations;

- ●the Company’s personnel, assets, environment, financials, or reputation.

- ●maintain and protect the Company’s value, assets and reputation;

- ●safeguard the Company’s decision-making and processes to achieve its objectives;

- ●ensure that the Company’s actions are consistent with its values.

b)Internal control

The risk management process also incorporates the definition of internal control company-wide to ensure that:

- ●the Company remains in full compliance with evolving laws and regulations, and operates with the highest level of ethical business standards;

- ●the instructions and guidelines issued by Executive Management are followed;

- ●the Company’s internal processes remain effective and continuously improve, particularly those involving the protection of its assets. Assets are understood to be both tangible and intangible (know-how, brand, image or reputation) and are used throughout existing Company processes;

- ●financial information is reliable.

- ●compliance with all applicable laws and regulations governing the Company and its daily operation;

- ●providing ongoing communication and guidance to employees to ensure they understand the full scope of their responsibilities and expected contributions to the Company;

- ●providing guidance for operational, industrial, commercial and financial processes;

- ●producing reliable financial statements (2). The reliability of such information depends on the quality of the associated internal control procedures and system (see reporting procedures Section 2.4.2.4 Internal Control procedures) including:

- ●the segregation of duties principle, enabling a clear separation between input, operating and retention duties,

- ●guidance regarding the identification of the source of the information and materials produced,

- ●transactions recorded in accordance with applicable accounting standards.

2.4.1.2Scope of Risk Management and Internal Control

Risk management and internal control, as defined in this report, apply to SOCIÉTÉ BIC as Group parent company and all Group consolidated entities.

- ●the existing organization;

- ●the objectives set out by the Board of Directors and the Executive Committee (see Section 2.4.3 Risk Management and Internal Control Participants, Specific Structure(s) in Charge/Respective Roles and Interactions); and

- ●compliance with laws and regulations.

Supporting principles and systems have been set up in all relevant areas and subsidiaries, considering local specificities and regulations. These principles are also known to and followed by the various centralized Group departments.

The Risk Management principles also apply to any entity joining the Group. Whenever possible, the Group asks its subcontractors and suppliers to also comply with these principles.

2.4.1.3Limitations of Risk Management and Internal Control Systems

Risk management and internal control systems have inherent limitations and cannot provide an absolute guarantee that the Company’s objectives will be met. Despite the control measures we currently have in place, our systems and those of our third-party service providers are subject to the ever-changing risk of compromised security, acts of vandalism, human errors and other unforeseen events.

-

Environmental, social and societal responsibility

To help its readers better understand the information provided, BIC covers the items required by French executive order No. 2017-1265 of August 9, 2017 (1) in the following chapters of its management report:

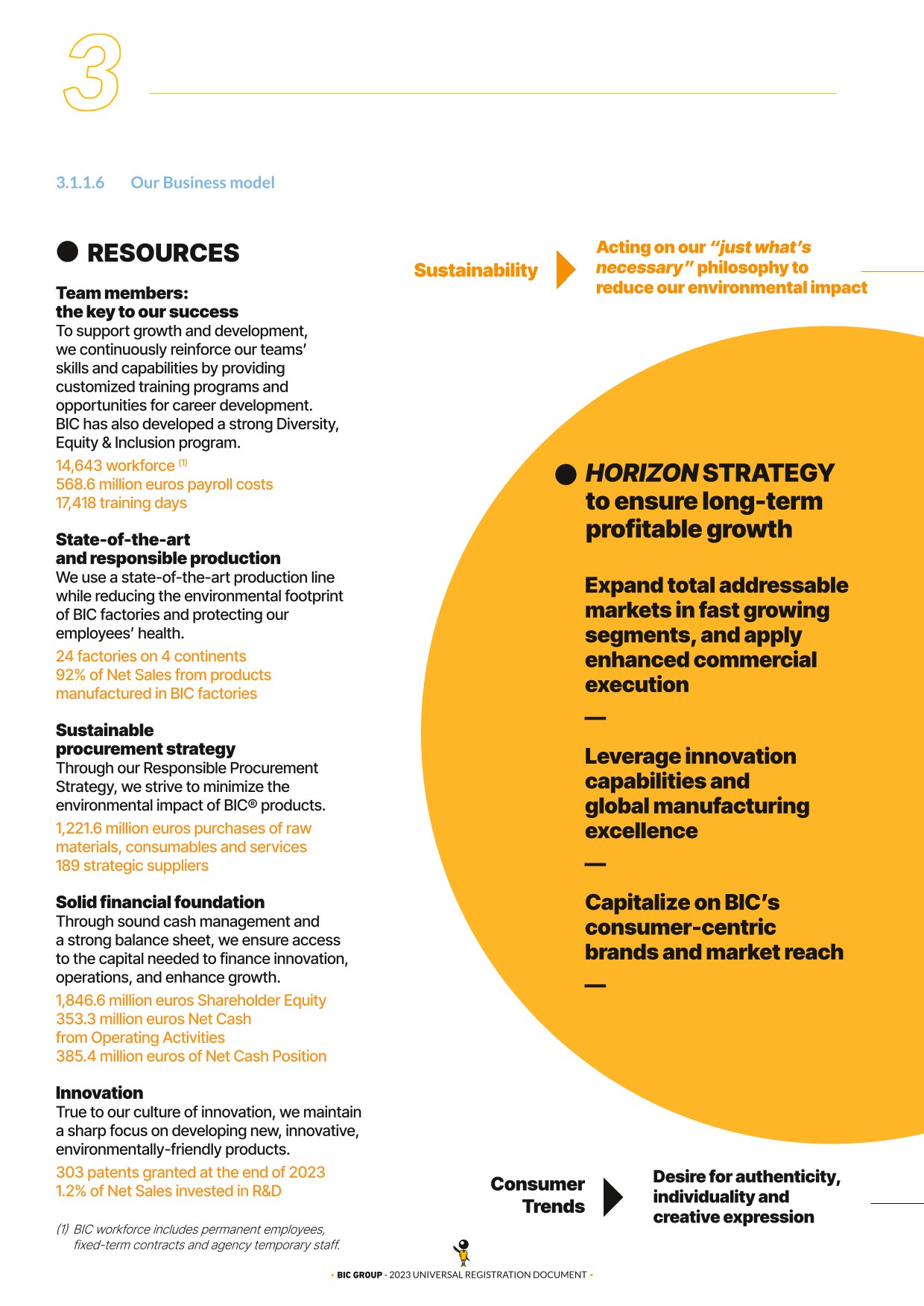

Business Model

Presented in Section 3.1.1.6

Major Risks

Also discussed in Section 2.1.

CSR Risks

Listed and described in Section 3.1.3

Chapter 3

This chapter describes:

- ●the sustainable development challenges in the introduction to each section;

- ●the risks and opportunities in the “Risks and Opportunities” sections;

- ●the policies and actions implemented under the “Policies, actions taken, results and outlook” sections;

- ●due diligence work to identify, prevent and reduce the frequency of risks or take the opportunities identified; and

- ●the results of these policies – notably, key performance indicators – and, where applicable, the relevant outlook.

In 2020, BIC released its first Climate-Related Performance Report based on the recommendations of the Task Force on Climate-related Financial Disclosure (TCFD). This report is now part of Section 3.2.1, and its sections are therefore structured as suggested by the TCFD.

BIC identifies information expressly required in the Non-Financial Performance Statement with the initials [NFPS] and [NFPS Risk X]. The Group also includes all the action plans related to its Sustainable Development Program, including those that do not directly help prevent or reduce a major risk. The Group has, however, reorganized this chapter to give precedence to the information directly related to the Non-Financial Performance Statement.

In 2022, BIC decided to start aligning the structure of its Non-Financial Performance Statement with the upcoming Corporate Sustainability Reporting Directive’s (CSRD) Sustainability reporting standards, hence Chapter 3’s new outline.

A summary table of the Non-Financial Performance Statement can also be found in Section 3.5.1.

Main CSR risks and opportunities are outlined in Section 3.1.3.

-

3.1.Strategy and business model, an overview [NFPS]

Sustainability is rooted in BIC’s Values and is an integral part of its day-to-day operations. It has played a fundamental role in enabling BIC’s strategy, especially its social and societal actions, for over 20 years.

In keeping with its core mission, the Group’s ambition is to ensure that it has a limited impact on the environment and a positive impact on society, while making a meaningful contribution to consumers’ and team members’ lives as well as to the long-term well-being of our planet.

In its “Writing the Future, Together” program, BIC seeks to build on its long-standing sustainable development efforts and to bolster its engagement by pledging to five commitments for the 2018 to 2025 period (see Section 3.1.1.3).

3.1.1Strategy and business model [NFPS]

3.1.1.1The history of BIC’s Sustainable Development Program

Launched in 2003, BIC’s Sustainable Development Program continues to evolve and addresses major environmental and human issues as well as stakeholder expectations. It also benefits from advances in R&D, innovation, and evolutions in the Group’s operations.

Since 2018, the program has been guided by the five ambitious commitments that make up “Writing the Future, Together”. In 2020, this program was reinforced with additional commitments on its use of plastic. Furthermore, in 2022, BIC announced its Greenhouse Gas (GHG) emission reduction targets.

3.1.1.2BIC’s ambition

Our approach to sustainability is one of our Values and is an integral part of our day-to-day operations. Staying true to our philosophy of honoring the past and inventing the future, we want our ongoing commitment to sustainable development to be long-lasting and far-reaching.

Our ambition is to ensure that we limit our impact on the planet and make a meaningful contribution to the lives of our employees and society over the long term.

To shape our business tomorrow and ensure we create a sustainable future, we believe it is essential to:

- ●promote sustainable innovation in our products;

- ●act against climate change;

- ●provide our team members with a safe workplace;

- ●make our supply chain more responsible; and

- ●reinforce our commitment to education.

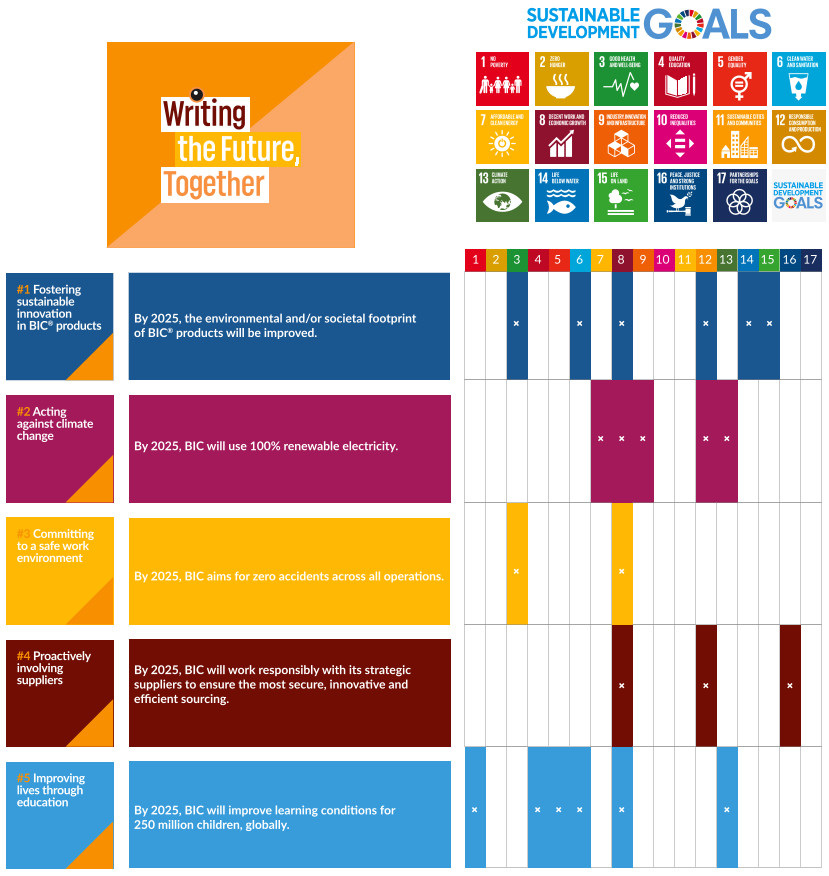

3.1.1.3Writing the Future, Together, a commitment for 2025

In 2017, BIC defined ambitious commitments that enable the Group to create value over the long term for all stakeholders. They are based on the principles of its sustainable development Program – materiality assessments and the UN Sustainable Development Goals – and on regulatory requirements, consultations with stakeholders, and lessons drawn from regular benchmarking.

This vision is defined in its “Writing the Future, Together” program. It is driven by BIC’s ambition for sustainability (see Section 3.1.1.2) and comprises five commitments which are an integral part of the Group’s strategic Horizon plan.

#1 Fostering sustainable innovation in BIC® products:

- ●by 2025, the environmental and/or societal footprint of BIC® products will be improved compared to their baseline (SDG 3, 6, 8, 12);

- ●by 2030, BIC aims for 50% use of non-virgin petroleum plastic in its products (SDG 14, 15);

- ●by 2025, BIC will use 100% reusable, recyclable or compostable plastic in consumer packaging (SDG 14, 15).

#2 Acting against climate change: by 2025, BIC will use 100% renewable electricity (SDG 7, 8, 9, 12, 13).

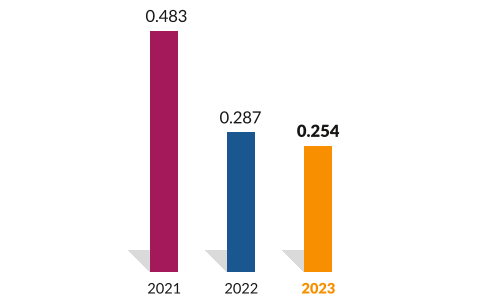

#3 Committing to a safe work environment: by 2025, BIC is aiming for zero lost-time incidents (2) across all operations (SDG 3, 8).

#4 Proactively involving suppliers: by 2025, BIC will work responsibly with its strategic suppliers to ensure the most secure, innovative and efficient sourcing (SDG 8, 12, 16).

#5 Improving lives through education: by 2025, BIC will improve learning conditions for 250 million children globally (SDG 1, 4, 5, 6, 8, 13).

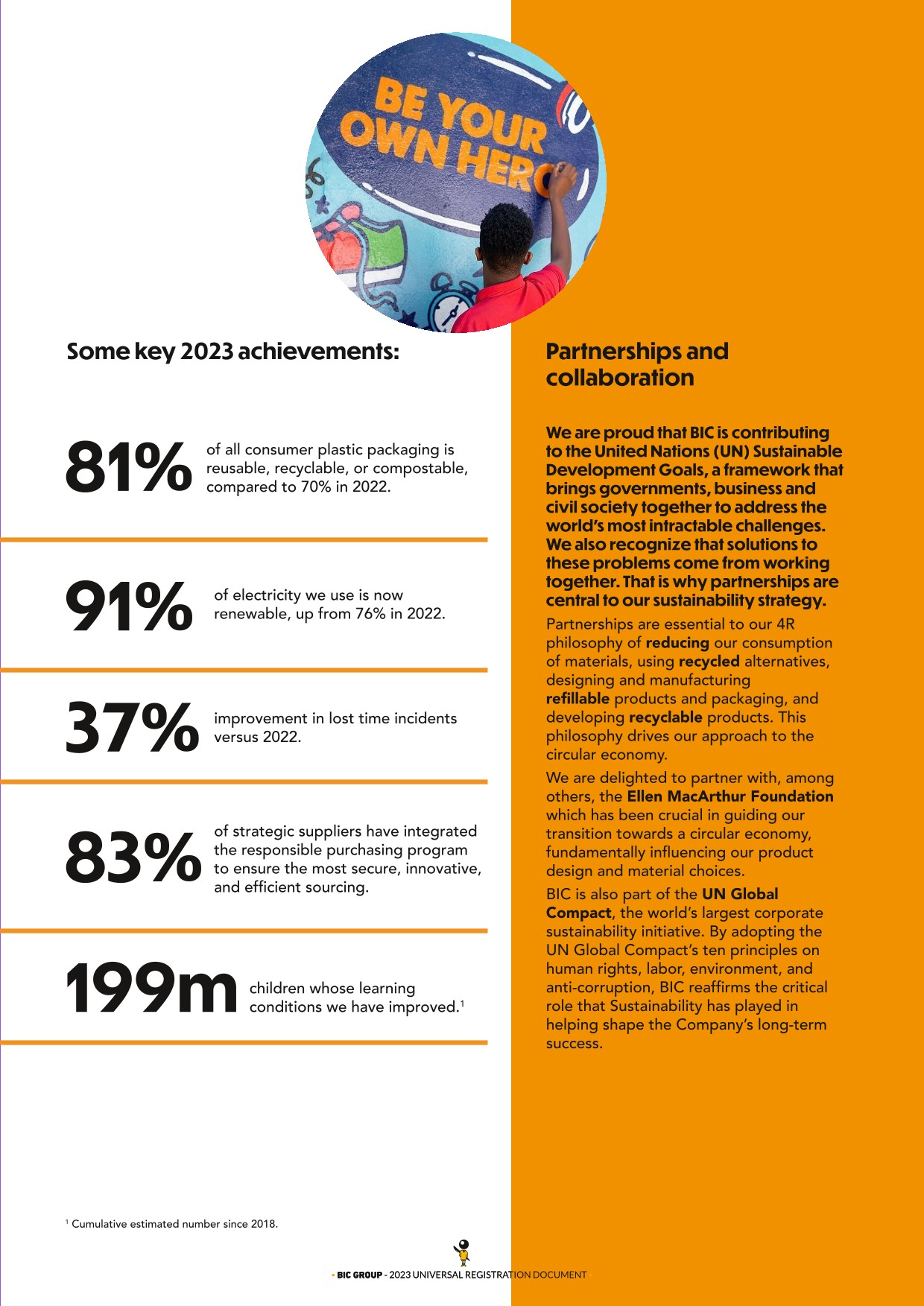

3.1.1.4Writing the Future, Together – Progress chart [NFPS]

Writing the Future, Together

5 Commitments

Progress as of Dec. 2023

Other factors: approach and performance

Section

UN SDG (a)

Issues and risks addressed (b)

By 2030, BIC aims for 50% non-virgin petroleum plastic in its products.

By 2025, 100% of BIC consumer plastic packaging will be reusable, recyclable, or compostable.

By 2025, the environmental and/or societal footprint of BIC® products will be improved compared to their baseline.

- ●8.0% of non-virgin petroleum plastic in BIC® products (5.7% in 2022);

- ●81.0% of reusable, recyclable or compostable plastic in consumer packaging;

- ●62.1% recycled content in plastic packaging;

- ●98.0% PVC-free packaging;

- ●99.1% of BIC paper and cardboard packaging comes from certified and/or recycled cellulosic sources;

- ●new products manufactured are subject to environmental and societal measurement thanks to the usage of EMA (c) to the extent of the categories’ coverage of the tool;

- ●for the product categories covered by this tool: 7 products were improved in 2023.

- ●16 BIC® products with the NF Environnement ecolabel;

- ●at end-2023, over 86.7 million writing instruments collected through TerraCycle.

[NFPS Risk 1]: risks related to plastics.

[NFPS Risk 2]: risks related to climate change.

[NFPS Risk 3]: risks related to product safety and consumer health & safety.

By 2025, BIC will use 100% renewable electricity.

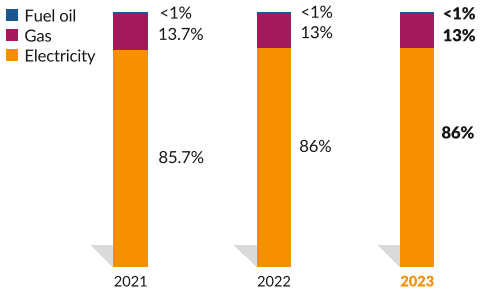

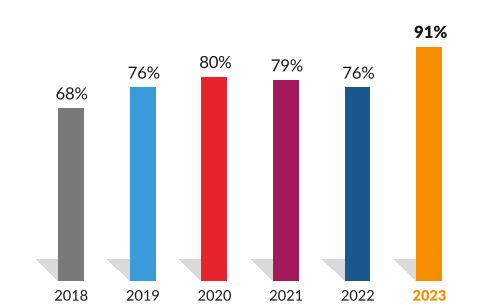

91% of BIC's electricity comes from renewable sources (d).

BIC’s use of renewable electricity is part of a comprehensive energy approach that also includes improving the energy efficiency of its operations.

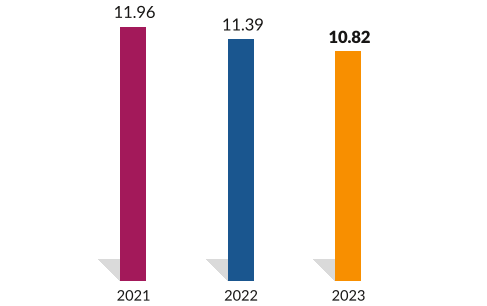

The Group continues to progress in energy efficiency. Over the last 10 years, its energy consumption per ton of products has decreased by 11%.

[NFPS Risk 2]: risks related to climate change.

- ( a ) UN Sustainable Development Goals.

- ( b ) Risks identified as part of the NFPS reporting process.

- ( c ) Environmentally & socially Measurable Advantage" scorecard. Coverage and methodology are reported in section 3.5.3.

- ( d ) Electricity generated from biomass (including biogas), geothermal, solar, water (including hydro power) and wind power is considered renewable.

Writing the Future, Together

5 Commitments

Progress as of Dec. 2023

Other factors: approach and performance

Section

UN SDG (a)

Issues and risks addressed (b)

By 2025, BIC aims for zero lost-time incidents (f) across all operations.

The Health & Safety approach continues to be rolled out across the whole Group.

Identification of two key focus areas to achieve the Zero Lost-Time Incidents (c) target by 2025:

- ●raise machine safety thresholds and standardize them across the Group;

- ●increasing levels of safety culture awareness among our team members;

Promote one EH&S topic a month, with material provided by the EH&S teams for the local teams;

Celebrated World Day for Safety and Health at Work on April 28th, 2023, and organized several health & safety activities at all Group Supply Chain facilities (d);

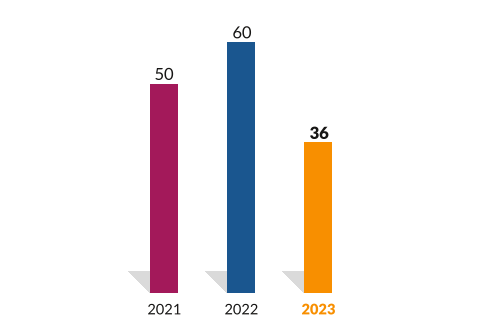

- ●36 lost-time incidents (c) for BIC headcount (e);

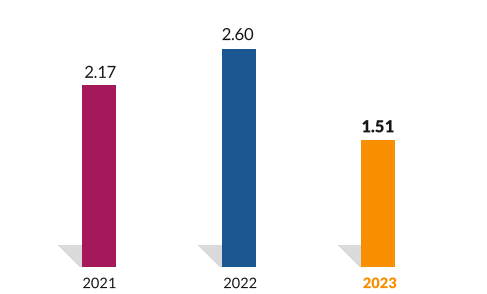

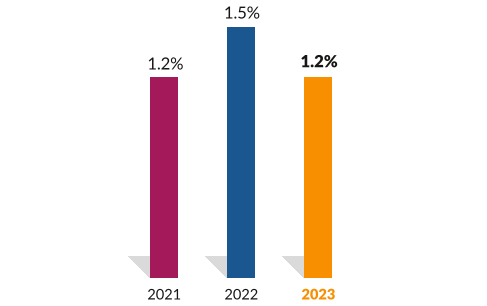

- ●1.51 incidence rate for the BIC headcount (e);

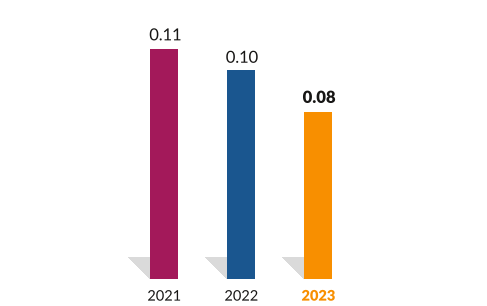

- ●0.08 severity rate (number of calendar days lost due to an incident per thousand hours worked) for BIC headcount (e);

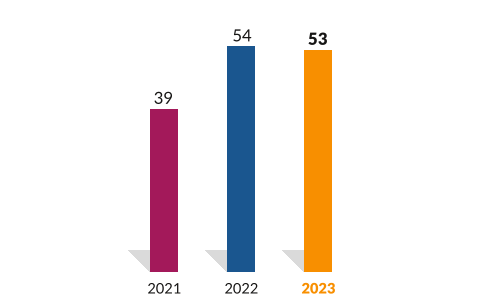

- ●53 facilities with 0 lost-time incidents for BIC headcount (e).

[NFPS Risk 4]: risks related to the health and safety of team members.

- ( a ) UN Sustainable Development Goals.

- ( b ) Risks identified as part of the NFPS reporting process.

- ( c ) Lost Time Incident (LTI): Incident in the workplace resulting in an Injured Person (IP), unable to work for at least one day (the day of the incident is not included).

- ( d ) Lighter factories excluded.

- ( e ) BIC headcount includes permanent employees, fixed-term contracts, apprentices and interns.

- ( f ) BIC has specified its commitment wording and is now using “lost-time incident” instead of “accident”.

Writing the Future, Together

5 Commitments

Progress as of Dec. 2023

Other factors: approach and performance

Section

UN SDG (a)

Issues and risks addressed (b)

By 2025, BIC will work responsibly with its strategic suppliers (c) to ensure the most secure, innovative and efficient sourcing.

By the end of 2023, 83% of strategic suppliers have been assessed on sustainability performance and practices, with no minimum score required, through the supplier sustainability assessment tool, a part of BIC global responsible procurement program (d).

CSR assessments (via supplier sustainability assessment tool) of strategic suppliers since 2011. Innovative new tools implemented, such as:

- ●Buy4BIC global procurement platform;

- ●PowerBI for sustainability reports; and

- ●a digital procurement ecosystem that combines sustainable procurement tools (e.g. supplier sustainability assessment tool, CO2 measuring tools) with Buy4BIC modules.

The tools are used to create supplier sustainability profiles.

The Global Procurement team continues to enhance the digital procurement ecosystem with sustainable procurement and other tools.

[NFPS Risk 5]: risks related to non-respect of Human Rights (child labor, ILO (e)’s international conventions).

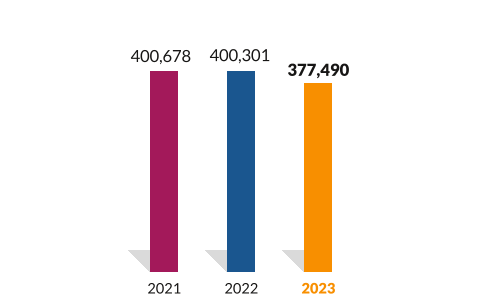

By 2025, BIC will improve learning conditions for 250 million children globally.

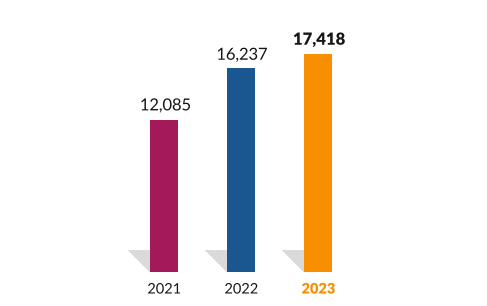

At the end of 2023, it has been estimated that the learning conditions of over 199 million children - of which 12 million children in 2023 - have been improved since 2018 through direct actions targeting children or teachers and parents.

Organization of activities and workshops in schools to raise awareness of the importance of education, writing, creativity, written composition, etc., and themed coloring contests for younger children.

Design of activity sheets and workshops for teachers on topics such as motor skill development and writing exercises.

Promotion of education in disadvantaged communities through Global Education Week and other local CSR activities.

Promotion of creativity in education by the BIC Corporate Foundation, through several initiatives, e.g. the Creativity Community of Practice network.

- ( a ) UN Sustainable Development Goals.

- ( b ) Risks identified as part of the NFPS reporting process.

- ( c ) For direct and indirect spend suppliers, BIC has set up criteria to qualify them as strategic. The criteria are linked to BIC’s spending, the uniqueness of a supplier, its impact on BIC’s business continuity, growth and development, and the sustainable advantages brought to BIC.

- ( d ) Excluding BIC Graphic, new acquisition and certain Original Equipment Manufacturers (OEM).

- ( e ) International Labour Organization.

3.1.1.5BIC contributes to the UN Sustainable Development Goals (SDGs) through its “Writing the Future, Together” commitments